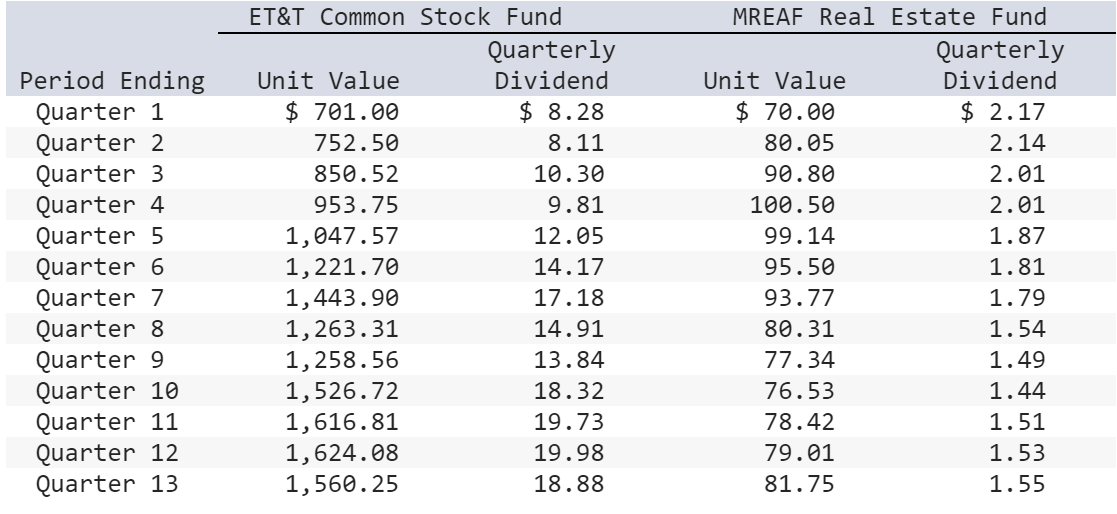

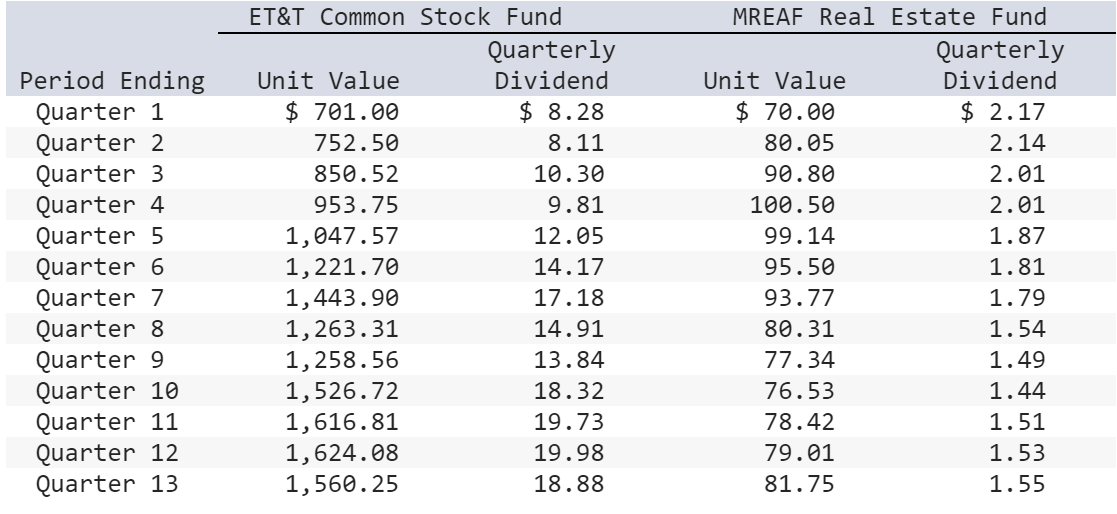

As an investment advisor for MREAF (Momentum Real Estate Advisory Fund), you are about to make a presentation to the portfolio manager of the ET&T pension fund. You would like to show what would have happened had ET&T made an investment in MREAF during the past 13 quarters. The ET&T manager has provided you with historical data on the performance of its portfolio, which is made up entirely of common stock. Historical data for the ET&T portfolio and MREAF are as follows:

Required:

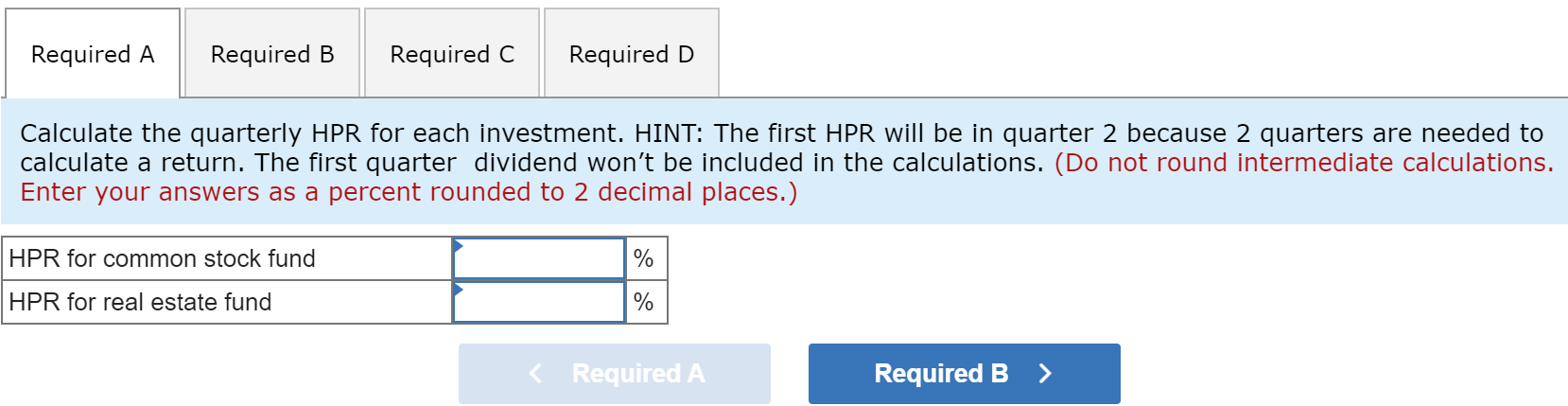

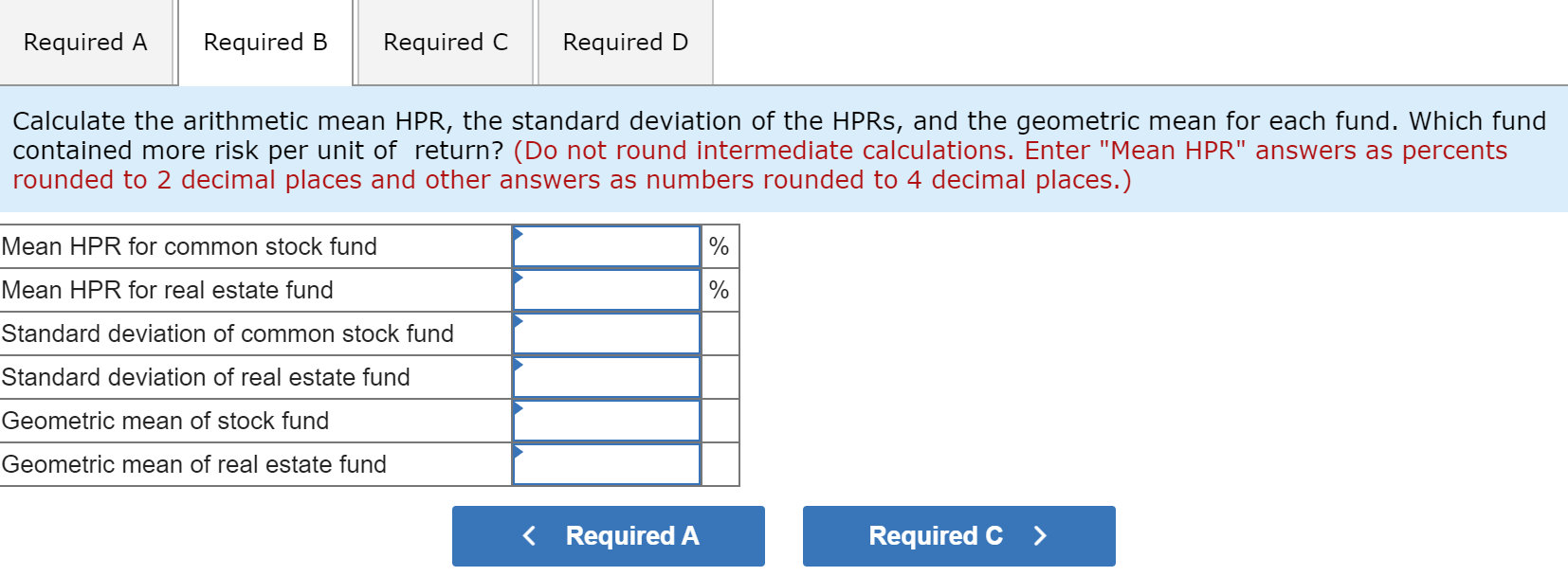

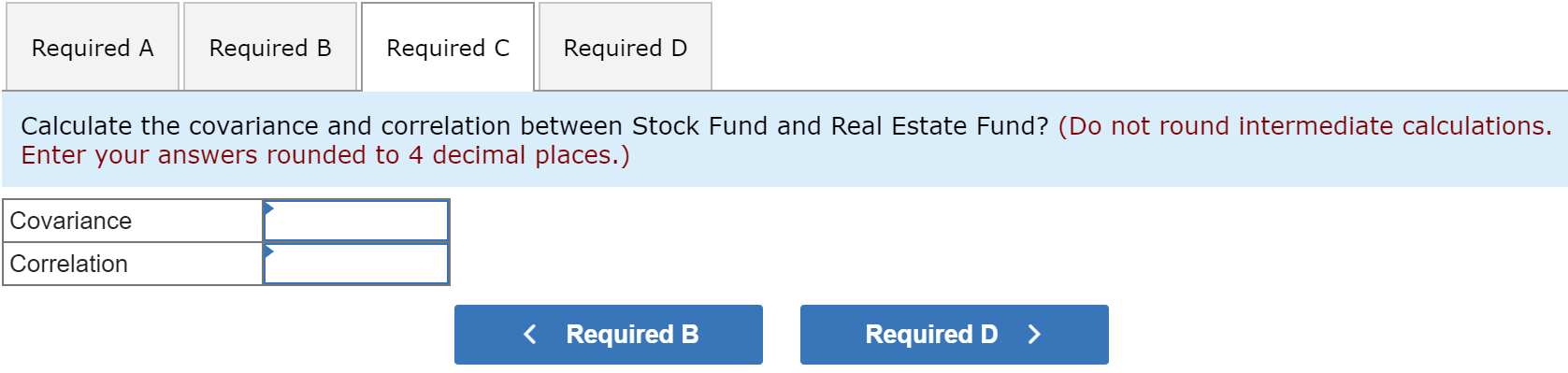

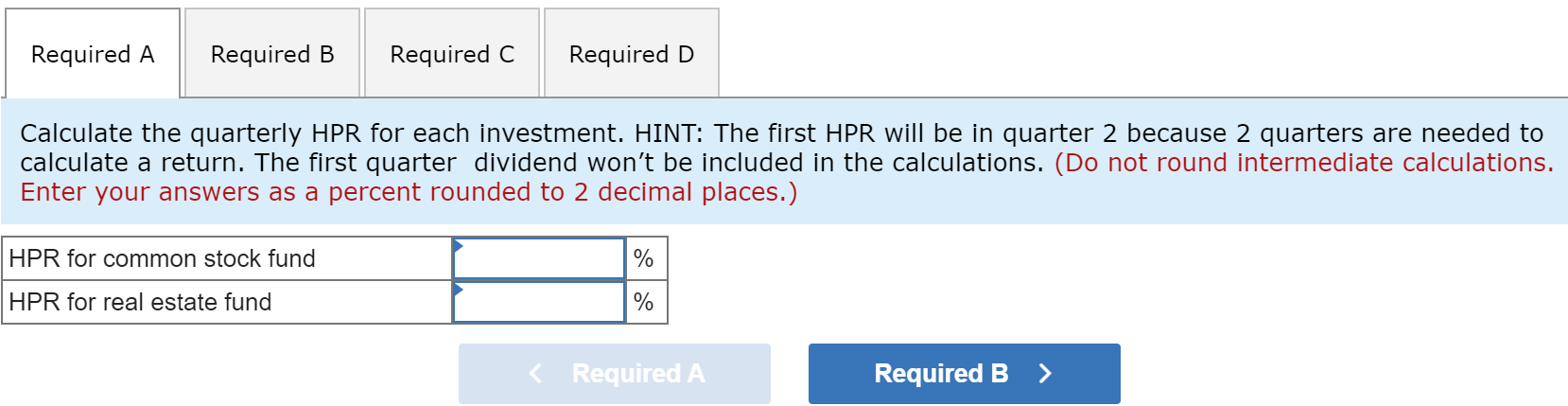

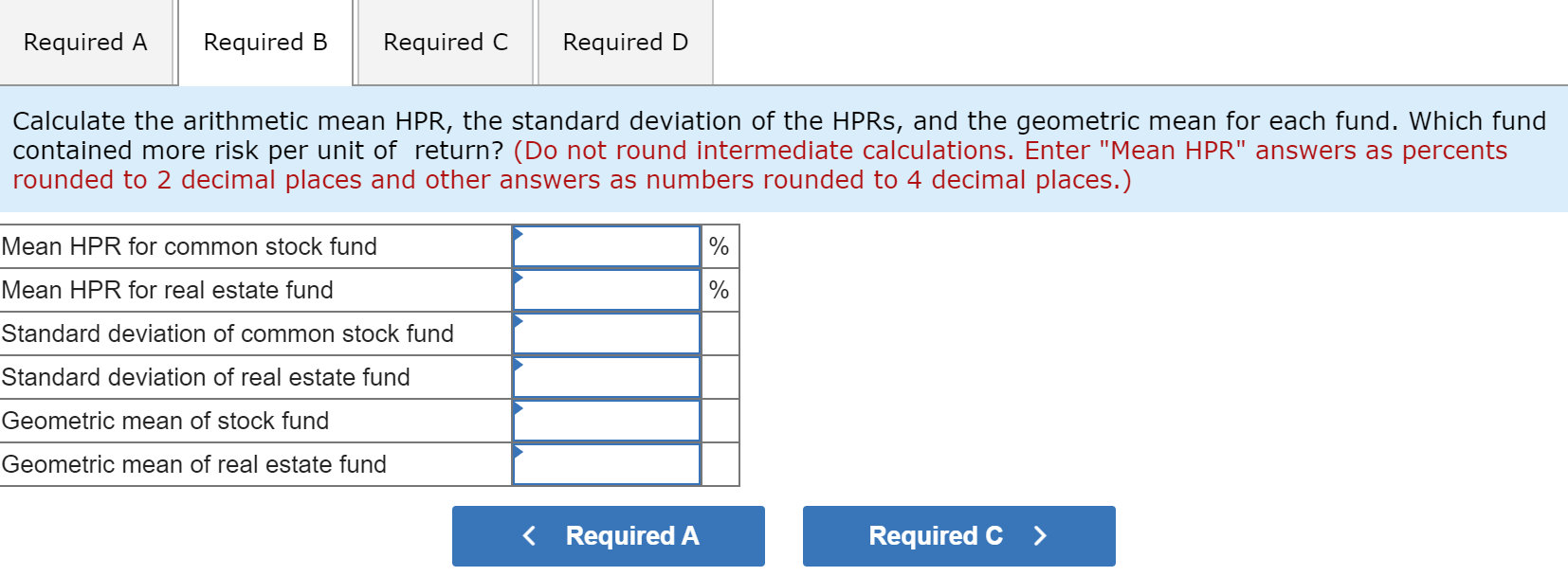

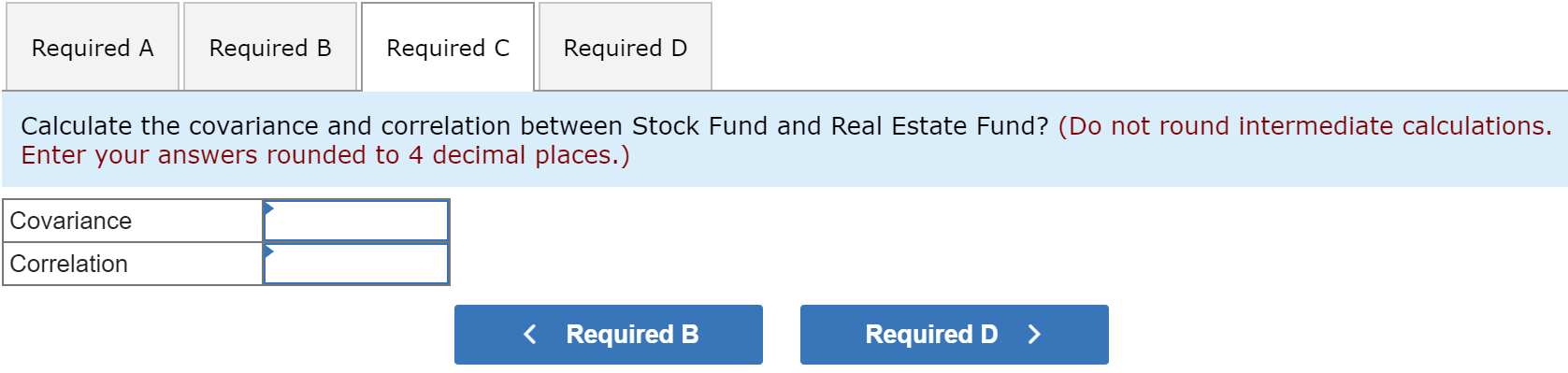

a. Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend wont be included in the calculations. b. Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? c. Calculate the covariance and correlation between Stock Fund and Real Estate Fund? d. Would the proposed portfolio provide any investment diversification?

Period Ending Quarter 1 Quarter 2 Quarter 3 Quarter 4 Quarter 5 Quarter 6 Quarter 7 Quarter 8 Quarter 9 Quarter 10 Quarter 11 Quarter 12 Quarter 13 ET&T Common Stock Fund Quarterly Unit Value Dividend $ 701.00 $ 8.28 752.50 8.11 850.52 10.30 953.75 9.81 1,047.57 12.05 1,221.70 14.17 1,443.90 17.18 1,263.31 14.91 1,258.56 13.84 1,526.72 18.32 1,616.81 19.73 1,624.08 19.98 1,560.25 18.88 MREAF Real Estate Fund Quarterly Unit Value Dividend $ 70.00 $ 2.17 80.05 2.14 90.80 2.01 100.50 2.01 99.14 1.87 95.50 1.81 93.77 1.79 80.31 1.54 77.34 1.49 76.53 1.44 78.42 1.51 79.01 1.53 81.75 1.55 Required A Required B Required C Required D Calculate the quarterly HPR for each investment. HINT: The first HPR will be in quarter 2 because 2 quarters are needed to calculate a return. The first quarter dividend won't be included in the calculations. (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) HPR for common stock fund % HPR for real estate fund % Required A Required B Required C Required D Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? (Do not round intermediate calculations. Enter "Mean HPR" answers as percents rounded to 2 decimal places and other answers as numbers rounded to 4 decimal places.) Mean HPR for common stock fund % Mean HPR for real estate fund % Standard deviation of common stock fund Standard deviation of real estate fund Geometric mean of stock fund Geometric mean of real estate fund Required A Required B Required C Required D Calculate the covariance and correlation between Stock Fund and Real Estate Fund? (Do not round intermediate calculations. Enter your answers rounded to 4 decimal places.) Covariance Correlation Required A Required B Required C Required D Calculate the arithmetic mean HPR, the standard deviation of the HPRs, and the geometric mean for each fund. Which fund contained more risk per unit of return? (Do not round intermediate calculations. Enter "Mean HPR" answers as percents rounded to 2 decimal places and other answers as numbers rounded to 4 decimal places.) Mean HPR for common stock fund % Mean HPR for real estate fund % Standard deviation of common stock fund Standard deviation of real estate fund Geometric mean of stock fund Geometric mean of real estate fund Required A Required B Required C Required D Calculate the covariance and correlation between Stock Fund and Real Estate Fund? (Do not round intermediate calculations. Enter your answers rounded to 4 decimal places.) Covariance Correlation