Answered step by step

Verified Expert Solution

Question

1 Approved Answer

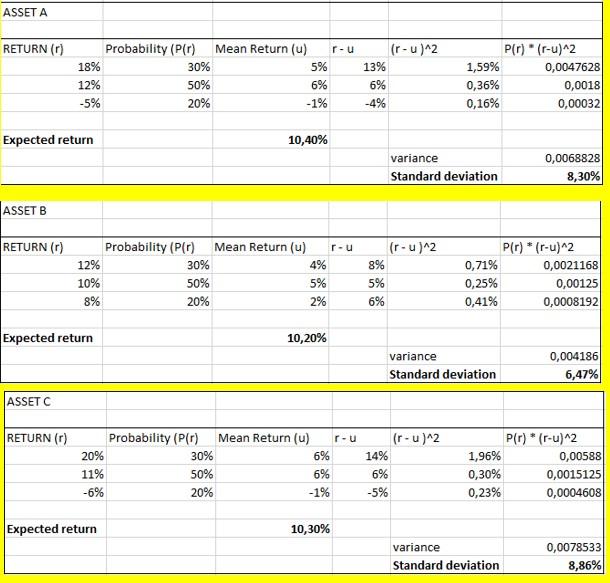

As an investor what do you choose among the three alternatives: A, B or C? Why? ASSET A RETURN (0) (r-u)^2 Probability (P(r) Mean Return

As an investor what do you choose among the three alternatives: A, B or C? Why?

ASSET A RETURN (0) (r-u)^2 Probability (P(r) Mean Return (u) r-u 18% 30% 5% 12% 50% 6% -5% 20% - 1% 13% 6% -4% P(r) (r-u)^2 1,59% 0,0047628 0,36% 0,0018 0,16% 0,00032 Expected return 10,40% variance Standard deviation 0,0068828 8,30% ASSET B RETURN (T) r-u (r-u)^2 Probability (PIT) Mean Return (u) 12% 30% 4% 10% 50% 5% 8% 20% 2% 8% 5% 6% 0,71% 0,25% 0,41% P(r) * (r-u)^2 0,0021168 0,00125 0,0008192 Expected return 10,20% variance Standard deviation 0,004186 6,47% ASSET C RETURN () r-u Probability (PT) Mean Return (u) 20% 30% 6% 11% 50% 6% -6% 20% -1% (r-u)^2 14% 6% -5% 1,96% 0,30% 0,23% P(r) * (r-u)^2 0,00588 0,0015125 0,0004608 Expected return 10,30% variance Standard deviation 0,0078533 8,86%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started