Question

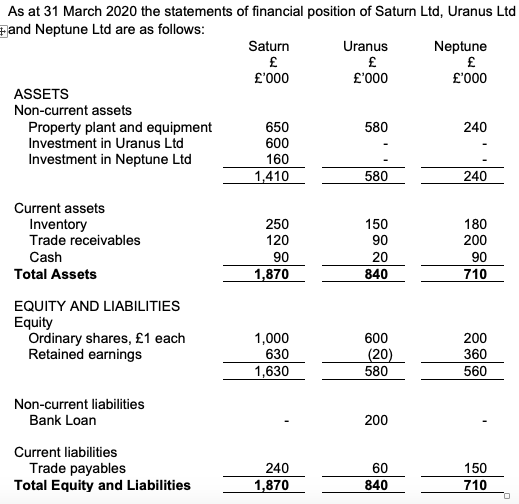

As at 31 March 2020 the statements of financial position of Saturn Ltd, Uranus Ltd and Neptune Ltd are as follows: Saturn Uranus Neptune 000

As at 31 March 2020 the statements of financial position of Saturn Ltd, Uranus Ltd and Neptune Ltd are as follows:

|

| Saturn |

| Uranus |

| Neptune |

|

|

|

|

|

|

|

|

| 000 |

| 000 |

| 000 |

| ASSETS |

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

| Property plant and equipment | 650 |

| 580 |

| 240 |

| Investment in Uranus Ltd | 600 |

| - |

| - |

| Investment in Neptune Ltd | 160 |

| - |

| - |

|

| 1,410 |

| 580 |

| 240 |

|

|

|

|

|

|

|

| Current assets Inventory Trade receivables Cash |

250 120 90 |

|

150 90 20 |

|

180 200 90 |

| Total Assets | 1,870 |

| 840 |

| 710 |

|

|

|

|

|

|

|

| EQUITY AND LIABILITIES |

|

|

|

|

|

| Equity |

|

|

|

|

|

| Ordinary shares, 1 each | 1,000 |

| 600 |

| 200 |

| Retained earnings | 630 |

| (20) |

| 360 |

|

| 1,630 |

| 580 |

| 560 |

|

|

|

|

|

|

|

| Non-current liabilities Bank Loan

Current liabilities Trade payables |

-

240 |

|

200

60 |

|

-

150 |

| Total Equity and Liabilities | 1,870 |

| 840 |

| 710 |

Notes

In addition, the following information is available:

- i. On 1 July 2019, Saturn acquired 80% of the ordinary shares of Uranus and 25% of the ordinary shares of Neptune.

- ii. At the date of acquisition (1 July 2019), the fair value of the property plant and equipment of Uranus was 60,000 higher than their book value (assume that this difference all relates to land). This valuation has not been reflected in the books of Uranus Ltd.

- iii. The retained earnings as at 1 July 2019 for Uranus Ltd and Neptune Ltd were 40,000 and 280,000 respectively.

- iv. On 31 March 2020, the goodwill arising on acquisition of Uranus was reviewed for impairment. It is deemed to have been impaired by 20,000 since the acquisition date. No impairment has previously been recognized on this goodwill.

- v. In February 2020, Saturn sold goods to Uranus at a mark-up on cost of 40%. These goods had originally cost Saturn 200,000 when purchased from a supplier outside the group. Three-quarters of thee goods had not been sold by Uranus as at 31 March 2020.

- vi. Any depreciation consequences of the fair value adjustment relating to the non-current assets of Uranus Ltd may be ignored.

Required:

Prepare the consolidated statement of financial position for the Saturn Group as at 31 March 2020, in accordance with international financial reporting standards.

As at 31 March 2020 the statements of financial position of Saturn Ltd, Uranus Ltd and Neptune Ltd are as follows: Saturn Uranus Neptune '000 '000 '000 ASSETS Non-current assets Property plant and equipment 650 580 240 Investment in Uranus Ltd 600 Investment in Neptune Ltd 160 1,410 580 240 Current assets Inventory Trade receivables Cash Total Assets 250 120 90 1,870 150 90 20 840 180 200 90 710 EQUITY AND LIABILITIES Equity Ordinary shares, 1 each Retained earnings 1,000 630 1,630 600 (20) 580 200 360 560 Non-current liabilities Bank Loan 200 Current liabilities Trade payables Total Equity and Liabilities 240 1,870 60 840 150 710

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started