Answered step by step

Verified Expert Solution

Question

1 Approved Answer

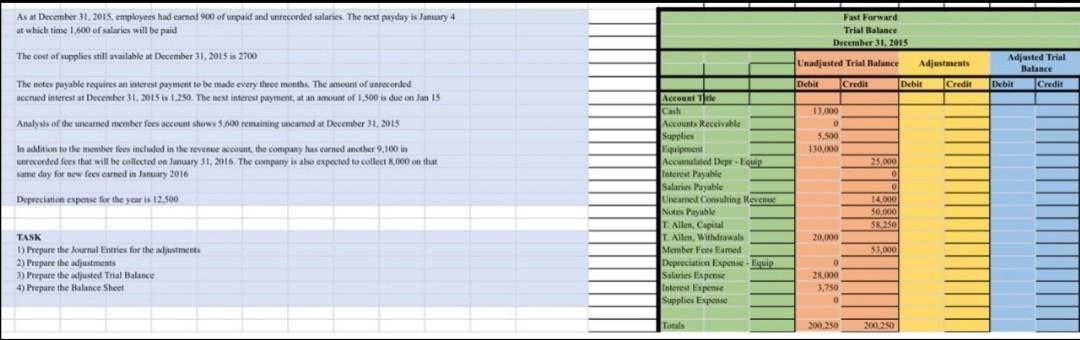

As at December 31, 2015, employees had eamet 90% of unpaid and unrecorded salaries. The next payday is January 4 at which time 1.600 of

As at December 31, 2015, employees had eamet 90% of unpaid and unrecorded salaries. The next payday is January 4 at which time 1.600 of salaries will be paid Fast Forward Trial Balance December 31, 2015 The cost of supplies still able at December 31, 2015 is 2700 Unadjusted Trial Balance Adjustments Debit Credit Debit Credit Adjusted Trial Balance Debit Credit The notes payable requires an interest payment to be made every three months. The amount of unrecorded sed interest at December 31, 2015 is 1.250. The best interest payment, an amount of 1,500 is dus on Jan 15 13.000 Analysis of the neumed member foes account shows 5,600 remaining uncanied at December 31, 2015 In addition to the member fees included in the revenue account, the company has earned another 9.100 in unrecented foes that will be collected on Sunary 31, 2016. The company is also expected to collect 8,000 on the same day for new fees carned in January 2016 5.500 110,000 25,000 Depreciation expense for the year is 12.500 Account Title Cash Accounts Receivable Supplies Accumulated Depe-up Interest Payable Salaris Payable Chementing Rex Notes Payable T. Allen, Capital 1 Allen, Withdrawal Member Fees Eamed Depreciatic spese.Eu Salaries Expense Interest Esporte Supplies Expense O 14.00 $0.00 58.250 20.000 53,000 TASK 1) Prepare the Journal Eintries for the adjustments 1 2)Prepare the times 3) Prepare the adjusted Trial Balance 4) Prepare the Balance Sheet O 28.000 3.750 0 Totals 200.250 200.250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started