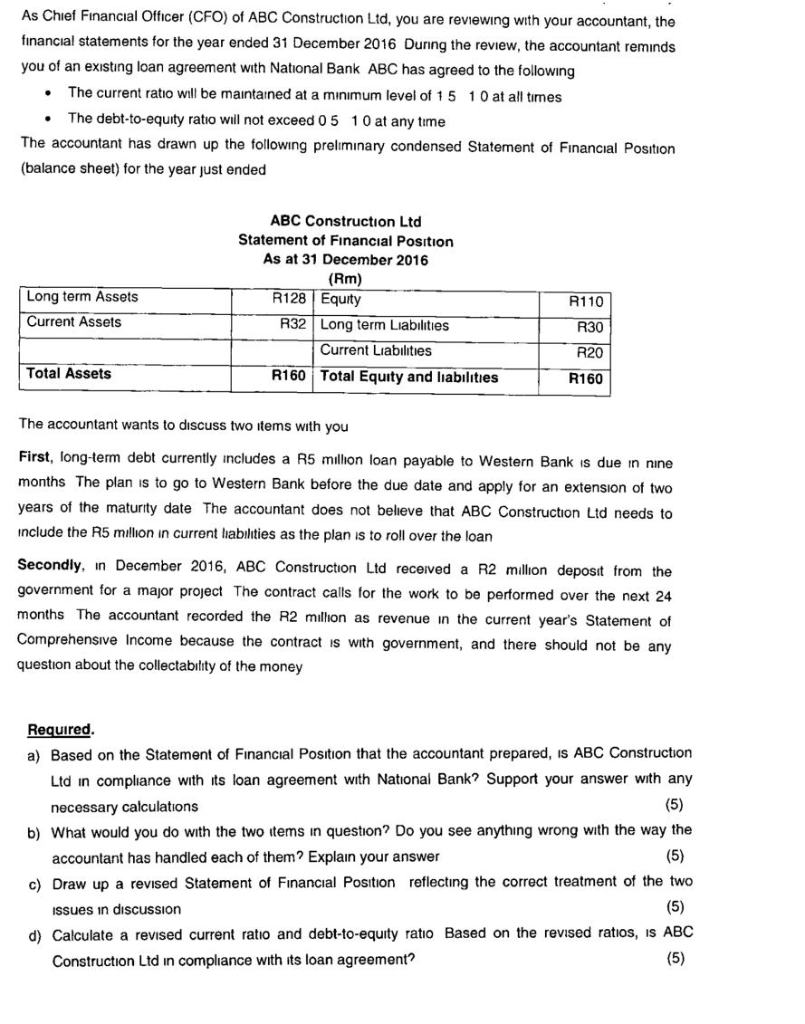

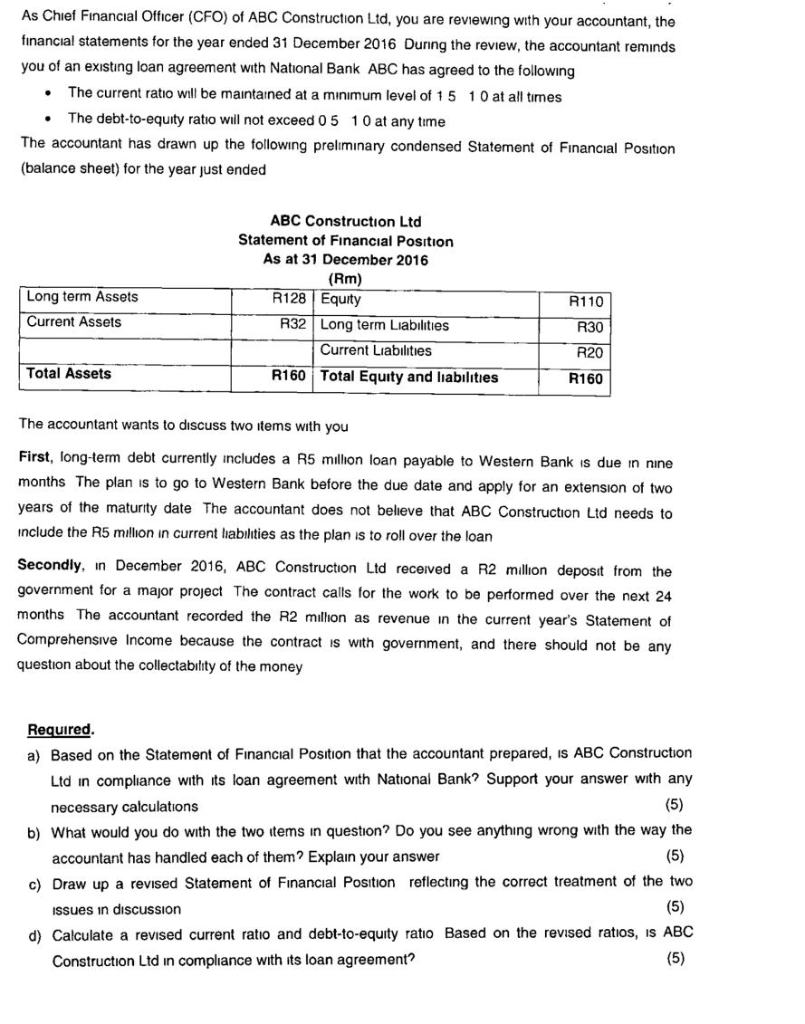

As Chief Financial Officer (CFO) of ABC Construction Ltd, you are reviewing with your accountant, the financial statements for the year ended 31 December 2016 Durng the review, the accountant reminds you of an existing loan agreement with National Bank ABC has agreed to the following The current ratio will be maintained at a minimum level of 1 5 10 at all times The debt-to-equity ratio will not exceed 0 5 0 at any time The accountant has drawn up the following preliminary condensed Statement of Financial Position (balance sheet) for the year just ended ABC Construction Ltd Statement of Financial Position As at 31 December 2016 (Rm) R128 Equity Long term Assets R110 Current Assets R32 Long term Liabilities R30 Current Liabilities R20 Total Assets R160 Total Equity and liabilities R160 The accountant wants to discuss two items with you First, long-term debt currently includes a R5 million loan payable to Western Bank due in nine months The plan is to go to Western Bank before the due date and apply for an extension of two years of the maturity date The accountant does not believe that ABC Construction Ltd needs to include the R5 million in current labilities as the plan is to roll over the loan Secondly, in December 2016, ABC Construction Ltd received a R2 million deposit from the government for a major project The contract calls for the work to be performed over the next 24 months The accountant recorded the R2 million as revenue in the current year's Statement of Comprehensive Income because the contract is with government, and there should not be any question about the collectability of the money Required a) Based on the Statement of Financial Position that the accountant prepared, is ABC Construction Ltd in compliance with its loan agreement with National Bank? Support your answer with any (5) necessary calculations b) What would you do with the two items in question? Do you see anything wrong with the way the (5) accountant has handled each of them? Explain your answer c) Draw up a revised Statement of Financial Position reflecting the correct treatment of the two (5) ISsues in discussion d) Calculate a revised current ratio and debt-to-equity ratio Based on the revised ratios, is ABC (5) Construction Ltd in compliance with its loan agreement