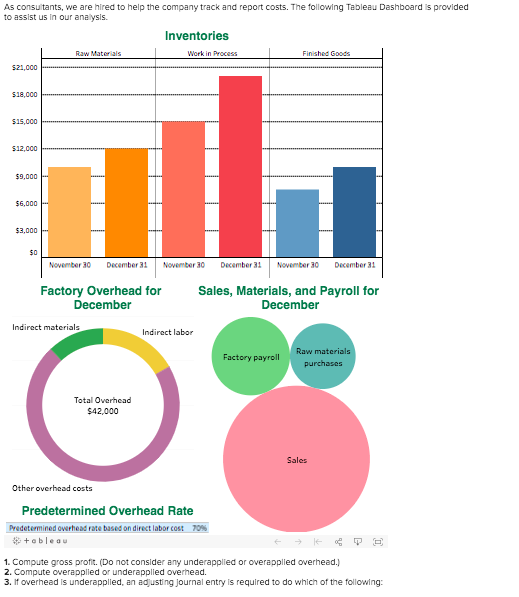

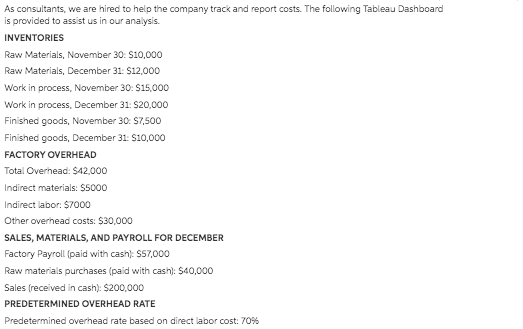

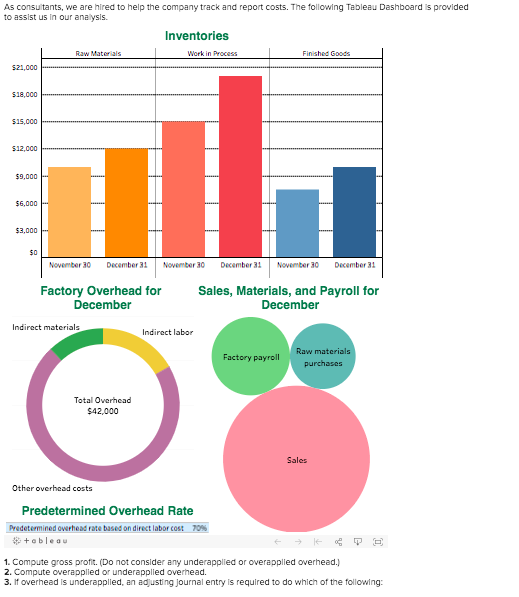

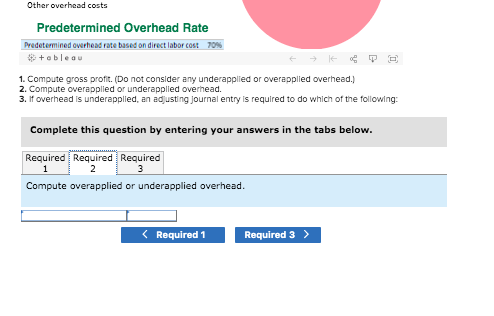

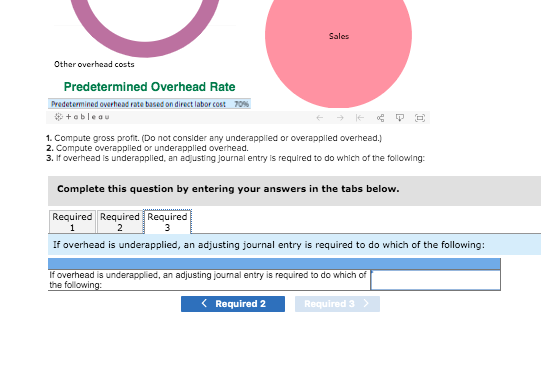

As consultants, we are hired to help the company track and report costs. The following Tableau Dashboard is provided to assist us in our analysis INVENTORIES Raw Materials, November 30: $10,000 Raw Materials, December 31: $12,000 Work in process, November 30: $15,000 Work in process, December 31: $20,000 Finished goods, November 30: S7,500 Finished goods, December 31: $10,000 FACTORY OVERHEAD Total Overhead: $42.000 Indirect materials: $5000 Indirect labor: $7000 Other overhead costs: $30,000 SALES, MATERIALS, AND PAYROLL FOR DECEMBER Factory Payroll (paid with cash) $57,000 Raw materials purchases (paid with cash): $40,000 Sales (received in cash): $200,000 PREDETERMINED OVERHEAD RATE Predetermined overhead rate based on direct labor cost: 70% As constants, we are hired to help the company track and report costs. The following Tableau Dashboard is provided to assist us in our analysis Inventories Raw Materials Work in Process Finished Goods $23.00C $3,000 November 10 December November 30 December November 30 December Factory Overhead for Sales, Materials, and Payroll for December December Indirect materials Indirect labor Factory payroll Raw materials purchases Total Overhead $42.000 Other Overhead costs Predetermined Overhead Rate Predetermined owerhead rate based on direct labor cost 70 tableau 1. Compute gross profit. (Do not consider any underapplied or overapolled overhead.) 2. Compute overapplied or underapplied overhead 3. If overhead is underapplied, an adjusting journal entry is required to do which of the following: Predetermined Overhead Rate Predetermined overhead rate based on direct labor cost 709 + obleau 1. Compute gross profit. (Do not consider any underapplied or overapplied overhead.) 2. Compute overappiled or underapplied overhead. 3. If overhead is underapplied, an adjusting journal entry is required to do which of the following: Complete this question by entering your answers in the tabs below. Required Required Required Compute gross profit. (Do not consider any underapplied or overapplied overhead.) Required 1 Required 2 > Other overhead costs Predetermined Overhead Rate Predetermined overhead rate based on direct labor cost 70% 38 + ableau 1. Compute gross profit. (Do not consider any underapplied or overapplied overhead. 2. Compute overapplied or underapplied overhead. 3. If overhead is underapplied, an adjusting journal entry is required to do which of the following: Complete this question by entering your answers in the tabs below. Required Required Required Compute overapplied or underapplied overhead. Other overhead costs Predetermined Overhead Rate Predetermined overhead rate based on direct labor cost 70% tableau 1. Compute gross profit. (Do not consider any underapplied or overapplied overhead. 2. Compute overapplied or underapplied overhead. 3. If overhead is underapplied, an adjusting journal entry is required to do which of the following: Complete this question by entering your answers in the tabs below. Required Required Required If overhead is underapplied, an adjusting journal entry is required to do which of the following: If overhead is underapplied, an adjusting joumal entry is required to do which of the following: