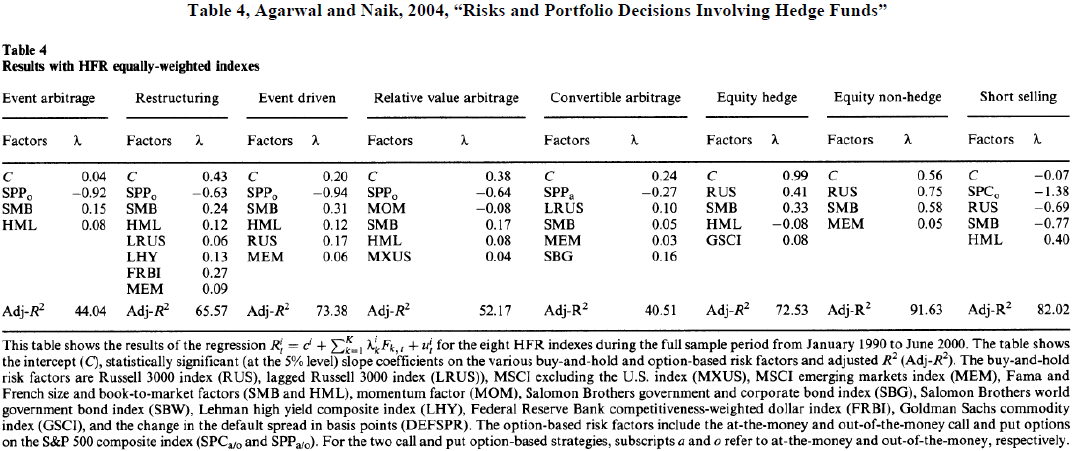

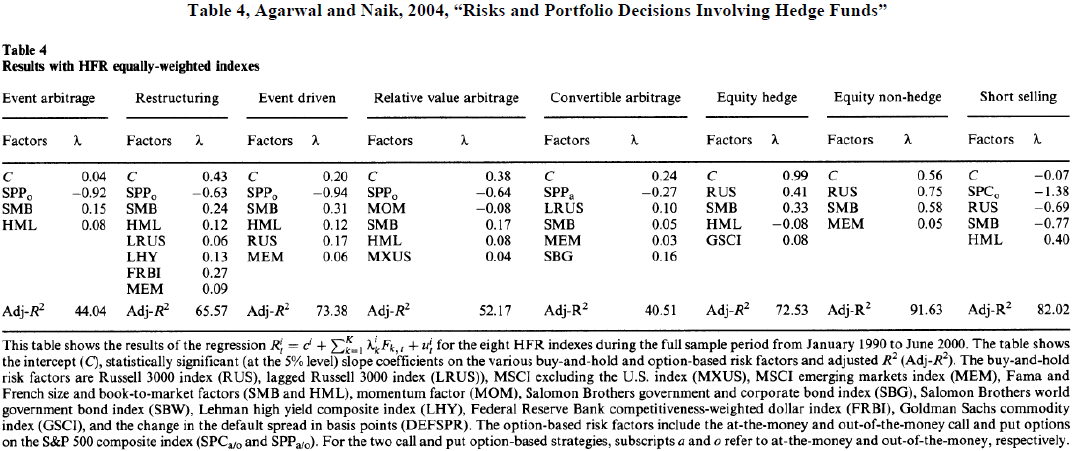

As evidenced by Table 4 from Agarwal and Naik (2004, Risks and portfolio decisions involving hedge funds, Review of Financial Studies) provided above:

Identify the hedge fund strategies that entail option-like exposures. (1 point)

Table 4, Agarwal and Naik, 2004, "Risks and Portfolio Decisions Involving Hedge Funds" Table 4 Results with HFR equally-weighted indexes Event arbitrage Restructuring Event driven Relative value arbitrage Convertible arbitrage Equity hedge Equity non-hedge Factors Factors 2 Factors. 2 Factors ^ Factors A Factors Factors A 0.04 C 0.43 0.38 0.24 -0.27 SPP SPP -0.64 SPPa -0.92 SPP. 0.15 SMB -0.63 SPP, 0.24 SMB RUS SMB HML -0.08 MEM 0.99 C 0.41 RUS 0.33 SMB 0.56 0.75 0.58 SPC RUS -0.07 - 1.38 -0.69 SMB MOM -0.08 LRUS 0.31 0.12 SMB 0.10 0.05 HML 0.08 HML 0.17 SMB 0.05 SMB -0.77 0.12 HML 0.06 RUS 0.17 HML 0.08 MEM 0.03 GSCI 0.08 0.40 HML LRUS LHY 0.13 MEM 0.06 MXUS 0.04 SBG 0.16 FRBI 0.27 MEM 0.09 Adj-R 44.04 Adj-R 65.57 Adj-R 73.38 Adj-R 52.17 Adj-R 40.51 Adj-R 72.53 Adj-R 82.02 91.63 Adj-R This table shows the results of the regression R = c +kFk, + for the eight HFR indexes during the full sample period from January 1990 to June 2000. The table shows the intercept (C), statistically significant (at the 5% level) slope coefficients on the various buy-and-hold and option-based risk factors and adjusted R (Adj-R). The buy-and-hold risk factors are Russell 3000 index (RUS), lagged Russell 3000 index (LRUS)), MSCI excluding the U.S. index (MXUS), MSCI emerging markets index (MEM), Fama and French size and book-to-market factors (SMB and HML), momentum factor (MOM), Salomon Brothers government and corporate bond index (SBG), Salomon Brothers world government bond index (SBW), Lehman high yield composite index (LHY), Federal Reserve Bank competitiveness-weighted dollar index (FRBI), Goldman Sachs commodity index (GSCI), and the change in the default spread in basis points (DEFSPR). The option-based risk factors include the at-the-money and out-of-the-money call and put options on the S&P 500 composite index (SPC/o and SPPalo). For the two call and put option-based strategies, subscripts a and o refer to at-the-money and out-of-the-money, respectively. Factors 0.20 -0.94 Short selling Table 4, Agarwal and Naik, 2004, "Risks and Portfolio Decisions Involving Hedge Funds" Table 4 Results with HFR equally-weighted indexes Event arbitrage Restructuring Event driven Relative value arbitrage Convertible arbitrage Equity hedge Equity non-hedge Factors Factors 2 Factors. 2 Factors ^ Factors A Factors Factors A 0.04 C 0.43 0.38 0.24 -0.27 SPP SPP -0.64 SPPa -0.92 SPP. 0.15 SMB -0.63 SPP, 0.24 SMB RUS SMB HML -0.08 MEM 0.99 C 0.41 RUS 0.33 SMB 0.56 0.75 0.58 SPC RUS -0.07 - 1.38 -0.69 SMB MOM -0.08 LRUS 0.31 0.12 SMB 0.10 0.05 HML 0.08 HML 0.17 SMB 0.05 SMB -0.77 0.12 HML 0.06 RUS 0.17 HML 0.08 MEM 0.03 GSCI 0.08 0.40 HML LRUS LHY 0.13 MEM 0.06 MXUS 0.04 SBG 0.16 FRBI 0.27 MEM 0.09 Adj-R 44.04 Adj-R 65.57 Adj-R 73.38 Adj-R 52.17 Adj-R 40.51 Adj-R 72.53 Adj-R 82.02 91.63 Adj-R This table shows the results of the regression R = c +kFk, + for the eight HFR indexes during the full sample period from January 1990 to June 2000. The table shows the intercept (C), statistically significant (at the 5% level) slope coefficients on the various buy-and-hold and option-based risk factors and adjusted R (Adj-R). The buy-and-hold risk factors are Russell 3000 index (RUS), lagged Russell 3000 index (LRUS)), MSCI excluding the U.S. index (MXUS), MSCI emerging markets index (MEM), Fama and French size and book-to-market factors (SMB and HML), momentum factor (MOM), Salomon Brothers government and corporate bond index (SBG), Salomon Brothers world government bond index (SBW), Lehman high yield composite index (LHY), Federal Reserve Bank competitiveness-weighted dollar index (FRBI), Goldman Sachs commodity index (GSCI), and the change in the default spread in basis points (DEFSPR). The option-based risk factors include the at-the-money and out-of-the-money call and put options on the S&P 500 composite index (SPC/o and SPPalo). For the two call and put option-based strategies, subscripts a and o refer to at-the-money and out-of-the-money, respectively. Factors 0.20 -0.94 Short selling