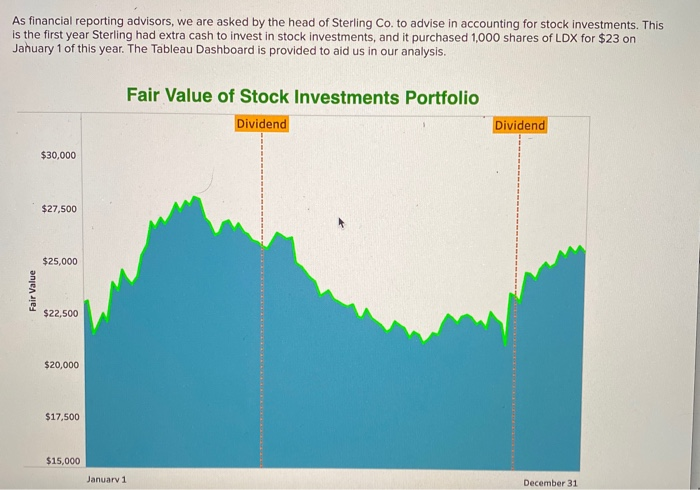

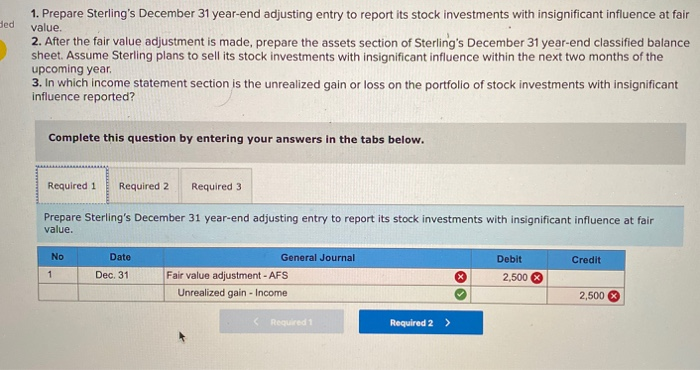

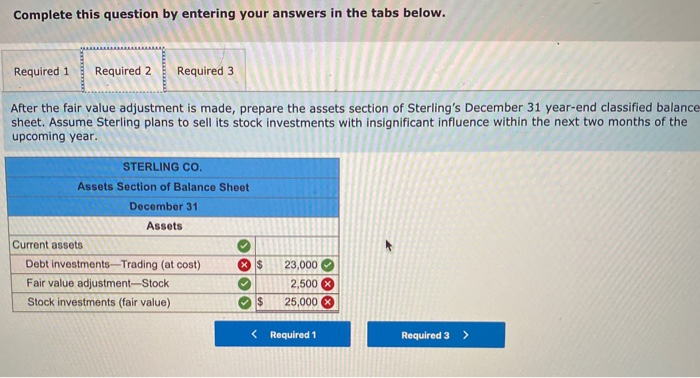

As financial reporting advisors, we are asked by the head of Sterling Co. to advise in accounting for stock investments. This is the first year Sterling had extra cash to invest in stock investments, and it purchased 1,000 shares of LDX for $23 on January 1 of this year. The Tableau Dashboard is provided to aid us in our analysis. Fair Value of Stock Investments Portfolio Dividend Dividend $30,000 $27,500 $25,000 Fair Value $22,500 $20,000 $17,500 $15.000 Januarv 1 December 31 ded 1. Prepare Sterling's December 31 year-end adjusting entry to report its stock investments with insignificant influence at fair value. 2. After the fair value adjustment is made, prepare the assets section of Sterling's December 31 year-end classified balance sheet. Assume Sterling plans to sell its stock investments with insignificant influence within the next two months of the upcoming year. 3. In which income statement section is the unrealized gain or loss on the portfolio of stock investments with insignificant influence reported? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare Sterling's December 31 year-end adjusting entry to report its stock investments with insignificant influence at fair value. Credit No 1 Date Dec. 31 General Journal Fair value adjustment - AFS Unrealized gain -Income Debit 2,500 2,500 Regedi Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 After the fair value adjustment is made, prepare the assets section of Sterling's December 31 year-end classified balance Assume Sterling plans to sell its stock investments with insignificant influence within the next two months of the upcoming year. STERLING CO. Assets Section of Balance Sheet December 31 Assets Current assets Debt investments-Trading (at cost) $ Fair value adjustment-Stock Stock investments (fair value) $ 23,000 2,500 25,000 As financial reporting advisors, we are asked by the head of Sterling Co. to advise in accounting for stock investments. This is the first year Sterling had extra cash to invest in stock investments, and it purchased 1,000 shares of LDX for $23 on January 1 of this year. The Tableau Dashboard is provided to aid us in our analysis. Fair Value of Stock Investments Portfolio Dividend Dividend $30,000 $27,500 $25,000 Fair Value $22,500 $20,000 $17,500 $15.000 Januarv 1 December 31 ded 1. Prepare Sterling's December 31 year-end adjusting entry to report its stock investments with insignificant influence at fair value. 2. After the fair value adjustment is made, prepare the assets section of Sterling's December 31 year-end classified balance sheet. Assume Sterling plans to sell its stock investments with insignificant influence within the next two months of the upcoming year. 3. In which income statement section is the unrealized gain or loss on the portfolio of stock investments with insignificant influence reported? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare Sterling's December 31 year-end adjusting entry to report its stock investments with insignificant influence at fair value. Credit No 1 Date Dec. 31 General Journal Fair value adjustment - AFS Unrealized gain -Income Debit 2,500 2,500 Regedi Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 After the fair value adjustment is made, prepare the assets section of Sterling's December 31 year-end classified balance Assume Sterling plans to sell its stock investments with insignificant influence within the next two months of the upcoming year. STERLING CO. Assets Section of Balance Sheet December 31 Assets Current assets Debt investments-Trading (at cost) $ Fair value adjustment-Stock Stock investments (fair value) $ 23,000 2,500 25,000