As George Harman of Centralia Construction Corporation (CCC) reviewed the drawings and cost estimates for the Myerson Industries plant expansion, he wondered how aggressively

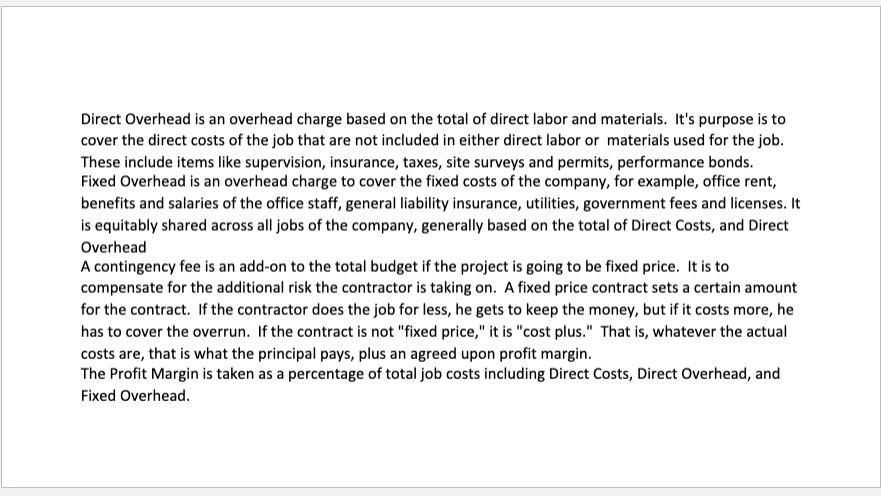

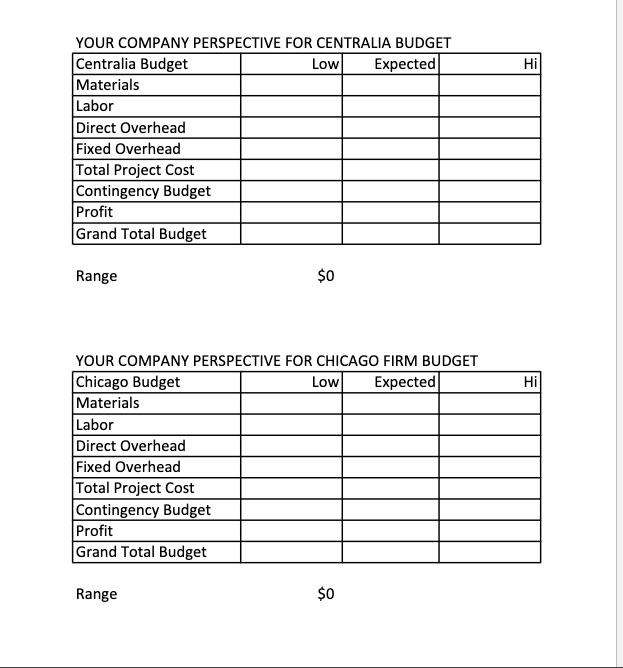

As George Harman of Centralia Construction Corporation (CCC) reviewed the drawings and cost estimates for the Myerson Industries plant expansion, he wondered how aggressively he should bid on the project. The current recession had taken a huge bite out of his business, and the Myerson contract would certainly brighten his rather gloomy view of the future. CCC was a family-run, general contracting firm specializing in the construction of commercial structures in south-central Illinois. Founded 30 years ago by George Harman's father, the business had prospered until the recent recession. For the first time in years, there was no backlog of projects, and layoffs had occurred. Although the firm was not in serious financial trouble, more work would be welcomed. Myerson Industries was a highly successful, fast-growing firm specializing in low-cost printers for use with personal computer systems. The Myerson plant was located approximately 50 miles from CCC's offices in Centralia, Illinois. Recently, Roger Myerson had informally inquired if CCC would be interested in bidding on a contract for an addition to the Myerson facility. Harman indicated that he would look forward to the opportunity to submit a bid. Last week the architectural drawings arrived with a cover letter stating that a fixed-price contract would be preferred; that is, the contractor would be paid an agreed fixed amount for the work and would assume the risk of any fluctuations in costs. Joe Planz, CCC's chief estimator, had prepared estimates of material and labor costs for the project on the basis of the specifications in the drawings. He believed that the material cost would be $1.8 million, plus or minus 10%, and the labor cost would be $650,000, plus or minus 10%. Harman had figured that additional direct overhead (supervision, insurance, taxes, interest on capital tied up with the project, surveys, bonds of performance, etc.) would add an amount totaling 10% of the material and labor costs. Fixed overhead was very small for jobs of this type, about $50,000. Harman knew that CCC was the only firm in the region that would have the expertise for a plant addition of this type. He worried, however, about the possibility of a large Chicago firm taking the job. Increasingly, large Chicago contractors had encroached on regional construction work, particularly in southern Illinois, about 200 miles from the city. He knew that the Chicago firms, because of their union contracts, had 30% higher labor costs than his own nonunion rates, but they had comparable material costs and direct overhead charges. Indirect costs would typically be much higher, as much as $100,000 for a job of this type, because of the large engineering and sales staffs of the Chicago firms. Rumors indicated that the Chicago firms had demanded large profit margins for working so far from headquarters. A profit margin of 10% to 20% was usual, with a figure of 15% being most likely. For fixed-price contracts, firms usually bid on the basis of the expected cost of construction plus profit and a contingency for the risk of taking the job on a fixed-cost basis. For a project of this nature, an appropriate contingency would be 5% of total expected cost. Under the current circumstances, Harman believed he could live with a 7% profit margin. To this figure, the contingency would have to be added. Harman was unwilling to consider a pro forma profit of less than $192,000 (7% of Planz's cost estimate); he preferred to pursue other opportunities if this profit level could not be obtained. (See the attached sample Negotiation Summary form.) Direct Overhead is an overhead charge based on the total of direct labor and materials. It's purpose is to cover the direct costs of the job that are not included in either direct labor or materials used for the job. These include items like supervision, insurance, taxes, site surveys and permits, performance bonds. Fixed Overhead is an overhead charge to cover the fixed costs of the company, for example, office rent, benefits and salaries of the office staff, general liability insurance, utilities, government fees and licenses. It is equitably shared across all jobs of the company, generally based on the total of Direct Costs, and Direct Overhead A contingency fee is an add-on to the total budget if the project is going to be fixed price. It is to compensate for the additional risk the contractor is taking on. A fixed price contract sets a certain amount for the contract. If the contractor does the job for less, he gets to keep the money, but if it costs more, he has to cover the overrun. If the contract is not "fixed price," it is "cost plus." That is, whatever the actual costs are, that is what the principal pays, plus an agreed upon profit margin. The Profit Margin is taken as a percentage of total job costs including Direct Costs, Direct Overhead, and Fixed Overhead. Question: What are your best estimates of the budget ranges for both Centralia and the Chicago firm with following template? YOUR COMPANY PERSPECTIVE FOR CENTRALIA BUDGET Centralia Budget Low Expected Materials Labor Direct Overhead Fixed Overhead Total Project Cost Contingency Budget Profit Grand Total Budget Range YOUR COMPANY PERSPECTIVE FOR CHICAGO FIRM BUDGET Chicago Budget Low Expected Materials Labor Direct Overhead Fixed Overhead Total Project Cost Contingency Budget Profit Grand Total Budget $0 Range $0 Hi Hi

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided here are the key considerations for George Harman in determining h...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started