Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As in class, consumers buy many differentiated varieties/brands of automobiles. An automobile brand is produced with increasing returns to scale: specifically, it takes f units

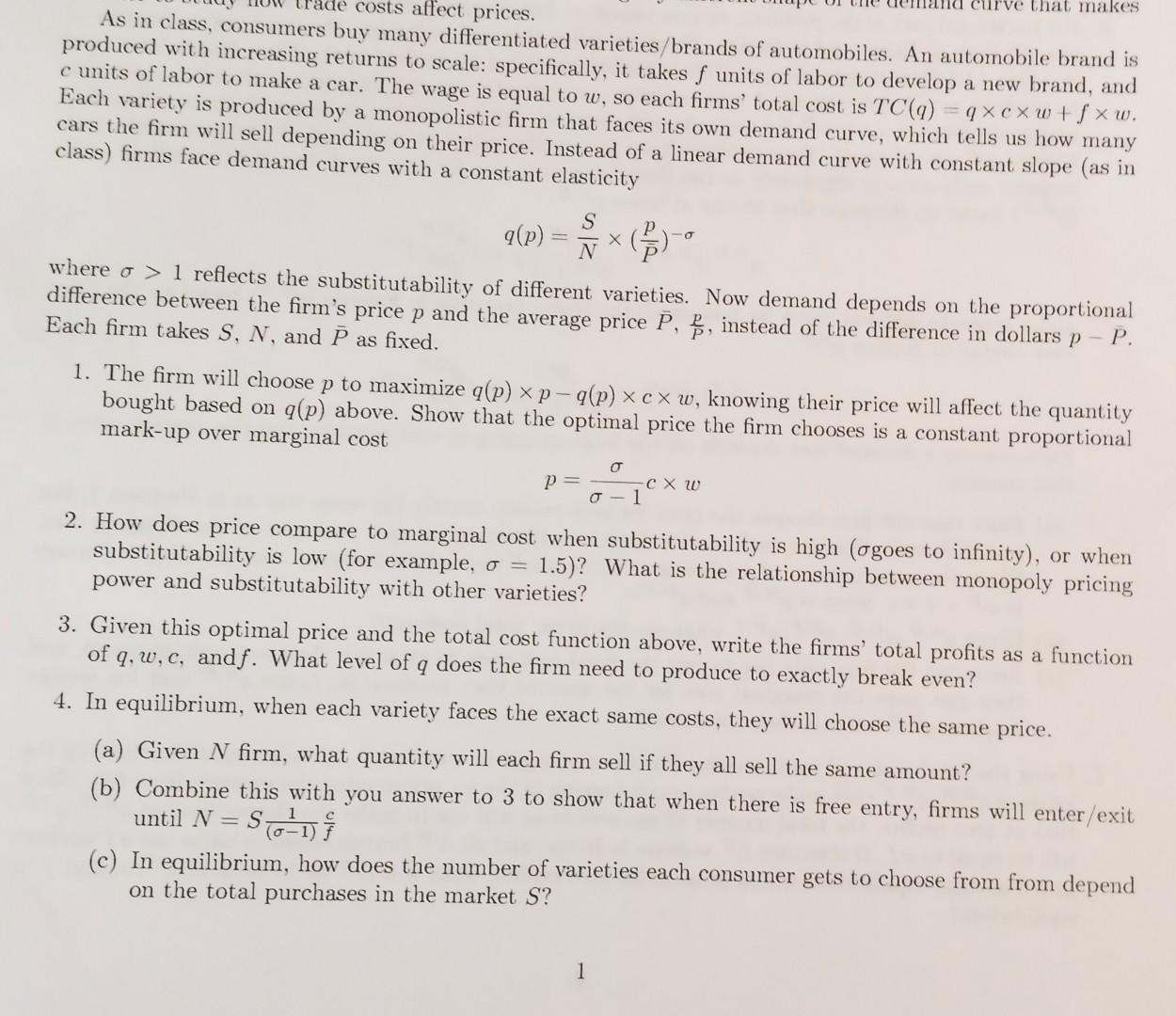

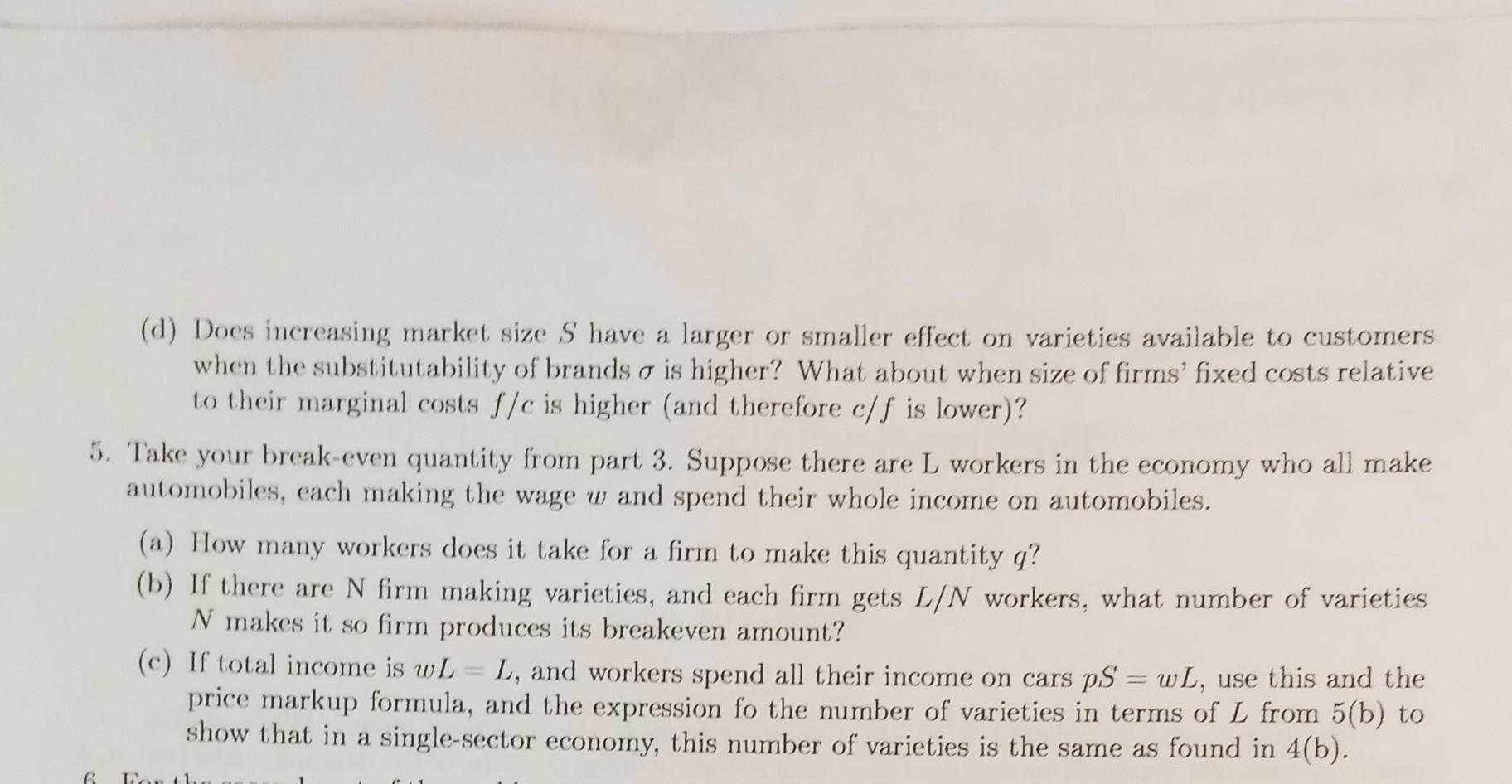

As in class, consumers buy many differentiated varieties/brands of automobiles. An automobile brand is produced with increasing returns to scale: specifically, it takes f units of labor to develop a new brand, and c units of labor to make a car. The wage is equal to w, so each firms' total cost is TC(q)=qcw+fw. Each variety is produced by a monopolistic firm that faces its own demand curve, which tells us how many cars the firm will sell depending on their price. Instead of a linear demand curve with constant slope (as in class) firms face demand curves with a constant elasticity q(p)=NS(Pp) where >1 reflects the substitutability of different varieties. Now demand depends on the proportional difference between the firm's price p and the average price P,Pp, instead of the difference in dollars pP. Each firm takes S,N, and P as fixed. 1. The firm will choose p to maximize q(p)pq(p)cw, knowing their price will affect the quantity bought based on q(p) above. Show that the optimal price the firm chooses is a constant proportional mark-up over marginal cost p=1cw 2. How does price compare to marginal cost when substitutability is high ( goes to infinity), or when substitutability is low (for example, =1.5 )? What is the relationship between monopoly pricing power and substitutability with other varieties? 3. Given this optimal price and the total cost function above, write the firms' total profits as a function of q,w,c, and f. What level of q does the firm need to produce to exactly break even? 4. In equilibrium, when each variety faces the exact same costs, they will choose the same price. (a) Given N firm, what quantity will each firm sell if they all sell the same amount? (b) Combine this with you answer to 3 to show that when there is free entry, firms will enter/exit until N=S(1)1fc (c) In equilibrium, how does the number of varieties each consumer gets to choose from from depend on the total purchases in the market S ? (d) Does increasing market size S have a larger or smaller effect on varieties available to customers when the substitutability of brands is higher? What about when size of firms' fixed costs relative to their marginal costs f/c is higher (and therefore c/f is lower)? 5. Take your break-even quantity from part 3. Suppose there are L workers in the economy who all make automobiles, each making the wage w and spend their whole income on automobiles. (a) How many workers does it take for a firm to make this quantity q ? (b) If there are N firm making varieties, and each firm gets L/N workers, what number of varieties N makes it so firm produces its breakeven amount? (c) If total income is wL=L, and workers spend all their income on cars pS=wL, use this and the price markup formula, and the expression fo the number of varieties in terms of L from 5 (b) to show that in a single-sector economy, this number of varieties is the same as found in 4(b). As in class, consumers buy many differentiated varieties/brands of automobiles. An automobile brand is produced with increasing returns to scale: specifically, it takes f units of labor to develop a new brand, and c units of labor to make a car. The wage is equal to w, so each firms' total cost is TC(q)=qcw+fw. Each variety is produced by a monopolistic firm that faces its own demand curve, which tells us how many cars the firm will sell depending on their price. Instead of a linear demand curve with constant slope (as in class) firms face demand curves with a constant elasticity q(p)=NS(Pp) where >1 reflects the substitutability of different varieties. Now demand depends on the proportional difference between the firm's price p and the average price P,Pp, instead of the difference in dollars pP. Each firm takes S,N, and P as fixed. 1. The firm will choose p to maximize q(p)pq(p)cw, knowing their price will affect the quantity bought based on q(p) above. Show that the optimal price the firm chooses is a constant proportional mark-up over marginal cost p=1cw 2. How does price compare to marginal cost when substitutability is high ( goes to infinity), or when substitutability is low (for example, =1.5 )? What is the relationship between monopoly pricing power and substitutability with other varieties? 3. Given this optimal price and the total cost function above, write the firms' total profits as a function of q,w,c, and f. What level of q does the firm need to produce to exactly break even? 4. In equilibrium, when each variety faces the exact same costs, they will choose the same price. (a) Given N firm, what quantity will each firm sell if they all sell the same amount? (b) Combine this with you answer to 3 to show that when there is free entry, firms will enter/exit until N=S(1)1fc (c) In equilibrium, how does the number of varieties each consumer gets to choose from from depend on the total purchases in the market S ? (d) Does increasing market size S have a larger or smaller effect on varieties available to customers when the substitutability of brands is higher? What about when size of firms' fixed costs relative to their marginal costs f/c is higher (and therefore c/f is lower)? 5. Take your break-even quantity from part 3. Suppose there are L workers in the economy who all make automobiles, each making the wage w and spend their whole income on automobiles. (a) How many workers does it take for a firm to make this quantity q ? (b) If there are N firm making varieties, and each firm gets L/N workers, what number of varieties N makes it so firm produces its breakeven amount? (c) If total income is wL=L, and workers spend all their income on cars pS=wL, use this and the price markup formula, and the expression fo the number of varieties in terms of L from 5 (b) to show that in a single-sector economy, this number of varieties is the same as found in 4(b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started