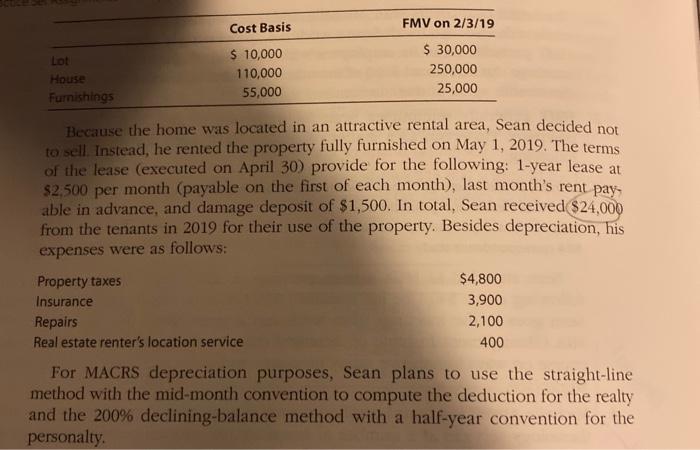

As Lucy's sole heir, Sean inherited her home and its furnishings Clocated at 5422 SW Sena Drive, Topeka, KS 66604). The costs and values involved are as follows: Cost Basis FMV on 2/3/19 Lot House Furnishings $ 10,000 110,000 55,000 $ 30,000 250,000 25,000 Because the home was located in an attractive rental area, Sean decided not to sell. Instead, he rented the property fully furnished on May 1, 2019. The terms of the lease (executed on April 30) provide for the following: 1-year lease at $2,500 per month (payable on the first of each month), last month's rent pay, able in advance, and damage deposit of $1,500. In total, Sean received $24,000 from the tenants in 2019 for their use of the property. Besides depreciation, his expenses were as follows: Property taxes $4,800 Insurance 3,900 Repairs 2,100 Real estate renter's location service 400 For MACRS depreciation purposes, Sean plans to use the straight-line method with the mid-month convention to compute the deduction for the realty and the 200% declining-balance method with a half-year convention for the personalty. As Lucy's sole heir, Sean inherited her home and its furnishings Clocated at 5422 SW Sena Drive, Topeka, KS 66604). The costs and values involved are as follows: Cost Basis FMV on 2/3/19 Lot House Furnishings $ 10,000 110,000 55,000 $ 30,000 250,000 25,000 Because the home was located in an attractive rental area, Sean decided not to sell. Instead, he rented the property fully furnished on May 1, 2019. The terms of the lease (executed on April 30) provide for the following: 1-year lease at $2,500 per month (payable on the first of each month), last month's rent pay, able in advance, and damage deposit of $1,500. In total, Sean received $24,000 from the tenants in 2019 for their use of the property. Besides depreciation, his expenses were as follows: Property taxes $4,800 Insurance 3,900 Repairs 2,100 Real estate renter's location service 400 For MACRS depreciation purposes, Sean plans to use the straight-line method with the mid-month convention to compute the deduction for the realty and the 200% declining-balance method with a half-year convention for the personalty