Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As much help as you can would be greatly appreciated! any help would be much appreciated, thanks! 7 begin{tabular}{|c|c|c|c|c|} hline DETERMINE the return on these

As much help as you can would be greatly appreciated!

any help would be much appreciated, thanks!

As much help as you can would be greatly appreciated!

any help would be much appreciated, thanks!

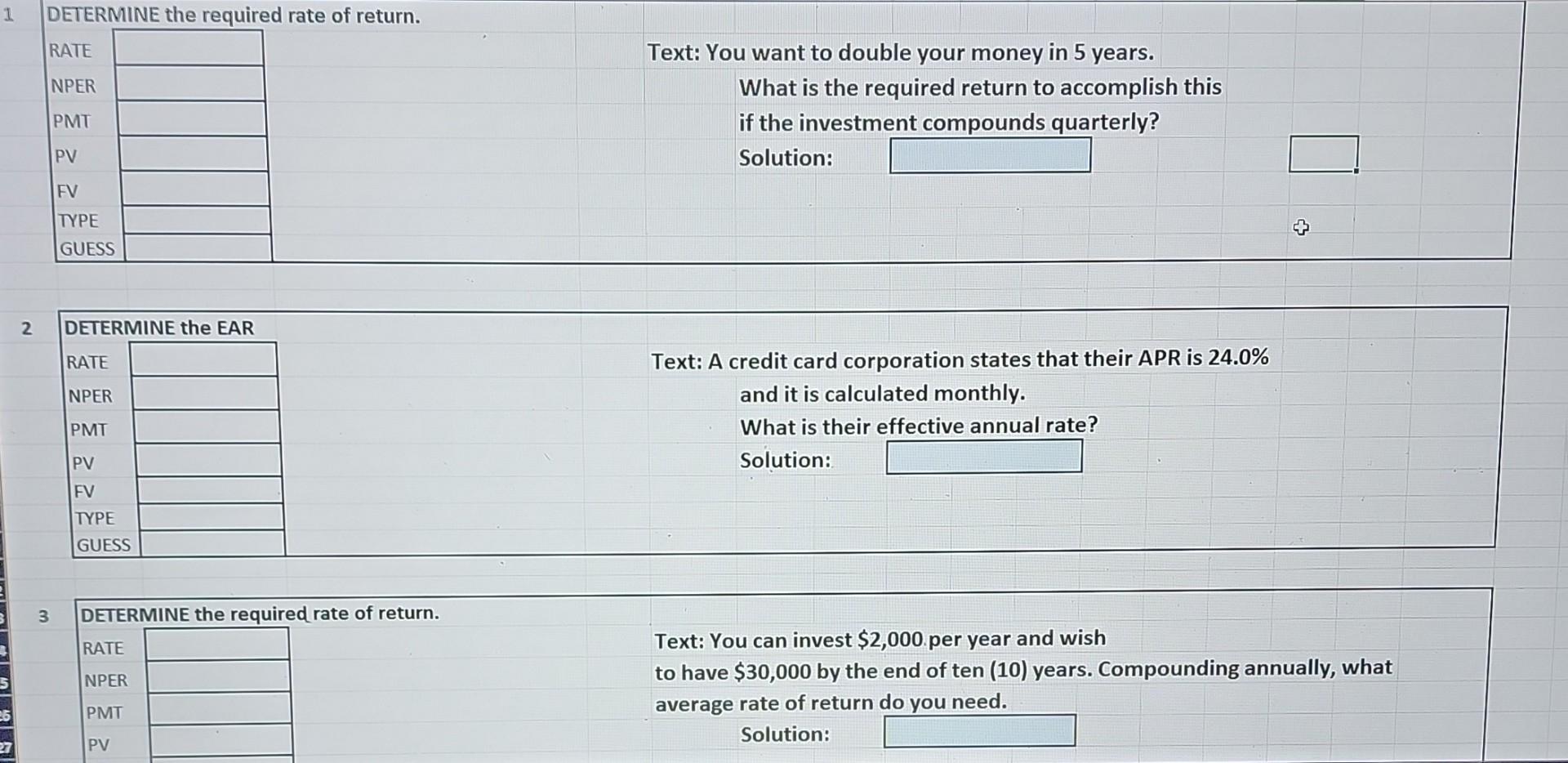

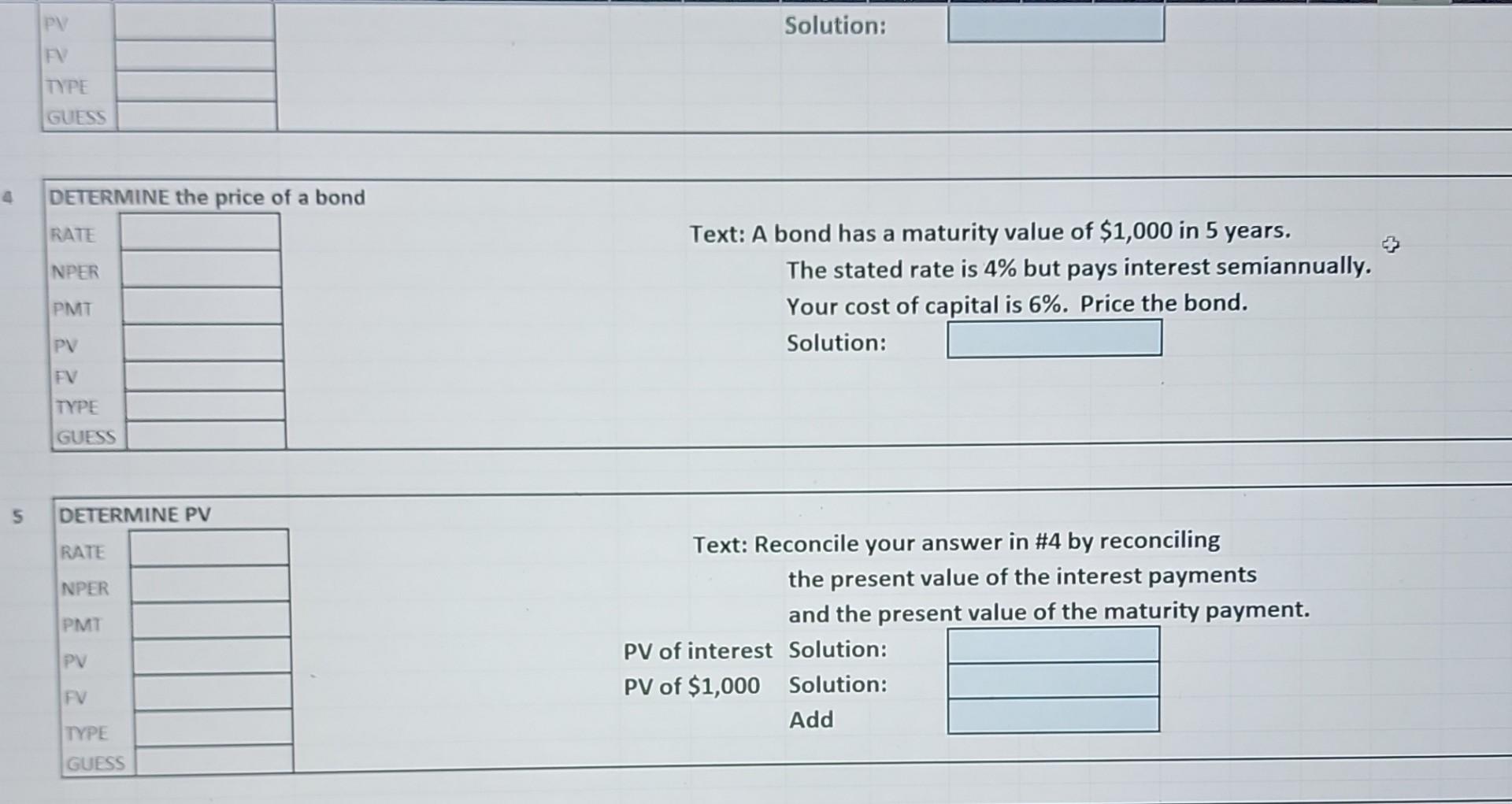

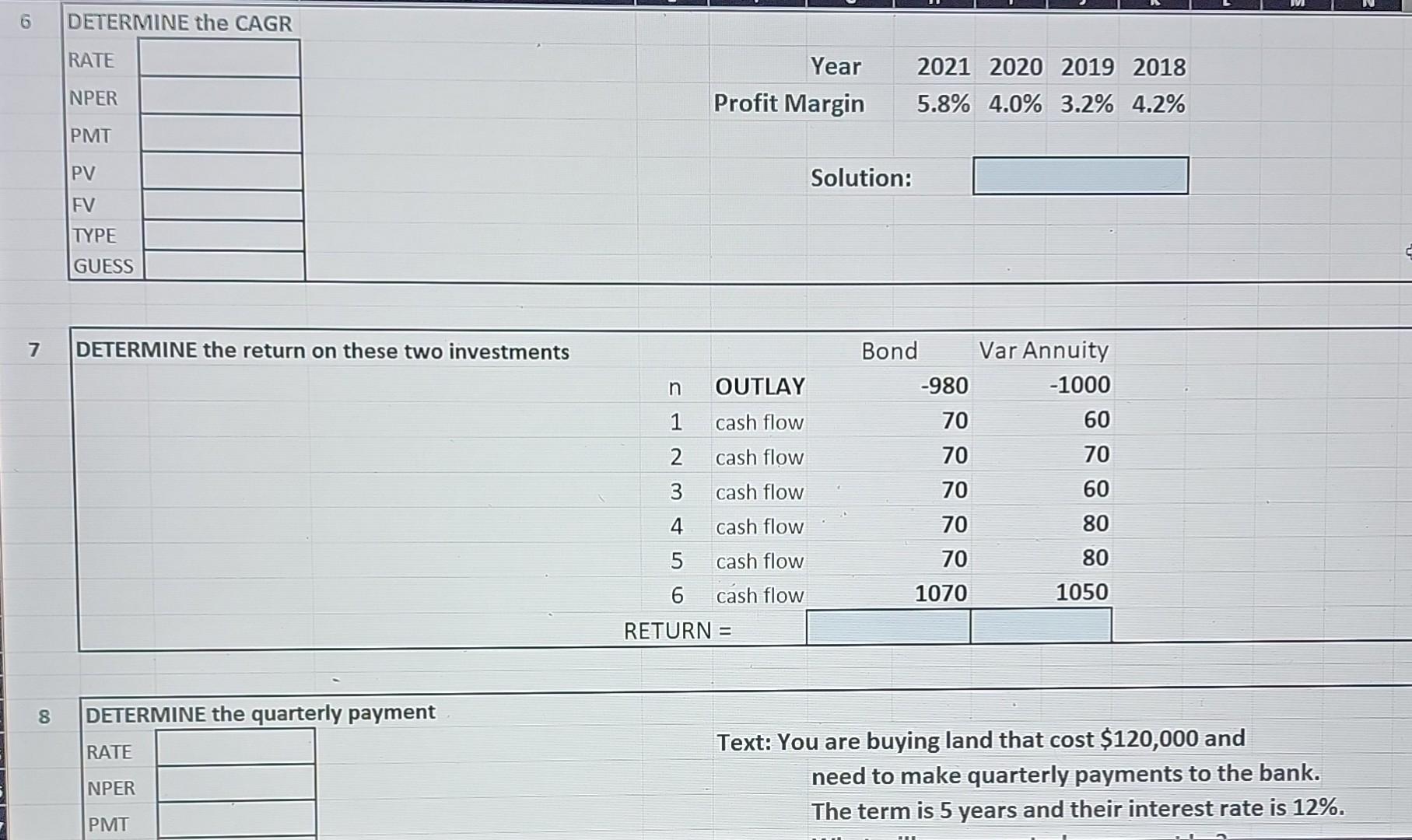

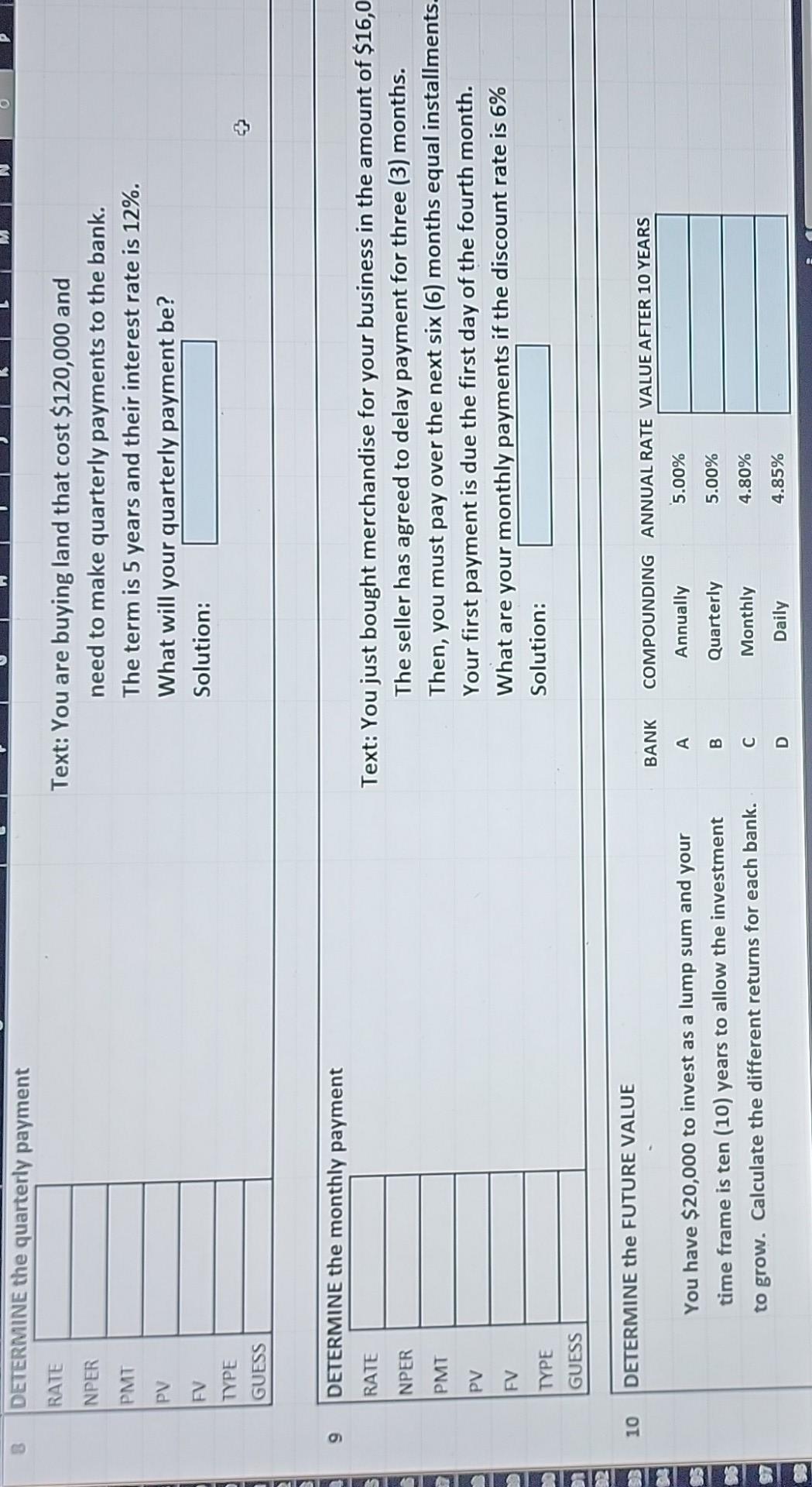

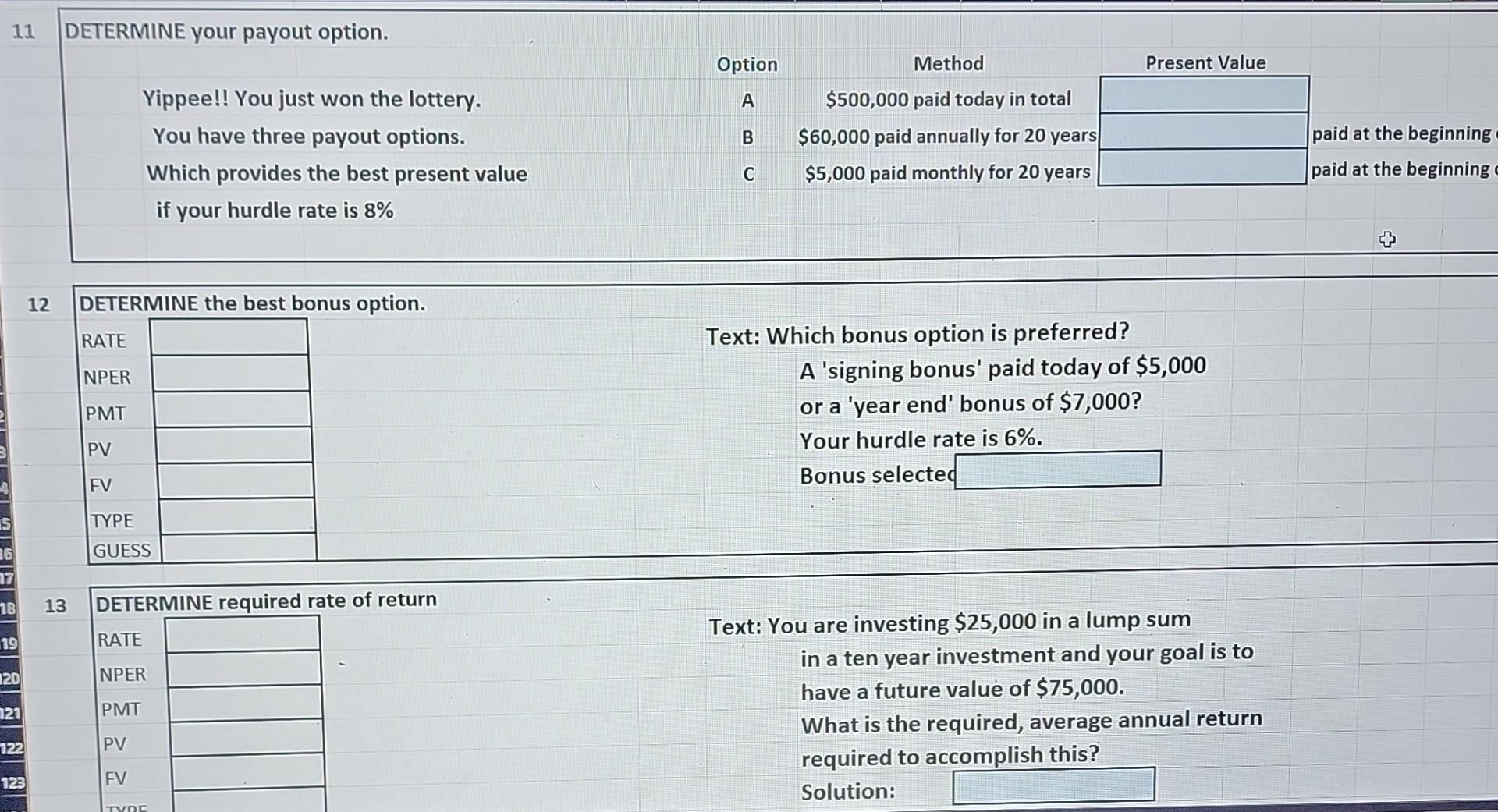

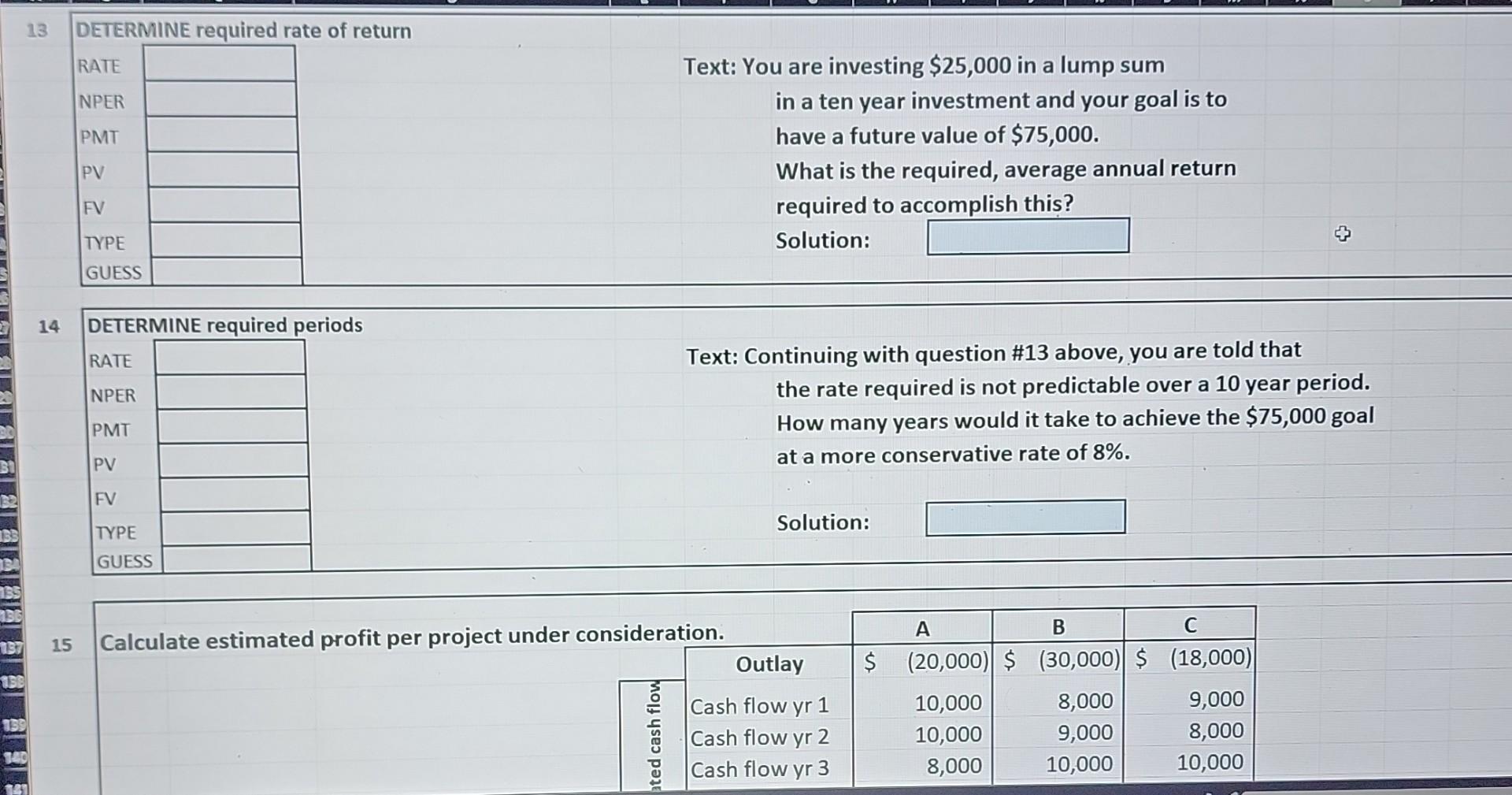

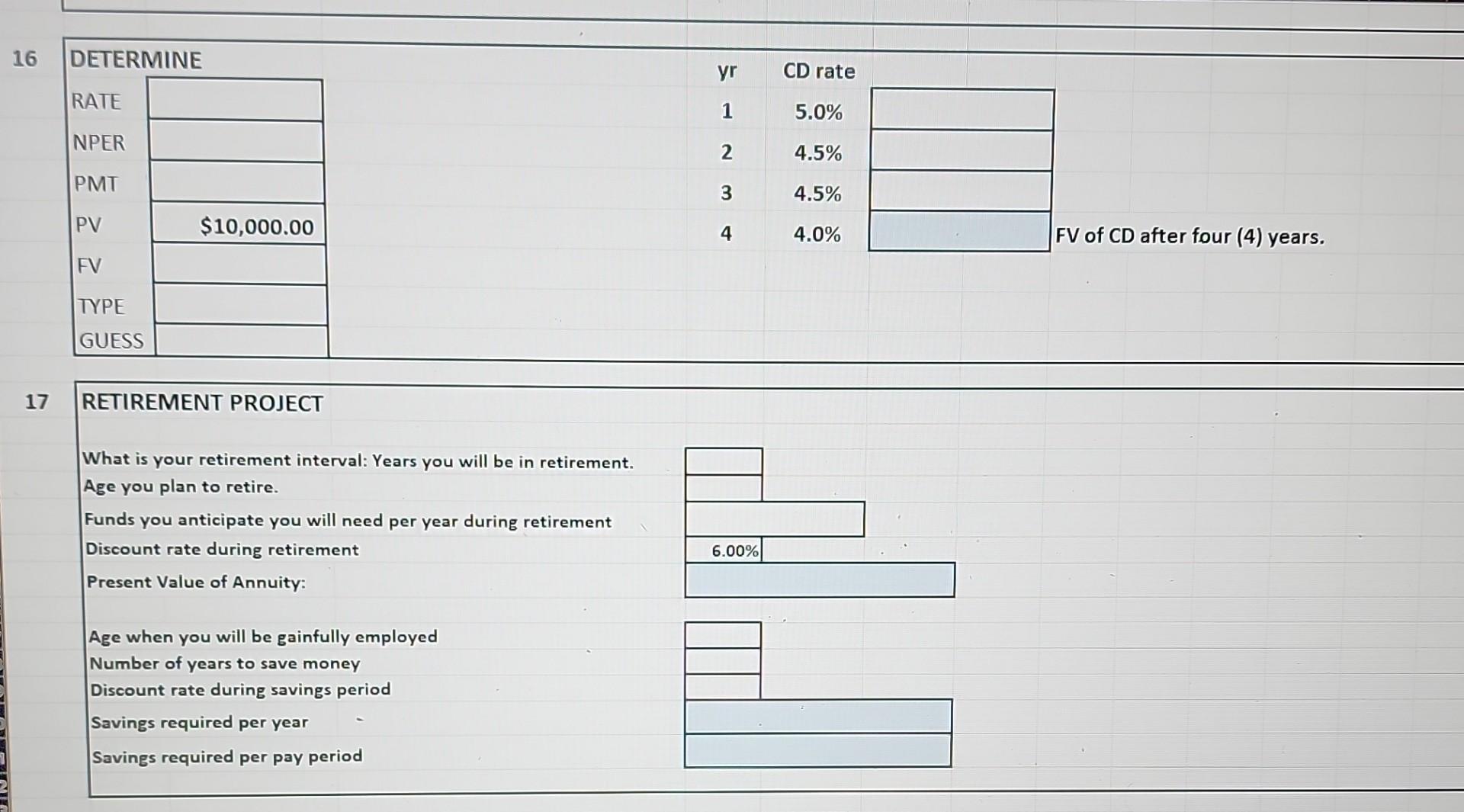

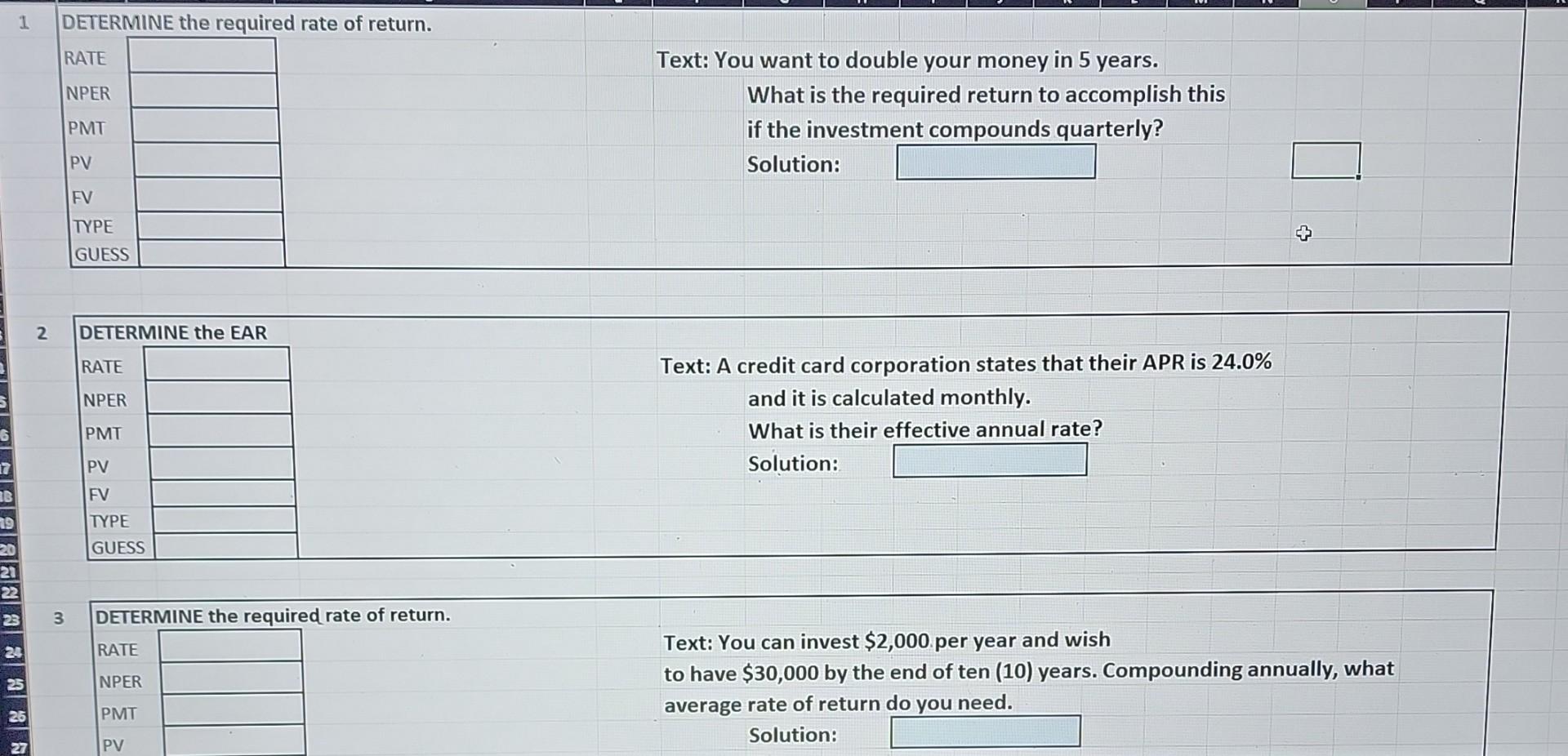

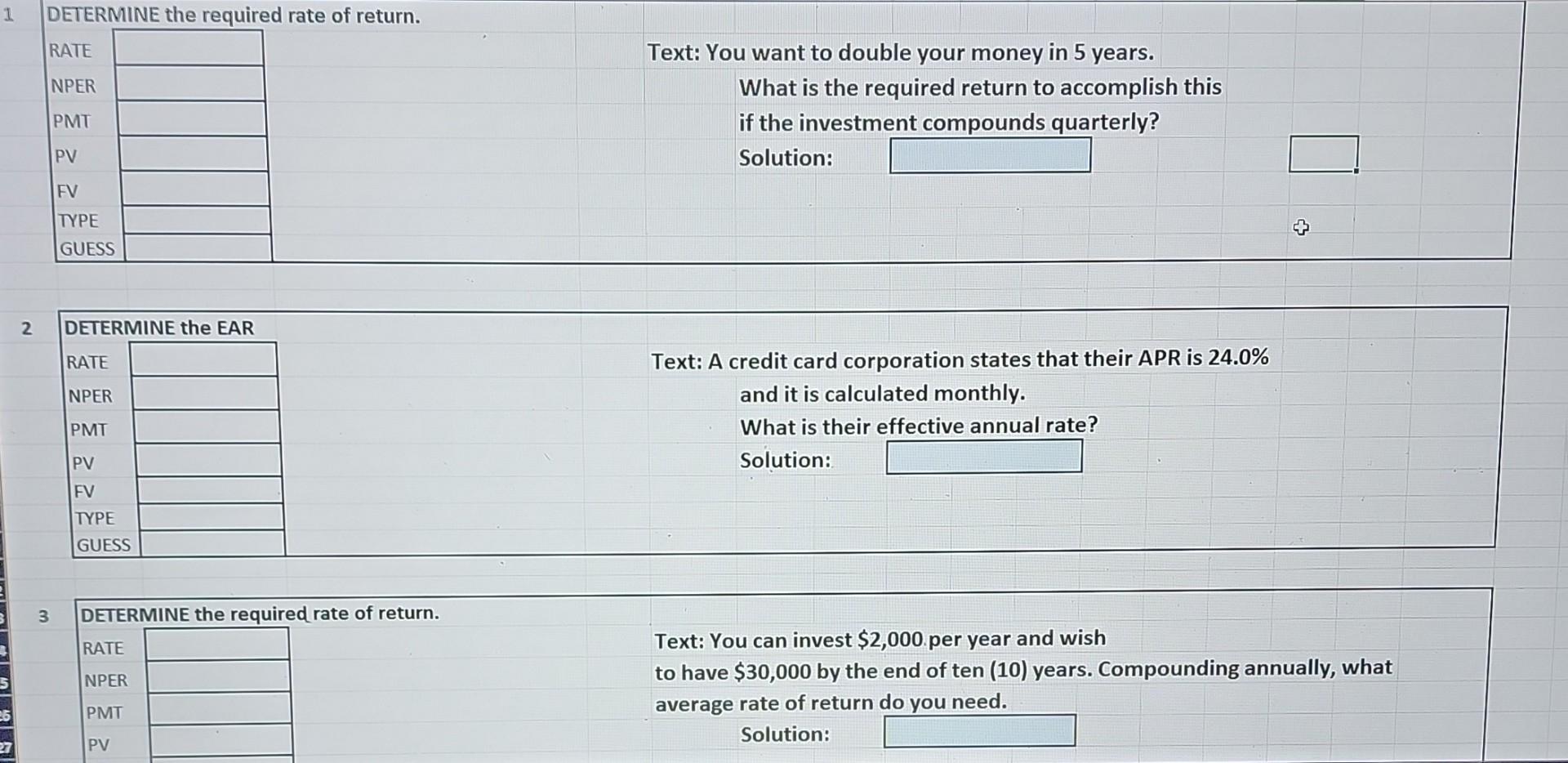

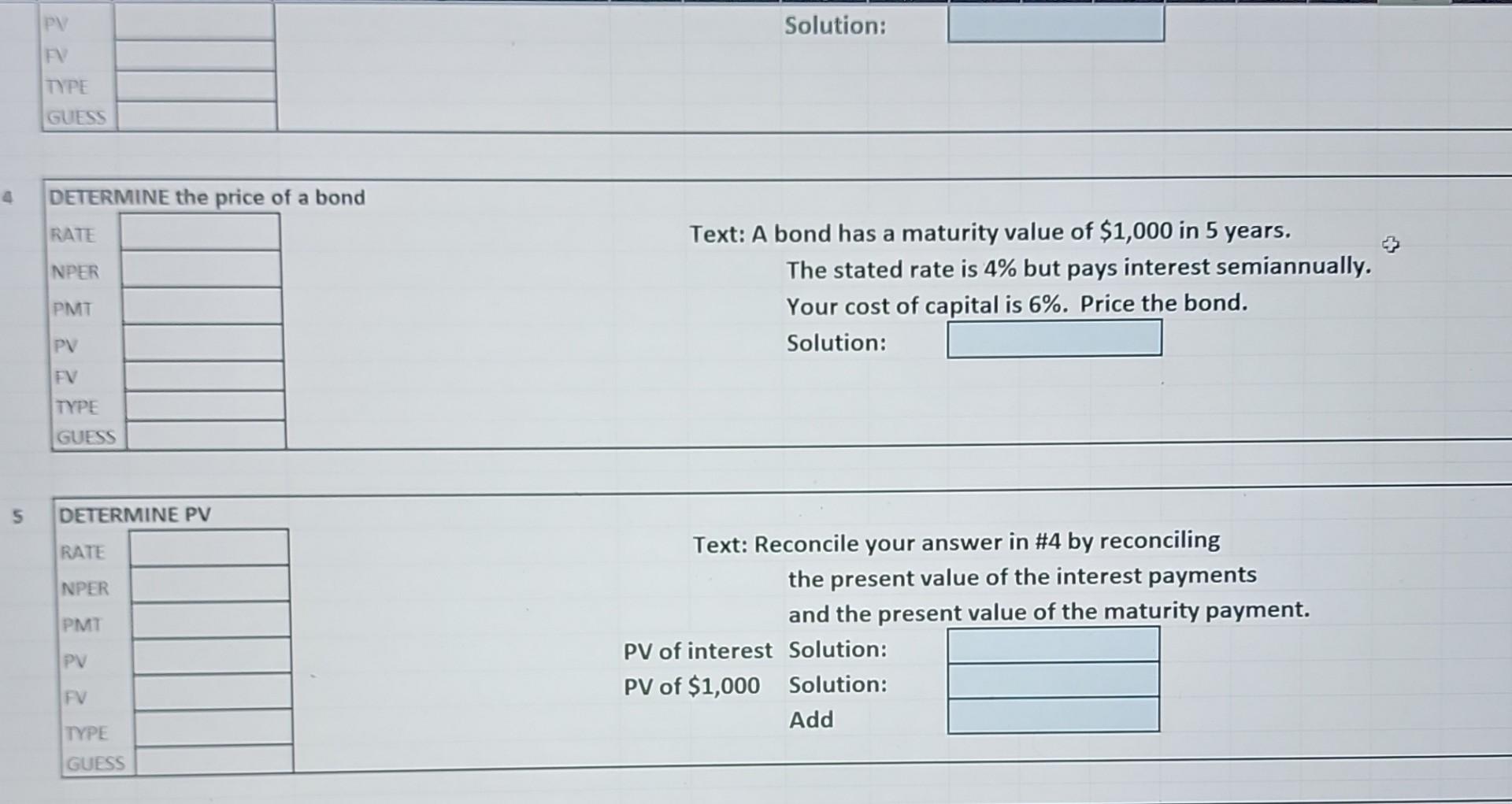

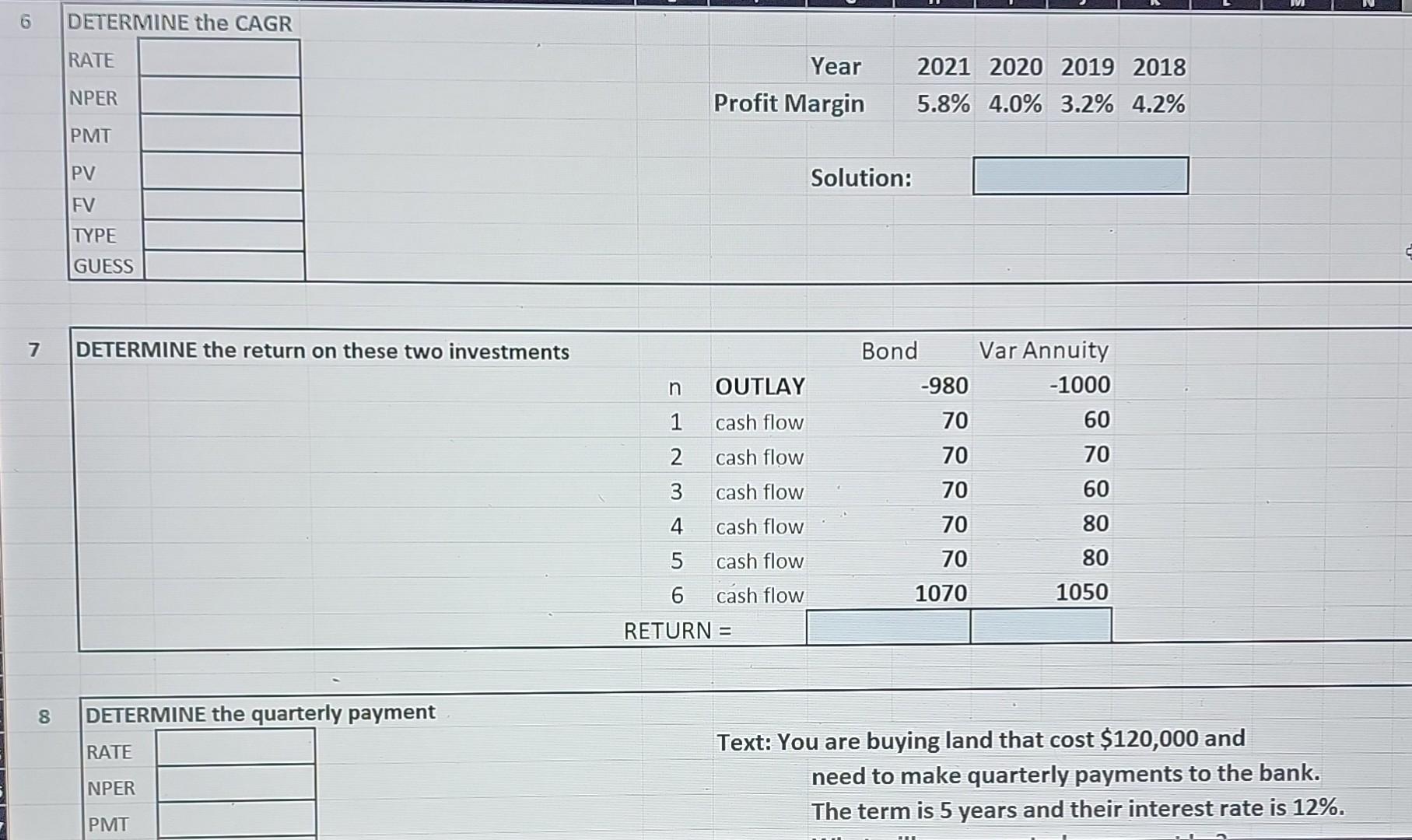

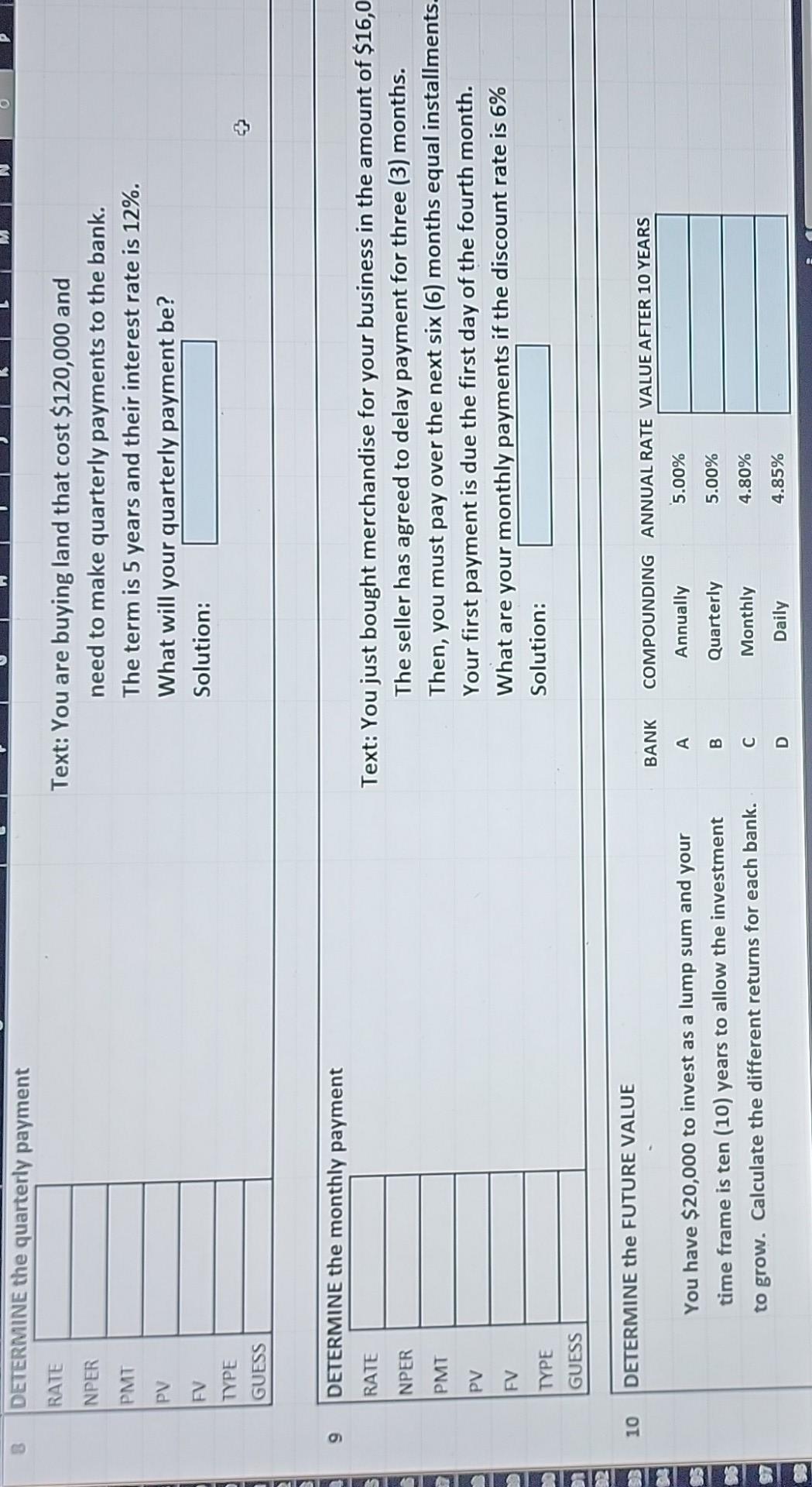

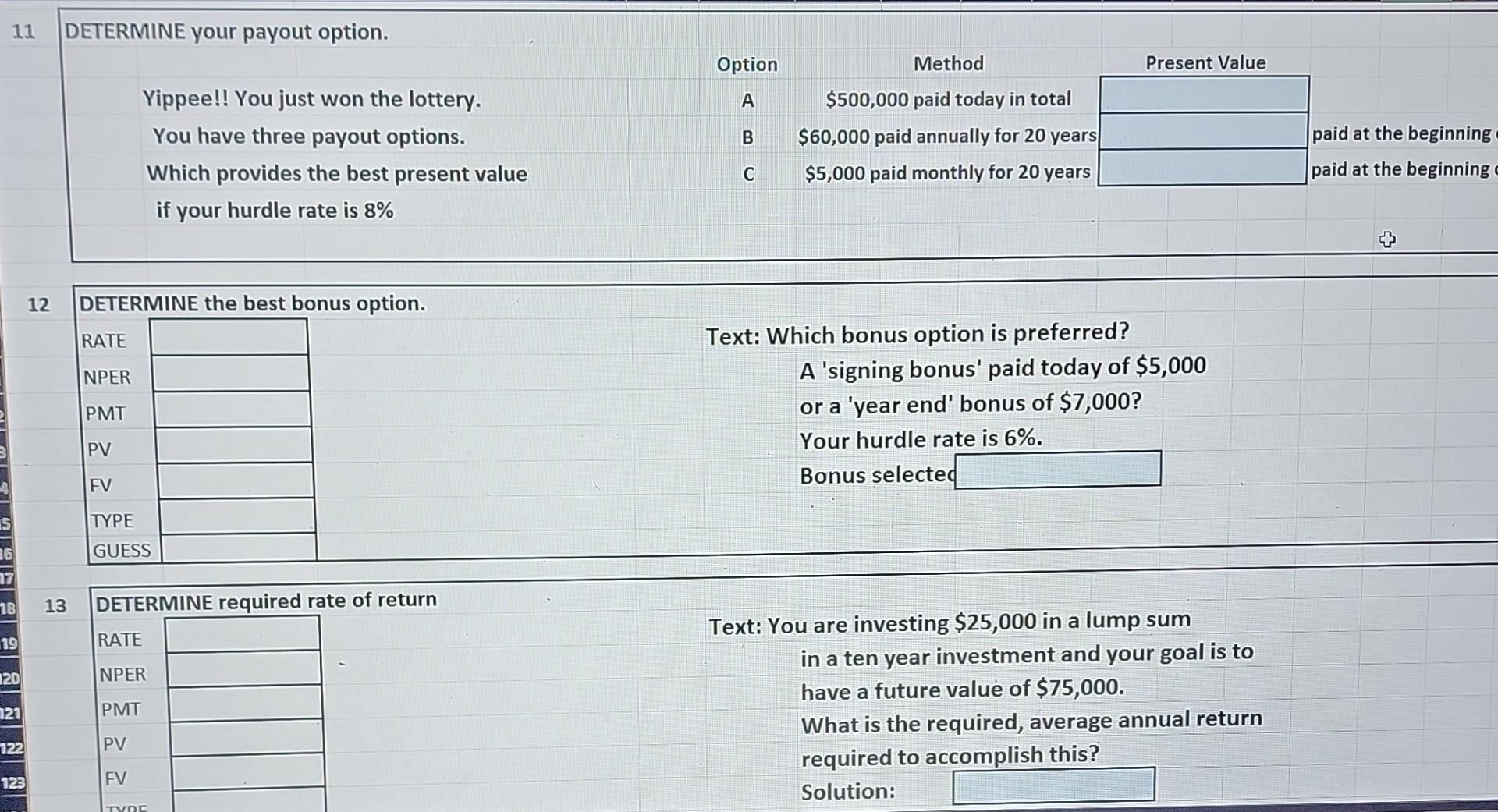

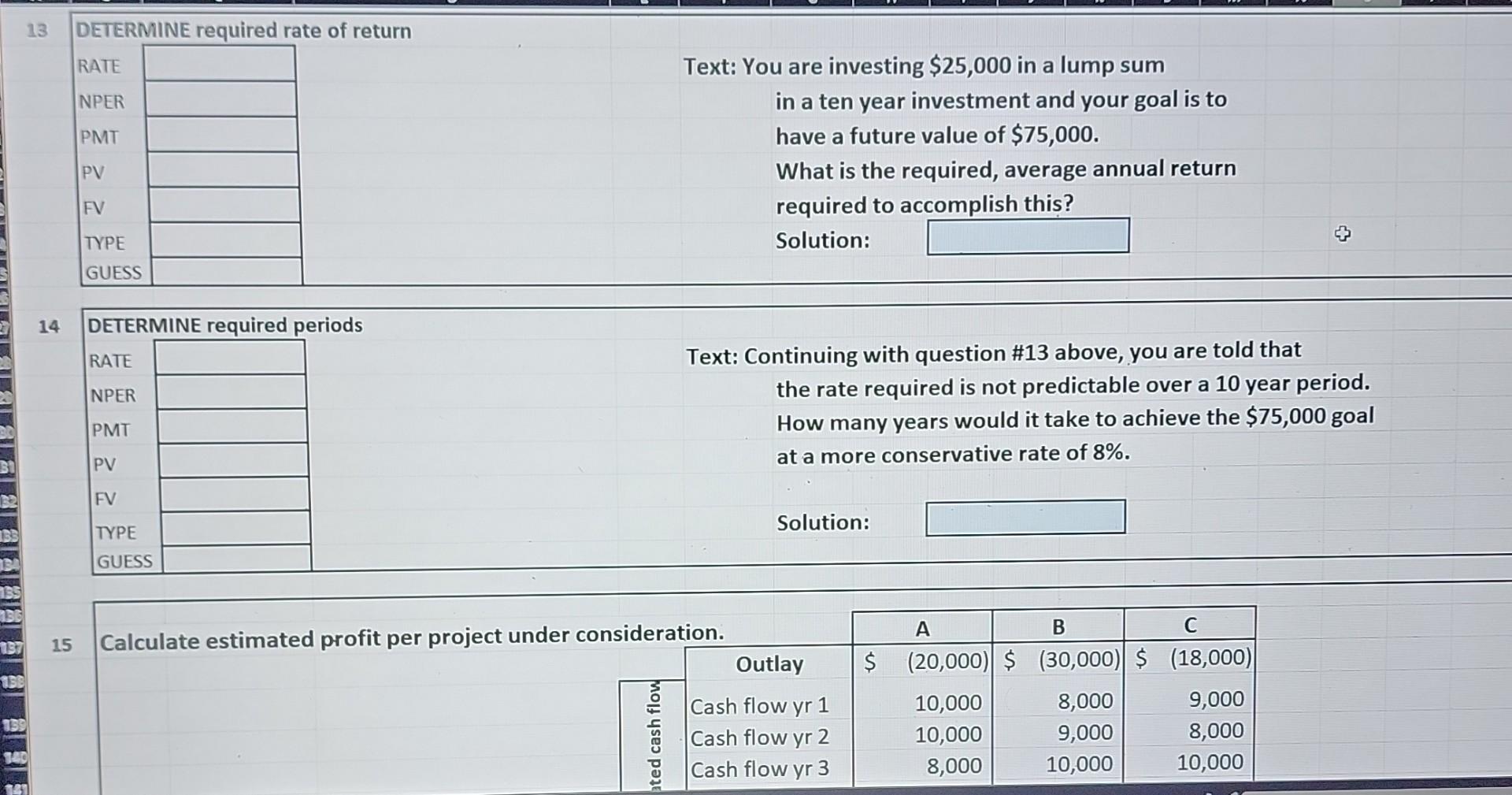

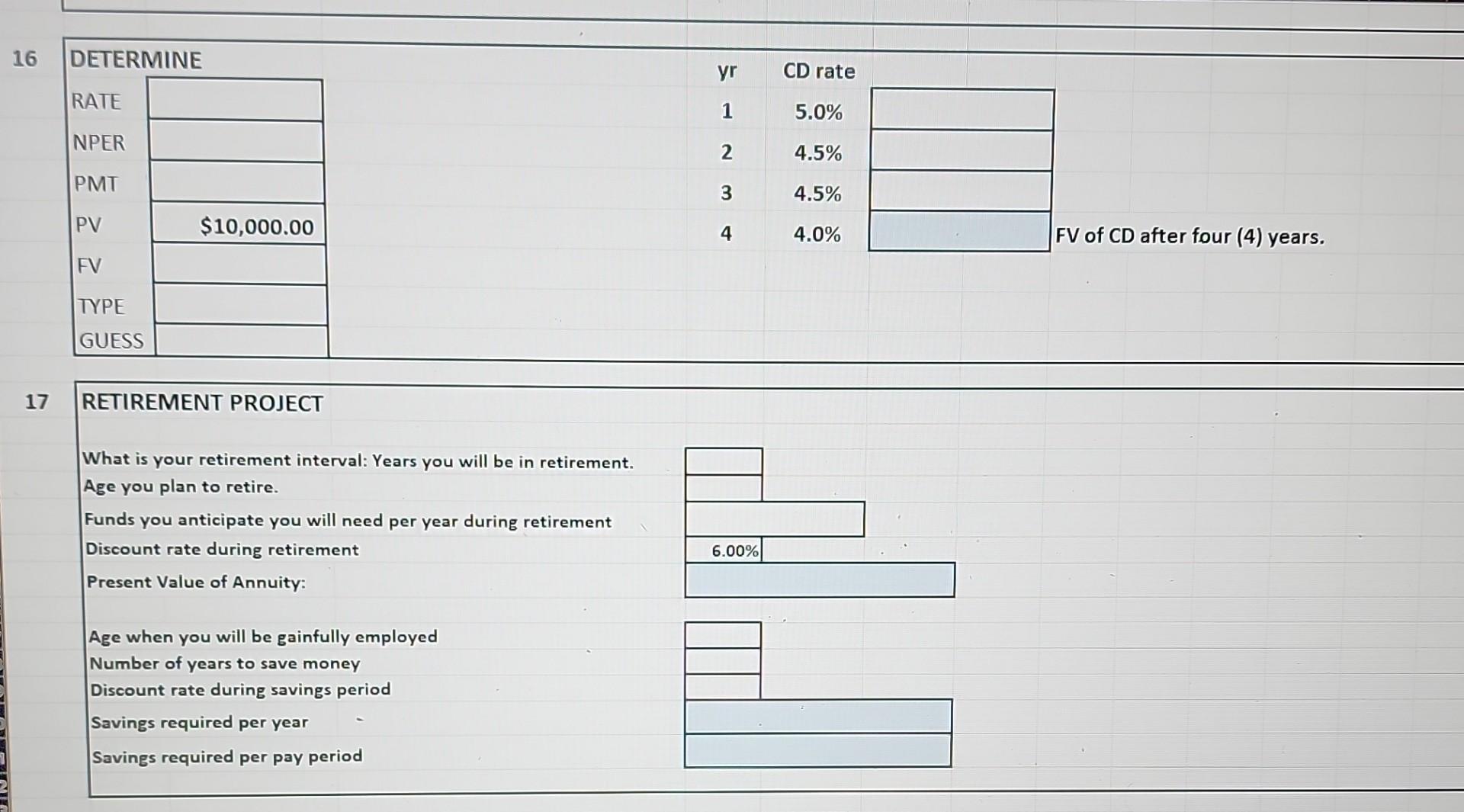

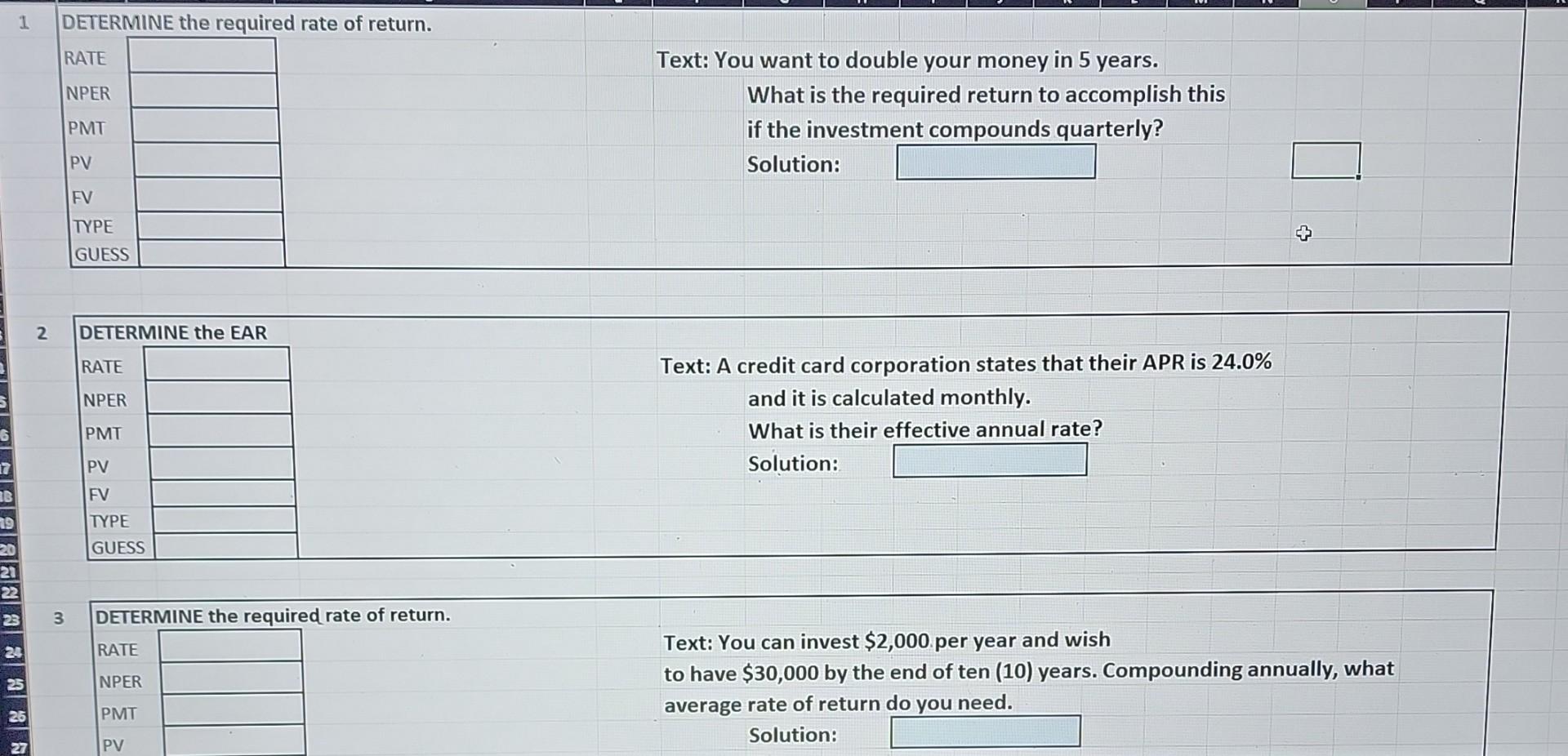

7 \begin{tabular}{|c|c|c|c|c|} \hline DETERMINE the return on these two investments & & & Bond & Var Annuity \\ \hline & n & OUTLAY & -980 & -1000 \\ \hline & 1 & cash flow & 70 & 60 \\ \hline & 2 & cash flow & 70 & 70 \\ \hline & 3 & cash flow & 70 & 60 \\ \hline & 4 & cash flow & 70 & 80 \\ \hline & 5 & cash flow & 70 & 80 \\ \hline & 6 & cash flow & 1070 & 1050 \\ \hline & RETUR & & & \\ \hline \end{tabular} 8 \begin{tabular}{|l|l|} \hline \multicolumn{2}{|l|}{ DETERMINE the quarterly } \\ \hline RATE \\ NPER \\ PMT \end{tabular} Text: You are buying land that cost $120,000 and need to make quarterly payments to the bank. The term is 5 years and their interest rate is 12%. Solution: DETERMINE the price of a bond RATE Text: A bond has a maturity value of $1,000 in 5 years. The stated rate is 4% but pays interest semiannually. Your cost of capital is 6%. Price the bond. Solution: 5 DETERMINE PV RATE Text: Reconcile your answer in \#4 by reconciling the present value of the interest payments and the present value of the maturity payment. PV of interest Solution: PV of $1,000 Solution: Add \begin{tabular}{|l|} \hline \\ \hline \\ \hline \end{tabular} 7 \begin{tabular}{|c|c|c|c|c|} \hline DETERMINE the return on these two investments & & & Bond & Var Annuity \\ \hline & n & OUTLAY & -980 & -1000 \\ \hline & 1 & cash flow & 70 & 60 \\ \hline & 2 & cash flow & 70 & 70 \\ \hline & 3 & cash flow & 70 & 60 \\ \hline & 4 & cash flow & 70 & 80 \\ \hline & 5 & cash flow & 70 & 80 \\ \hline & 6 & cash flow & 1070 & 1050 \\ \hline & RETUR & & & \\ \hline \end{tabular} 8 \begin{tabular}{|l|l|} \hline \multicolumn{2}{|l|}{ DETERMINE the quarterly } \\ \hline RATE \\ NPER \\ PMT \end{tabular} Text: You are buying land that cost $120,000 and need to make quarterly payments to the bank. The term is 5 years and their interest rate is 12%. Text: You are investing $25,000 in a lump sum in a ten year investment and your goal is to have a future value of $75,000. What is the required, average annual return required to accomplish this? Solution: ] 1 DETERMINE the required rate of return. RATE NPER PMT PV FV TYPE GUESS Text: You want to double your money in 5 years. What is the required return to accomplish this if the investment compounds quarterly? Solution: Solution: Text: A credit card corporation states that their APR is 24.0% and it is calculated monthly. What is their effective annual rate? Solution: 2 \begin{tabular}{l|l|} \hline \multicolumn{2}{l}{ DETERMINE the EAR } \\ \cline { 2 - 2 } RATE & \\ \cline { 2 - 2 } NPER & \\ \cline { 2 - 2 } PMT & \\ \cline { 2 - 2 } PV & \\ FV & \\ TYPE & \\ \cline { 2 - 2 } GUESS & \\ \cline { 2 - 2 } & \end{tabular} 3 DETERMINE the required rate of return. RATE NPER PMT PV \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} Text: You can invest $2,000 per year and wish to have $30,000 by the end of ten (10) years. Compounding annually, what average rate of return do you need. Solution: Solution: DETERMINE the price of a bond RATE Text: A bond has a maturity value of $1,000 in 5 years. The stated rate is 4% but pays interest semiannually. Your cost of capital is 6%. Price the bond. Solution: 5 DETERMINE PV RATE Text: Reconcile your answer in \#4 by reconciling the present value of the interest payments and the present value of the maturity payment. PV of interest Solution: PV of $1,000 Solution: Add \begin{tabular}{|l|} \hline \\ \hline \\ \hline \end{tabular} 16 \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{ DETERMINE } & \multirow{2}{*}{yr1} & \multirow{2}{*}{CDrate5.0%} & \\ \hline RATE & & & & \\ \hline NPER & & 2 & 4.5% & \\ \hline PMT & & 3 & 4.5% & \\ \hline PV & $10,000.00 & 4 & 4.0% & FV of CD after four (4) years. \\ \hline \multicolumn{5}{|l|}{ FV } \\ \hline \multicolumn{5}{|l|}{ TYPE } \\ \hline GUESS & & & & \\ \hline \end{tabular} 17 RETIREMENT PROJECT What is your retirement interval: Years you will be in retirement. Age you plan to retire. Funds you anticipate you will need per year during retirement Discount rate during retirement Present Value of Annuity: Age when you will be gainfully employed Number of years to save money Discount rate during savings period Savings required per year Savings required per pay period \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} 1 DETERMINE the required rate of return. RATE NPER PMT PV FV TYPE Text: You want to double your money in 5 years. What is the required return to accomplish this if the investment compounds quarterly? Solution: 2 \begin{tabular}{|l|l|} \hline \multicolumn{2}{ll}{ DETERMINE the EAR } \\ \cline { 2 - 2 } RATE \\ \cline { 2 - 2 } NPER & \\ \cline { 2 - 2 } PMT & \\ \cline { 2 - 2 } PV & \\ \cline { 2 - 2 } FV & \\ \cline { 2 - 2 } TYPE & \\ \cline { 2 - 2 } GUESS & \\ \hline \end{tabular} Text: A credit card corporation states that their APR is 24.0% and it is calculated monthly. What is their effective annual rate? Solution: 3 \begin{tabular}{|l|l|} \hline \multicolumn{2}{|l|}{ DETERMINE the require } \\ \cline { 2 - 2 } RATE \\ \cline { 2 - 2 } NPER \\ \cline { 2 - 2 } \\ PMT \\ PV \end{tabular} Text: You can invest $2,000 per year and wish to have $30,000 by the end of ten (10) years. Compounding annually, what average rate of return do you need. Solution: \begin{tabular}{|c|c|} \hline RATE & . \\ \hline NPER & \\ \hline PMT & \\ \hlinev & \\ \hline FV & \\ \hline & \\ \hline ESS & L \\ \hline \end{tabular} Text: Continuing with question #13 above, you are told that the rate required is not predictable over a 10 year period. How many years would it take to achieve the $75,000 goal at a more conservative rate of 8%. Solution: Calculate estimated profit per project under con

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started