Question

As of December 31, 2014, the books of Triple E Partnership showed capital balances of E1 - P40,000; E2 - P25,000; and E3-P5,000. They

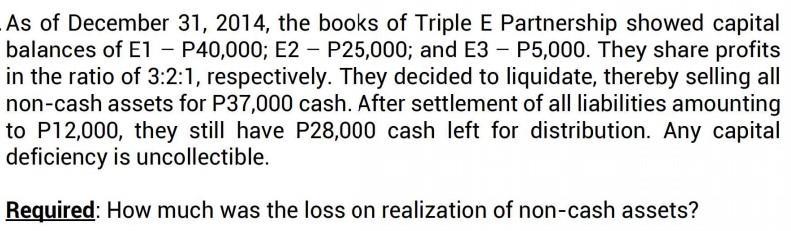

As of December 31, 2014, the books of Triple E Partnership showed capital balances of E1 - P40,000; E2 - P25,000; and E3-P5,000. They share profits in the ratio of 3:2:1, respectively. They decided to liquidate, thereby selling all non-cash assets for P37,000 cash. After settlement of all liabilities amounting to P12,000, they still have P28,000 cash left for distribution. Any capital deficiency is uncollectible. Required: How much was the loss on realization of non-cash assets?

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer Value of Non Cash Assets Realisation on Liquidation Loss on Realisation Working N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey of Accounting

Authors: Thomas Edmonds, Christopher, Philip Olds, Frances McNair, Bor

4th edition

77862376, 978-0077862374

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App