Question

As of December 31, 2020, there are two long-term loans. Both have an annual interest rate of 7%. A.The first loan will mature on June

As of December 31, 2020, there are two long-term loans. Both have an annual interest rate of 7%.

A.The first loan will mature on June 30, 2020, and the remaining principal balance to be paid on June 30, 2020, is ₱400,000.

B.The second loan which was incurred on December 31, 2020, worth ₱1,350,000 is paid at the rate of ₱225,000 principal balance every June 30 and December 31.

New loans of ₱1,500,000 will be incurred on December 31, 2021, payable at the rate of ₱250,000 every June 30 and December 31. The annual interest rate is expected at 7%

•For January 2021, ₱500,000 new PPE will be acquired. It is the policy of the company that PPE acquired in the first half of the year will be depreciated for one full year.

•As of December 31, 2020, the gross balance of Property, Plant, and Equipment (PPE) is ₱1,200,000.

Depreciation expense is 5% of the gross beginning balance of property, plant and equipment.

Capital Stock – remain unchanged

Retained Earnings - arrived at by adding projected net income to beginning retained earnings then deducting dividends to be declared during the year.

Cash dividends of ₱110,000 will be paid for 2021.

Required: Cura Company's Projected Statement of Financial Position December 31, 2021

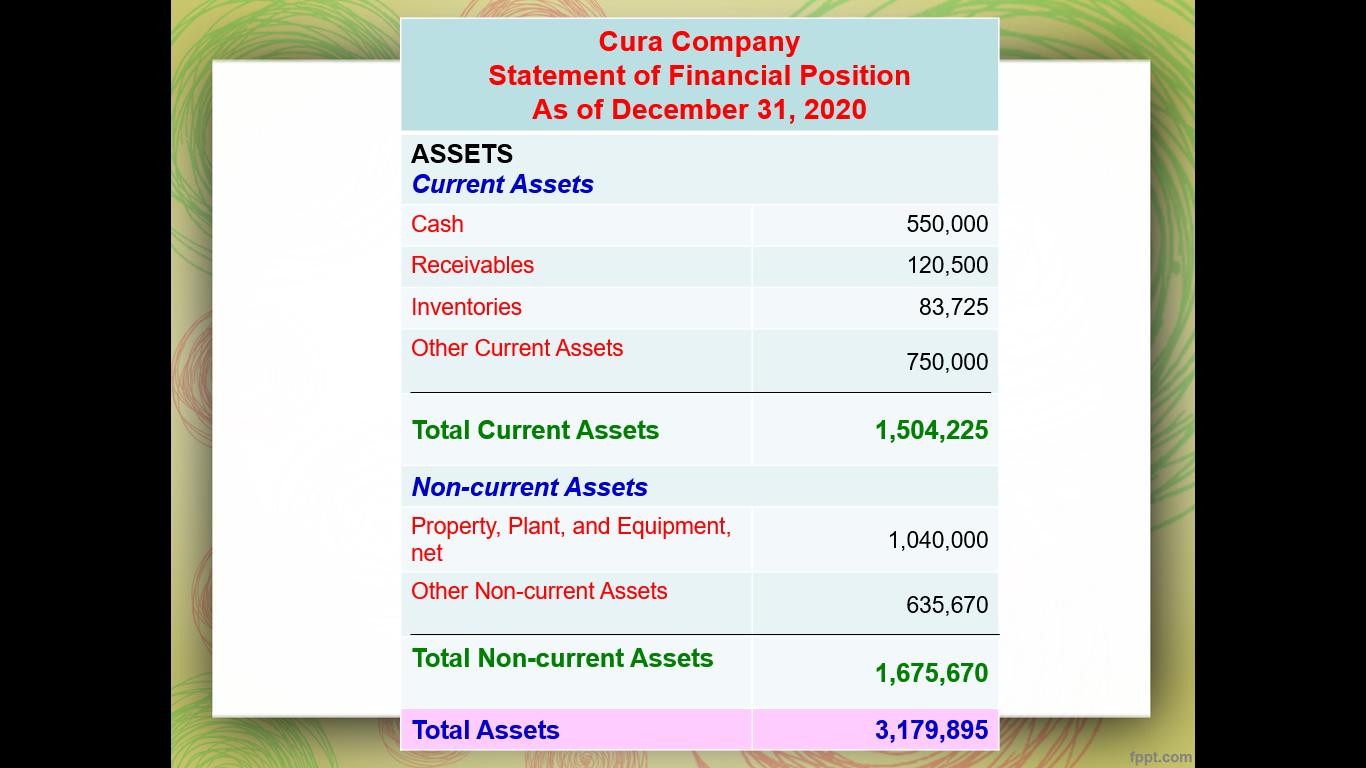

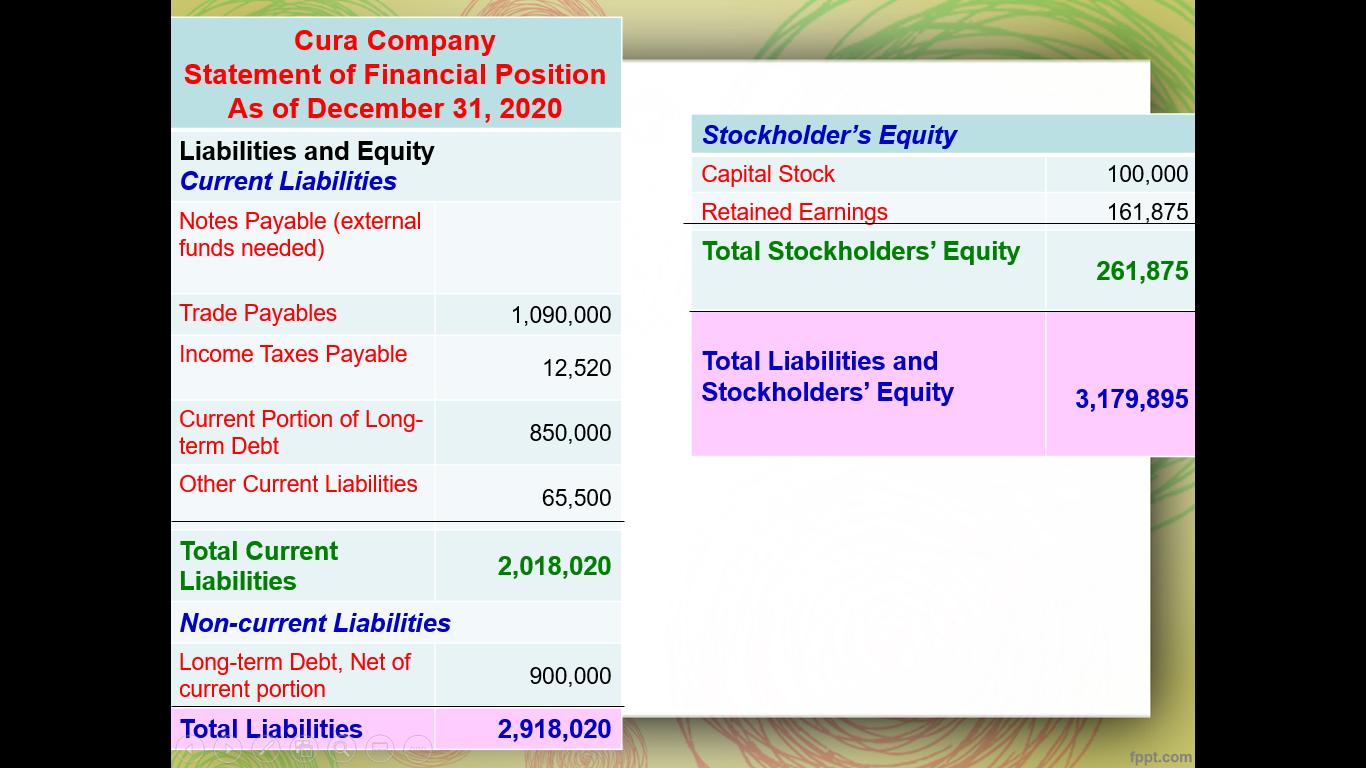

Cura Company Statement of Financial Position As of December 31, 2020 ASSETS Current Assets Cash Receivables Inventories Other Current Assets Total Current Assets Non-current Assets Property, Plant, and Equipment, net Other Non-current Assets Total Non-current Assets Total Assets 550,000 120,500 83,725 750,000 1,504,225 1,040,000 635,670 1,675,670 3,179,895 fppt.com

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Cura Company Statement of Financial Position As of December 31 2021 ASSETS Current Assets Cash 14000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started