Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As of December 31, 2021, your company, Timo Inc., is considering a five-year contract with a client to offer compensation consulting services on a

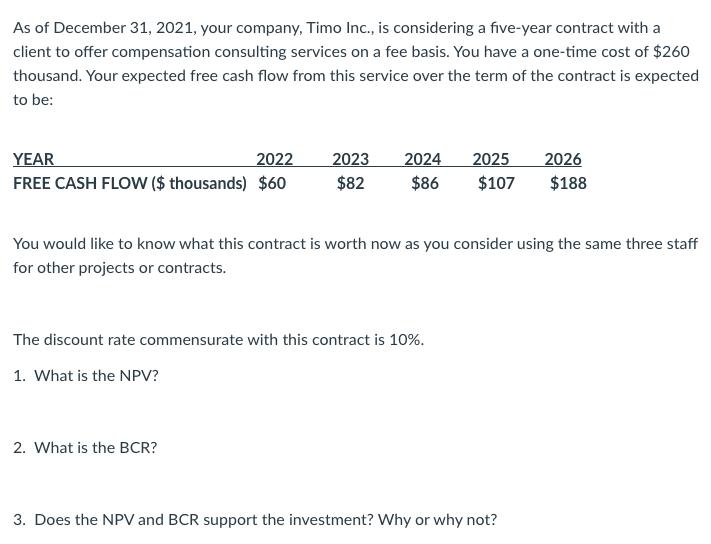

As of December 31, 2021, your company, Timo Inc., is considering a five-year contract with a client to offer compensation consulting services on a fee basis. You have a one-time cost of $260 thousand. Your expected free cash flow from this service over the term of the contract is expected to be: YEAR 2022 2023 2024 2025 2026 FREE CASH FLOW ($ thousands) $60 $82 $86 $107 $188 You would like to know what this contract is worth now as you consider using the same three staff for other projects or contracts. The discount rate commensurate with this contract is 10%. 1. What is the NPV? 2. What is the BCR? 3. Does the NPV and BCR support the investment? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Timo Inc Contract Analysis 1 Net Present Value NPV To calculate the NPV we need to discount each yea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started