Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As of February 2010, what is your assessment of the worth of Wal-Mart's stock? Utilize all the methods discussed in the case to value

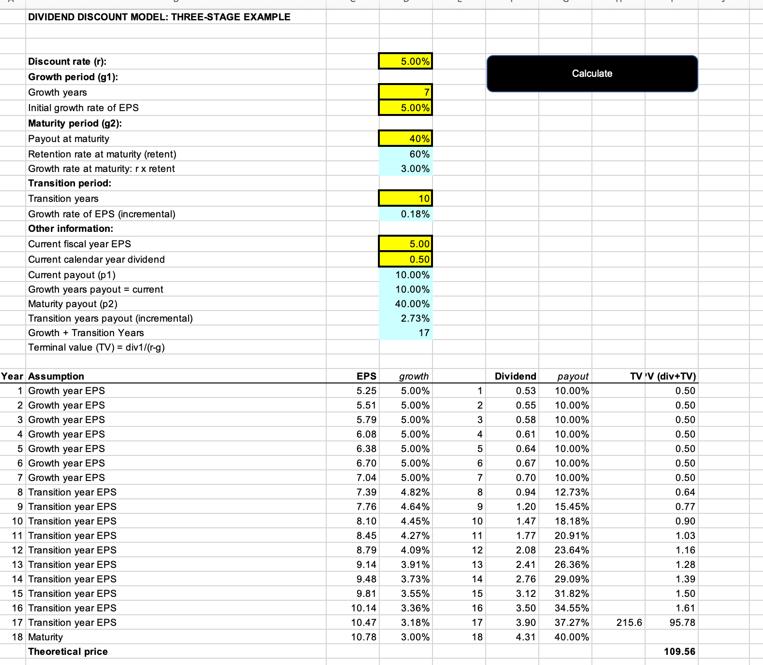

As of February 2010, what is your assessment of the worth of Wal-Mart's stock? Utilize all the methods discussed in the case to value the shares, including the following: a. The perpetual growth in dividends b. Forecasted dividends for the next several years plus sale of the stock in the future c. The three-stage dividend model d. The price/earnings approach Clearly State any assumptions DIVIDEND DISCOUNT MODEL: THREE-STAGE EXAMPLE Discount rate (r): Growth period (g1): Growth years Initial growth rate of EPS Maturity period (92): Payout at maturity Retention rate at maturity (retent) Growth rate at maturity: r x retent Transition period: Transition years Growth rate of EPS (incremental) Other information: Current fiscal year EPS Current calendar year dividend Current payout (p1) Growth years payout = current Maturity payout (p2) Transition years payout (incremental) Growth+ Transition Years Terminal value (TV) = div1/(r-g) Year Assumption 1 Growth year EPS 2 Growth year EPS 3 Growth year EPS 4 Growth year EPS 5 Growth year EPS 6 Growth year EPS 7 Growth year EPS 8 Transition year EPS 9 Transition year EPS 10 Transition year EPS 11 Transition year EPS 12 Transition year EPS 13 Transition year EPS 14 Transition year EPS 15 Transition year EPS 16 Transition year EPS 17 Transition year EPS 18 Maturity Theoretical price EPS 5.25 5.51 5.79 6.08 5.00% 5.00% 40% 60% 3.00% 10 0.18% 5.00 0.50 10.00% 10.00% 40.00% 2.73% 17 growth 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 5.00% 4.82% 4.64% 4.45% 6.38 6.70 7.04 7.39 7.76 8.10 8.45 8.79 4.09% 9.14 9.48 4.27% 3.91% 3.73% 3.55% 9.81 10.14 10.47 3.18% 3.36% 10.78 3.00% 1 2345 60 6 7 8 9 10 11 12 13 4 15 16 17 18 14 Dividend Calculate payout 10.00% 10.00% 10.00% 10.00% 0.53 0.55 0.58 0.61 0.64 0.67 10.00% 10.00% 10.00% 12.73% 0.70 0.94 1.20 1.47 1.77 15.45% 18.18% 20.91% 2.08 23.64% 26.36% 2.41 2.76 29.09% 31.82% 3.12 3.50 3.90 4.31 34.55% 37.27% 40.00% TV V (div+TV) 0.50 0.50 0.50 0.50 0.50 0.50 0.50 0.64 0.77 0.90 215.6 1.03 1.16 1.28 1.39 1.50 1.61 95.78 109.56

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To assess the worth of WalMarts stock utilizing the methods mentioned in the case including t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started