Answered step by step

Verified Expert Solution

Question

1 Approved Answer

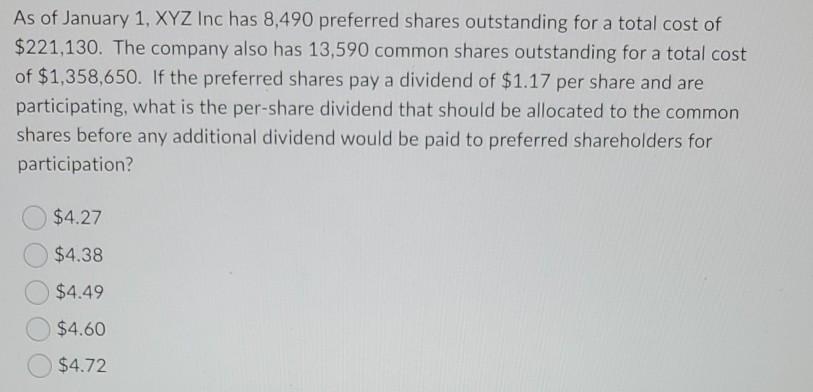

As of January 1, XYZ Inc has 8,490 preferred shares outstanding for a total cost of $221,130. The company also has 13,590 common shares outstanding

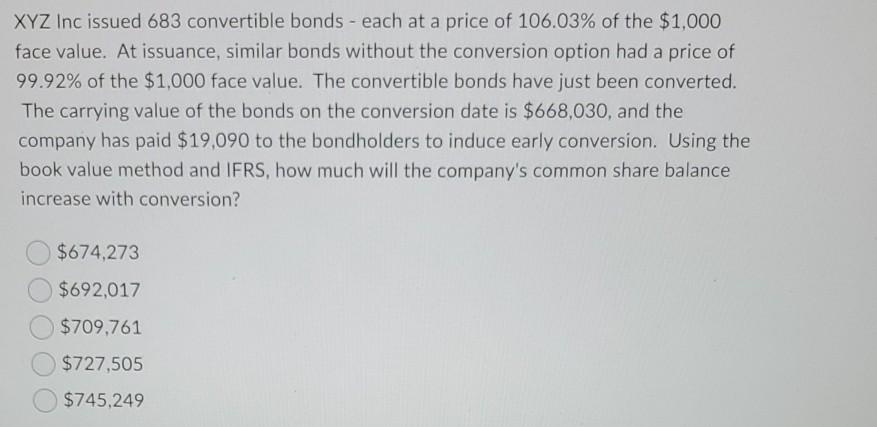

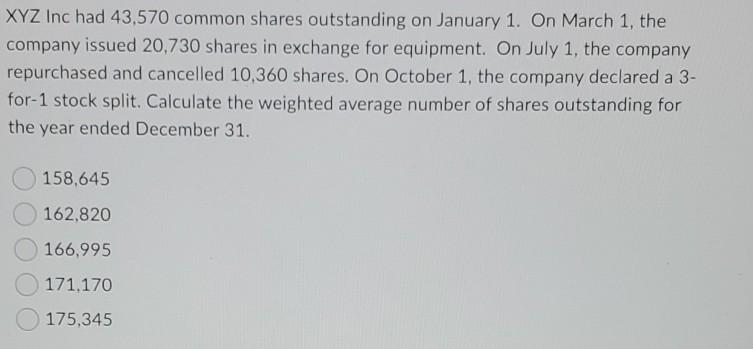

As of January 1, XYZ Inc has 8,490 preferred shares outstanding for a total cost of $221,130. The company also has 13,590 common shares outstanding for a total cost of $1,358,650. If the preferred shares pay a dividend of $1.17 per share and are participating, what is the per-share dividend that should be allocated to the common shares before any additional dividend would be paid to preferred shareholders for participation? $4.27 $4.38 $4.49 $4.60 $4.72 XYZ Inc issued 683 convertible bonds - each at a price of 106.03% of the $1,000 face value. At issuance, similar bonds without the conversion option had a price of 99.92% of the $1,000 face value. The convertible bonds have just been converted. The carrying value of the bonds on the conversion date is $668,030, and the company has paid $19,090 to the bondholders to induce early conversion. Using the book value method and IFRS, how much will the company's common share balance increase with conversion? $674,273 $692,017 $709,761 $727,505 $745,249 XYZ Inc had 43,570 common shares outstanding on January 1. On March 1, the company issued 20,730 shares in exchange for equipment. On July 1, the company repurchased and cancelled 10,360 shares. On October 1, the company declared a 3- for-1 stock split. Calculate the weighted average number of shares outstanding for the year ended December 31. 158,645 162,820 166,995 171.170 175,345

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started