Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As of March 9, 2021, the price of GameStop Corp. (ticker: GME) is $246.90 and its closing price on March 10,2020 is $4.23. You believe

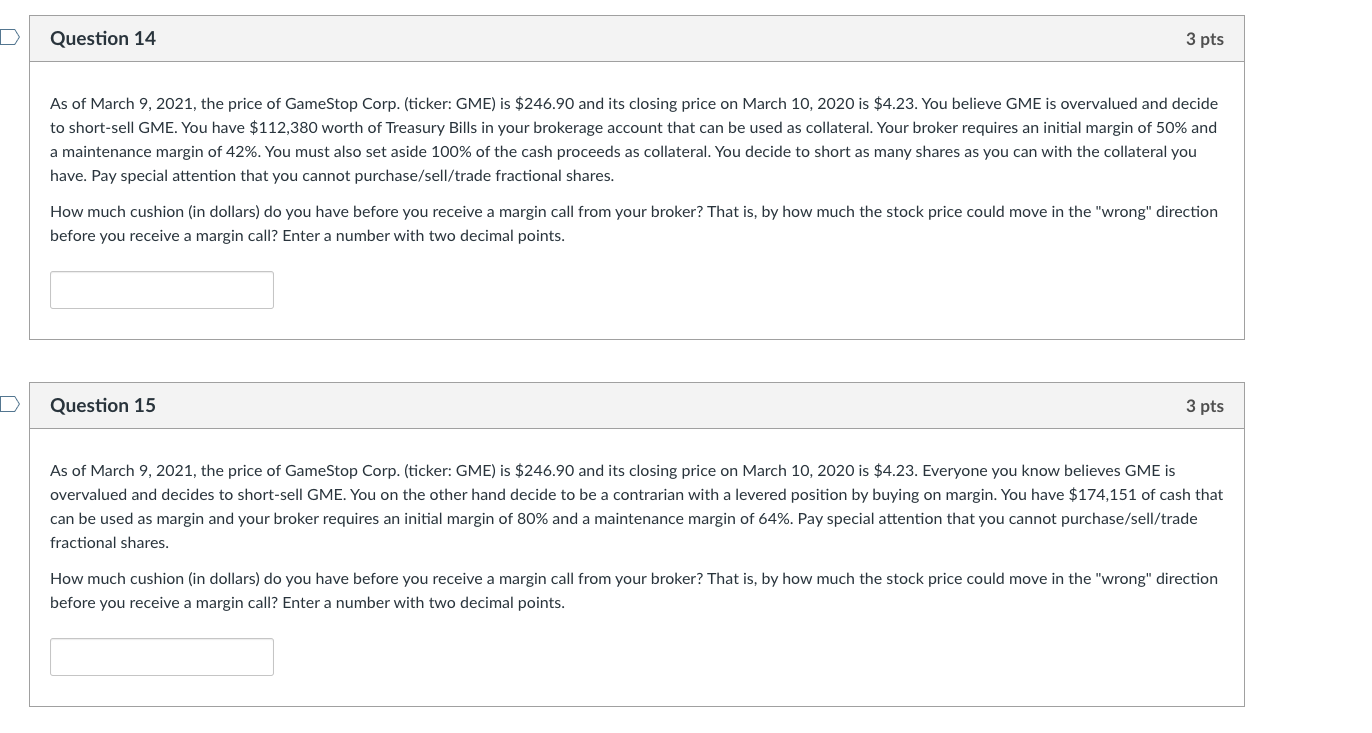

As of March 9, 2021, the price of GameStop Corp. (ticker: GME) is $246.90 and its closing price on March 10,2020 is $4.23. You believe GME is overvalued and decide to short-sell GME. You have $112,380 worth of Treasury Bills in your brokerage account that can be used as collateral. Your broker requires an initial margin of 50% and a maintenance margin of 42%. You must also set aside 100% of the cash proceeds as collateral. You decide to short as many shares as you can with the collateral you have. Pay special attention that you cannot purchase/sell/trade fractional shares. How much cushion (in dollars) do you have before you receive a margin call from your broker? That is, by how much the stock price could move in the "wrong" direction before you receive a margin call? Enter a number with two decimal points. Question 15 As of March 9, 2021, the price of GameStop Corp. (ticker: GME) is $246.90 and its closing price on March 10,2020 is $4.23. Everyone you know believes GME is overvalued and decides to short-sell GME. You on the other hand decide to be a contrarian with a levered position by buying on margin. You have $174,151 of cash that can be used as margin and your broker requires an initial margin of 80% and a maintenance margin of 64%. Pay special attention that you cannot purchase/sell/trade fractional shares. How much cushion (in dollars) do you have before you receive a margin call from your broker? That is, by how much the stock price could move in the "wrong" direction before you receive a margin call? Enter a number with two decimal points

As of March 9, 2021, the price of GameStop Corp. (ticker: GME) is $246.90 and its closing price on March 10,2020 is $4.23. You believe GME is overvalued and decide to short-sell GME. You have $112,380 worth of Treasury Bills in your brokerage account that can be used as collateral. Your broker requires an initial margin of 50% and a maintenance margin of 42%. You must also set aside 100% of the cash proceeds as collateral. You decide to short as many shares as you can with the collateral you have. Pay special attention that you cannot purchase/sell/trade fractional shares. How much cushion (in dollars) do you have before you receive a margin call from your broker? That is, by how much the stock price could move in the "wrong" direction before you receive a margin call? Enter a number with two decimal points. Question 15 As of March 9, 2021, the price of GameStop Corp. (ticker: GME) is $246.90 and its closing price on March 10,2020 is $4.23. Everyone you know believes GME is overvalued and decides to short-sell GME. You on the other hand decide to be a contrarian with a levered position by buying on margin. You have $174,151 of cash that can be used as margin and your broker requires an initial margin of 80% and a maintenance margin of 64%. Pay special attention that you cannot purchase/sell/trade fractional shares. How much cushion (in dollars) do you have before you receive a margin call from your broker? That is, by how much the stock price could move in the "wrong" direction before you receive a margin call? Enter a number with two decimal points Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started