Question

As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs. Job

As of the end of June, the job cost sheets at Racing Wheels, Inc., show the following total costs accumulated on three custom jobs.

| Job 102 | Job 103 | Job 104 | |||||||

| Direct materials | $ | 15,000 | $ | 33,000 | $ | 27,000 | |||

| Direct labor | 8,000 | 14,200 | 21,000 | ||||||

| Overhead applied | 4,000 | 7,100 | 10,500 | ||||||

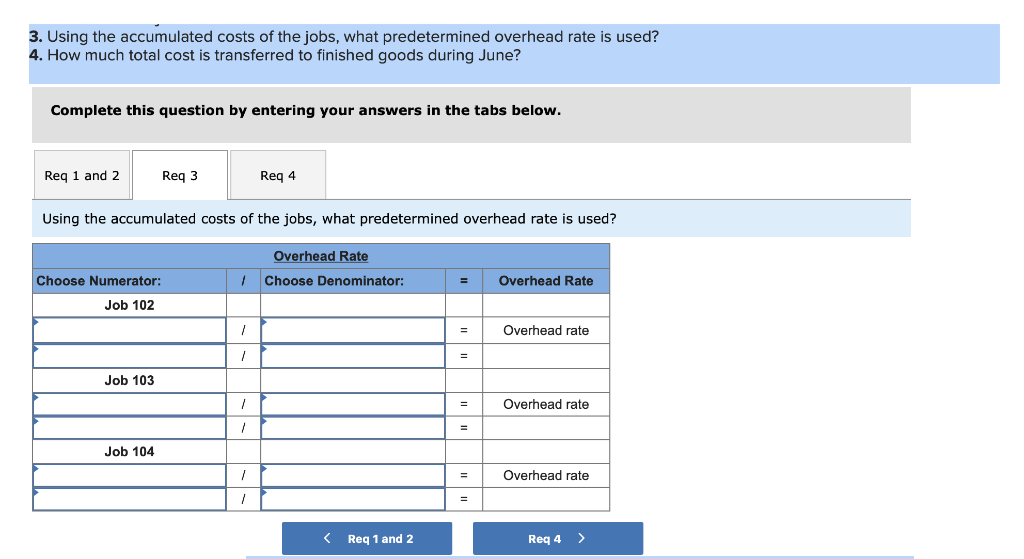

Job 102 was started in production in May, and the following costs were assigned to it in May: direct materials, $6,000; direct labor, $1,800; and overhead, $900. Jobs 103 and 104 were started in June. Overhead cost is applied with a predetermined rate based on direct labor cost. Jobs 102 and 103 were finished in June, and Job 104 is expected to be finished in July. No raw materials were used indirectly in June. Using this information, answer the following questions. (Assume this companys predetermined overhead rate did not change across these months.) 1&2. Complete the table below to calculate the cost of the raw materials requisitioned and direct labor cost incurred during June for each of the three jobs. 3. Using the accumulated costs of the jobs, what predetermined overhead rate is used? 4. How much total cost is transferred to finished goods during June?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started