Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As part of its long-term strategic plan, Greenwater Inc. purchased a 34% interest in the common shares of one of its suppliers, Prosperous Company.

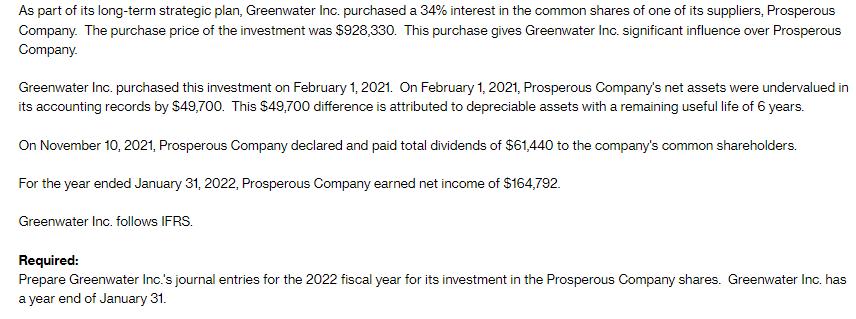

As part of its long-term strategic plan, Greenwater Inc. purchased a 34% interest in the common shares of one of its suppliers, Prosperous Company. The purchase price of the investment was $928,330. This purchase gives Greenwater Inc. significant influence over Prosperous Company. Greenwater Inc. purchased this investment on February 1, 2021. On February 1, 2021, Prosperous Company's net assets were undervalued in its accounting records by $49,700. This $49,700 difference is attributed to depreciable assets with a remaining useful life of 6 years. On November 10, 2021, Prosperous Company declared and paid total dividends of $61,440 to the company's common shareholders. For the year ended January 31, 2022, Prosperous Company earned net income of $164,792. Greenwater Inc. follows IFRS. Required: Prepare Greenwater Inc.'s journal entries for the 2022 fiscal year for its investment in the Prosperous Company shares. Greenwater Inc. has a year end of January 31.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Since Greenwater Inc has significant influence over Prosperous Company the equity method sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started