Question

As part of our project, we must include a section on the Balance Sheet. This statement is a significant financial document that provides information on

As part of our project, we must include a section on the Balance Sheet. This statement is a significant financial document that provides information on a company's assets, liabilities, and equity at a specific point in time.

To make a report on the Balance Sheet, please follow these instructions:

Introduction: Begin with a brief introduction to the purpose of the Balance Sheet and why it is important for businesses and investors.

Key Components: Describe the key components of the Balance Sheet, including assets, liabilities, and equity. Explain how these components are categorized and what they represent regarding a company's financial position.

Analysis: Analyze the Balance Sheet by examining the assets, liabilities, and equity trends over time. Identify any significant changes in the components and explain their potential impact on the business. Discuss any challenges or limitations in interpreting the statement.

Conclusion: Summarize the key points discussed in the report and provide final thoughts on the importance of the Balance Sheet for businesses and investors.

When preparing your report, please ensure that you use accurate and up-to-date financial data for the company. You should also use clear and concise language and provide relevant charts or graphs to support your analysis.

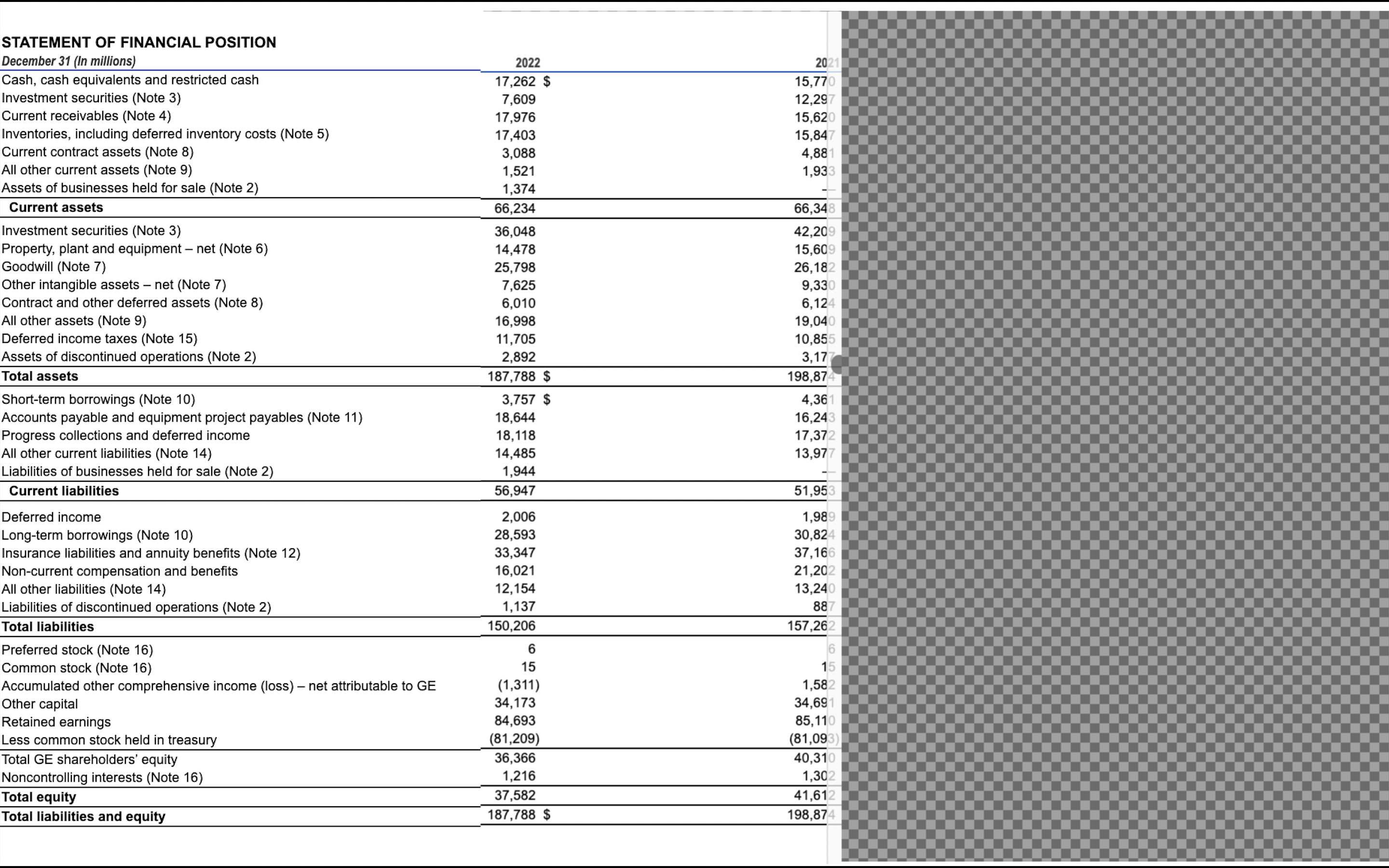

STATEMENT OF FINANCIAL POSITION December 31 (In millions) Cash, cash equivalents and restricted cash Investment securities (Note 3) Current receivables (Note 4) Inventories, including deferred inventory costs (Note 5) Current contract assets (Note 8) All other current assets (Note 9) Assets of businesses held for sale (Note 2) Current assets Investment securities (Note 3) Property, plant and equipment - net (Note 6) Goodwill (Note 7) Other intangible assets - net (Note 7) Contract and other deferred assets (Note 8) All other assets (Note 9) Deferred income taxes (Note 15) Assets of discontinued operations (Note 2) Total assets Short-term borrowings (Note 10) Accounts payable and equipment project payables (Note 11) Progress collections and deferred income All other current liabilities (Note 14) Liabilities of businesses held for sale (Note 2) Current liabilities Deferred income Long-term borrowings (Note 10) Insurance liabilities and annuity benefits (Note 12) Non-current compensation and benefits All other liabilities (Note 14) Liabilities of discontinued operations (Note 2) Total liabilities Preferred stock (Note 16) Common stock (Note 16) Accumulated other comprehensive income (loss) - net attributable to GE Other capital Retained earnings Less common stock held in treasury Total GE shareholders' equity Noncontrolling interests (Note 16) Total equity Total liabilities and equity 2022 17,262 $ 7,609 17,976 17,403 3,088 1,521 1,374 66,234 36,048 14,478 25,798 7,625 6,010 16,998 11,705 2,892 187,788 $ 3,757 $ 18,644 18,118 14,485 1,944 56,947 2,006 28,593 33,347 16,021 12,154 1,137 150,206 6 15 (1,311) 34,173 84,693 (81,209) 36,366 1,216 37,582 187,788 $ 2021 15,770 12,297 15,620 15,847 4,881 1,933 66,348 42,209 15,609 26,182 9,330 6,124 19,040 10,855 3,17 198,874 4,361 16,243 17,372 13,977 51,953 1,989 30,824 37,166 21,202 13,240 88 157,262 6 15 1,582 34,691 85,110 (81,093) 40,310 1,302 41,612 198,874

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understanding the Balance Sheet A Core Financial Statement The balance sheet serves as a snapshot of a companys financial health at a specific point i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started