Answered step by step

Verified Expert Solution

Question

1 Approved Answer

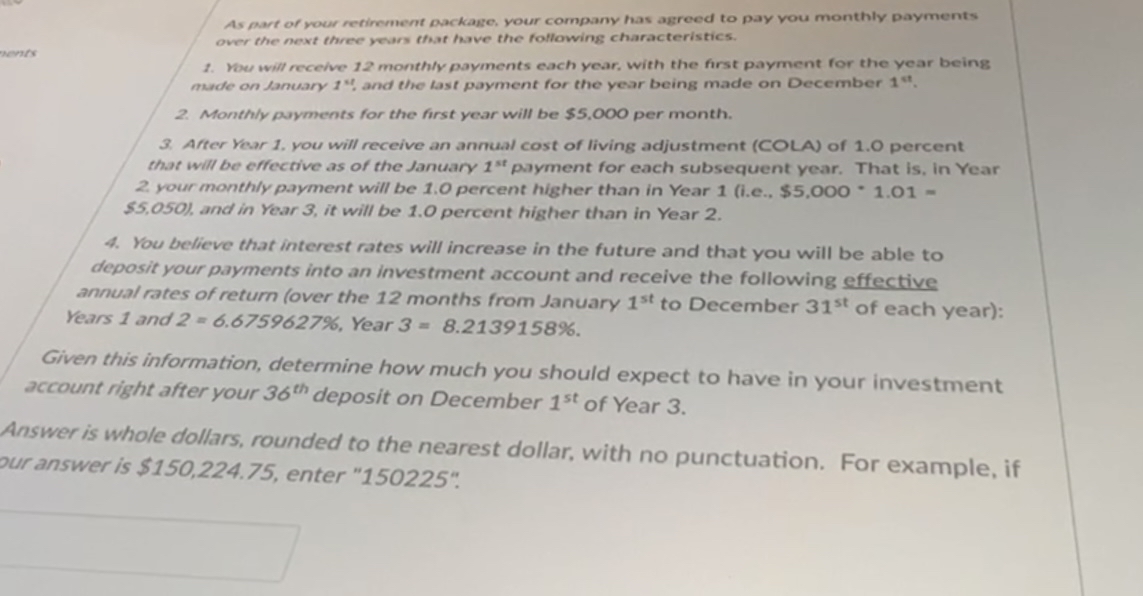

As part of your recirement package, your company has agreed to pay vou monthly payments over the next three yeurs that have the following characteristics.

As part of your recirement package, your company has agreed to pay vou monthly payments over the next three yeurs that have the following characteristics.

Wou will recelve monthly payments each year, with the first payment for the year being mude on lanuany and the last payment for the year being made on December st

Monthly puyments for the first year will be $ per month.

After Year you will receive an annual cost of living adjustment COLA of percent that will be effective as of the January payment for each subsequent year. That is in Year your monthly payment will be percent higher than in Year ie $ $ and in Year it will be percent higher than in Year

You believe that interest rates will increase in the future and that you will be able to deposit your payments into an investment account and receive the following effective annual rates of return over the months from January to December st of each year: Years and Year

Given this information, determine how much you should expect to have in your investment account right after your deposit on December of Year

Answer is whole dollars, rounded to the nearest dollar, with no punctuation. For example, if our answer is $ enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started