Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As per para 6. AS 16, borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset should be capitalised

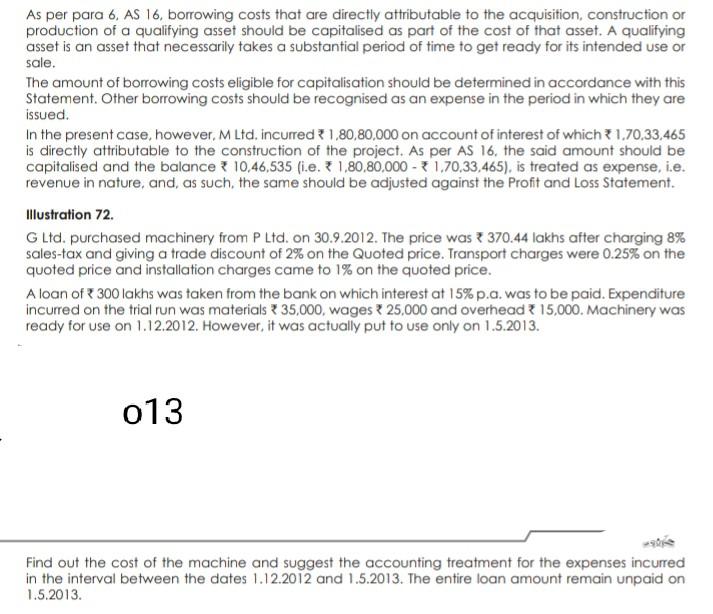

As per para 6. AS 16, borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset should be capitalised as part of the cost of that asset. A qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. The amount of borrowing costs eligible for capitalisation should be determined in accordance with this Statement. Other borrowing costs should be recognised as an expense in the period in which they are issued. In the present case, however, M Ltd. incurred 1,80,80,000 on account of interest of which 1,70,33,465 is directly attributable to the construction of the project. As per AS 16, the said amount should be capitalised and the balance 10,46,535 (i.e. 1,80,80,000 - + 1.70,33,465), is treated as expense, i.e. revenue in nature, and, as such, the same should be adjusted against the Profit and Loss Statement. Illustration 72 GLtd. purchased machinery from P Ltd. on 30.9.2012. The price was 370.44 lakhs after charging 8% sales-tax and giving a trade discount of 2% on the Quoted price. Transport charges were 0.25% on the quoted price and installation charges came to 1% on the quoted price. A loan of 300 lakhs was taken from the bank on which interest at 15%p.a. was to be paid. Expenditure incurred on the trial run was materials 35,000, wages 25,000 and overhead 15,000. Machinery was ready for use on 1.12.2012. However, it was actually put to use only on 1.5.2013. 013 Find out the cost of the machine and suggest the accounting treatment for the expenses incurred in the interval between the dates 1.12.2012 and 1.5.2013. The entire loan amount remain unpaid on 1.5.2013

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started