Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As recognized legal experts here in Lonline, and as a result of our reputation in criminal law, we have re- cently been contacted by

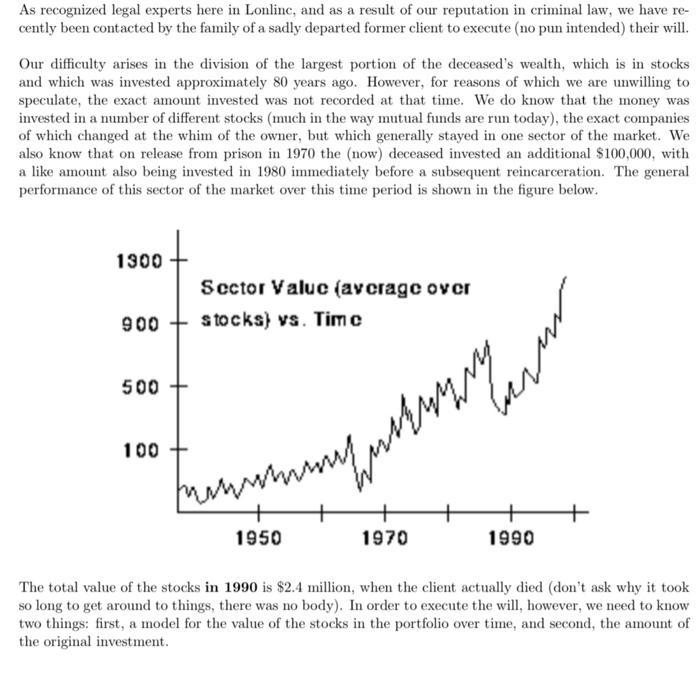

As recognized legal experts here in Lonline, and as a result of our reputation in criminal law, we have re- cently been contacted by the family of a sadly departed former client to execute (no pun intended) their will. Our difficulty arises in the division of the largest portion of the deceased's wealth, which is in stocks and which was invested approximately 80 years ago. However, for reasons of which we are unwilling to speculate, the exact amount invested was not recorded at that time. We do know that the money was invested in a number of different stocks (much in the way mutual funds are run today), the exact companies of which changed at the whim of the owner, but which generally stayed in one sector of the market. We also know that on release from prison in 1970 the (now) deceased invested an additional $100,000, with a like amount also being invested in 1980 immediately before a subsequent reincarceration. The general performance of this sector of the market over this time period is shown in the figure below. 1300 Sector Value (average over 900 stocks) vs. Time 500 1950 100 1970 1990 + The total value of the stocks in 1990 is $2.4 million, when the client actually died (don't ask why it took so long to get around to things, there was no body). In order to execute the will, however, we need to know two things: first, a model for the value of the stocks in the portfolio over time, and second, the amount of the original investment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 11 Here in this case our main objective is to find an equation which will present of this parti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started