Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AS SEEN IN OTHER EXAMPLES. ALL INFORMATION NEEDED TO ANSWER QUESTION IS GIVEN THANK YOU As a fixed income portfolio manager, you are considering purchasing

AS SEEN IN OTHER EXAMPLES. ALL INFORMATION NEEDED TO ANSWER QUESTION IS GIVEN

THANK YOU

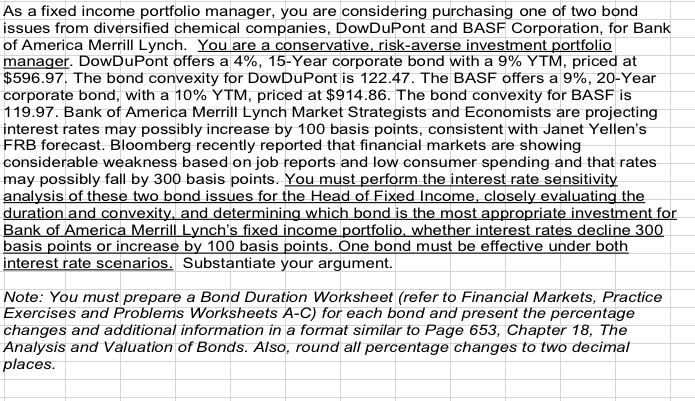

As a fixed income portfolio manager, you are considering purchasing one of two bond issues from diversified chemical companies, DowDuPont and BASF Corporation, for Bank of America Merrill Lynch. You are a conservative, risk-averse investment portfolio manager. DowDuPont offers a 4%, 15-Year corporate bond with a 9% YTM, priced at $596.97. The bond convexity for DowDuPont is 122.47. The BASF offers a 9%, 20-Year corporate bond, with a 10% YTM, priced at $914.86. The bond convexity for BASF is 119.97. Bank of America Merrill Lynch Market Strategists and Economists are projecting interest rates may possibly increase by 100 basis points, consistent with Janet Yellen's FRB forecast. Bloomberg recently reported that financial markets are showing considerable weakness based on job reports and low consumer spending and that rates may possibly fall by 300 basis points. You must perform the interest rate sensitivity analysis of these two bond issues for the Head of Fixed Income closely evaluating the duration and convexity and determining which bond is the most appropriate investment for Bank of America Merrill Lynch's fixed income portfolio, whether interest rates decline 300 basis points or increase by 100 basis points. One bond must be effective under both interest rate scenarios. Substantiate your argument. Note: You must prepare a Bond Duration Worksheet (refer to Financial Markets, Practice Exercises and Problems Worksheets A-C) for each bond and present the percentage changes and additional information in a format similar to Page 653, Chapter 18, The Analysis and Valuation of Bonds. Also, round all percentage changes to two decimal places. As a fixed income portfolio manager, you are considering purchasing one of two bond issues from diversified chemical companies, DowDuPont and BASF Corporation, for Bank of America Merrill Lynch. You are a conservative, risk-averse investment portfolio manager. DowDuPont offers a 4%, 15-Year corporate bond with a 9% YTM, priced at $596.97. The bond convexity for DowDuPont is 122.47. The BASF offers a 9%, 20-Year corporate bond, with a 10% YTM, priced at $914.86. The bond convexity for BASF is 119.97. Bank of America Merrill Lynch Market Strategists and Economists are projecting interest rates may possibly increase by 100 basis points, consistent with Janet Yellen's FRB forecast. Bloomberg recently reported that financial markets are showing considerable weakness based on job reports and low consumer spending and that rates may possibly fall by 300 basis points. You must perform the interest rate sensitivity analysis of these two bond issues for the Head of Fixed Income closely evaluating the duration and convexity and determining which bond is the most appropriate investment for Bank of America Merrill Lynch's fixed income portfolio, whether interest rates decline 300 basis points or increase by 100 basis points. One bond must be effective under both interest rate scenarios. Substantiate your argument. Note: You must prepare a Bond Duration Worksheet (refer to Financial Markets, Practice Exercises and Problems Worksheets A-C) for each bond and present the percentage changes and additional information in a format similar to Page 653, Chapter 18, The Analysis and Valuation of Bonds. Also, round all percentage changes to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started