Answered step by step

Verified Expert Solution

Question

1 Approved Answer

as soon as possible CHAPTER 11 Partnerships Keith Williams and Brian Adams were students when they formed a partnership several years ago for a part-

as soon as possible

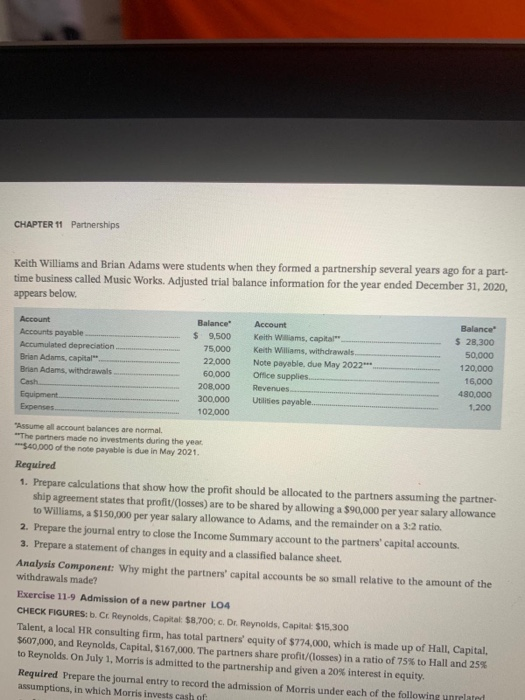

CHAPTER 11 Partnerships Keith Williams and Brian Adams were students when they formed a partnership several years ago for a part- time business called Music Works. Adjusted trial balance information for the year ended December 31, 2020, appears below. Account Accounts payable Accumulated depreciation Brian Adams, capital Brian Adams, withdrawals Cash Equipment Expenses Balance" $ 9,500 75.000 22.000 60,000 200.000 300,000 102,000 Account Keith Williams, capital Keith Williams, withdrawals Note payable, due May 2022" Office supplies Revenues Utilities payable Balance $ 28,300 50,000 120,000 16,000 480,000 1.200 "Assume all account balances are normal **The partners made no investments during the year ***$40,000 of the note payable is due in May 2021. Required 1. Prepare calculations that show how the profit should be allocated to the partners assuming the partner ship agreement states that profit/(losses) are to be shared by allowing a $90,000 per year salary allowance to Williams, a $150,000 per year salary allowance to Adams, and the remainder on a 3:2 ratio. 2. Prepare the journal entry to close the Income Summary account to the partners' capital accounts. 3. Prepare a statement of changes in equity and a classified balance sheet. Analysis Component: Why might the partners' capital accounts be so small relative to the amount of the withdrawals made? Exercise 11-9 Admission of a new partner L04 CHECK FIGURES: b. Cr Reynolds, Capital: $8,700, c. Dr. Reynolds, Capital $15,300 Talent, a local HR consulting firm, has total partners' equity of $774,000, which is made up of Hall, Capital, $607,000, and Reynolds, Capital, $167,000. The partners share profit/(losses) in a ratio of 75% to Hall and 25% to Reynolds. On July 1, Morris is admitted to the partnership and given a 20% interest in equity. Required Prepare the journal entry to record the admission of Morris under each of the following unrelated assumptions, in which Morris invests cash af Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started