As the accountant for Veneskey & Sons, you have been hired to prepare the payroll and everything that goes along with it for OlFashion Industries

As the accountant for Veneskey & Son’s, you have been hired to prepare the payroll and everything that goes along with it for Ol’Fashion Industries which has 4 employees. Their necessary payroll information is listed below and in the Excel spreadsheet for the current year. The employees are paid monthly (last day of the current month) and were last paid Sept. 30th. Assume this is an Indiana company and use the Indiana withholding rates. SUTA rate = 3.5%.

Employee Gross Wages Marital Status Recent Termination per check Hire date

Larry 13,500 Married N/A

Keagan 4,400 Single N/A

Martha 3,700 Single Aug. 1st Nov. 30th

Nancy 3,500 Married Sept. 1st

***All Medical Premium Insurance and Flexible Spending are part of a cafeteria plan***

Larry – Has $450/ pay deducted for 401K, $500/pay deducted for Medical Premium insurance , and $400 withheld for his Flexible Spending Account (FSA). Step 3 of W4 = $2,500. Spouse does not work.

Keagan - Has $300/ pay deducted for 401K, $250/pay deducted for Medical Premium insurance , and $150 withheld for FSA. Step 3 of W4 = $500

Martha- Has $50/ pay deducted for 401K, $200/pay deducted for Medical Premium insurance , and $150 withheld for FSA. Nothing for Step 3 or 4

Nancy- Has $50/ pay deducted for 401K, $350/pay deducted for Medical Premium insurance , and $400 withheld for FSA. Spouse makes the same as her (checked step 2 on W4)

**Employer will match 401K contributions up to $500. Employer’s portion of the Medical Premiums is twice what the employee pays.**

Instructions:

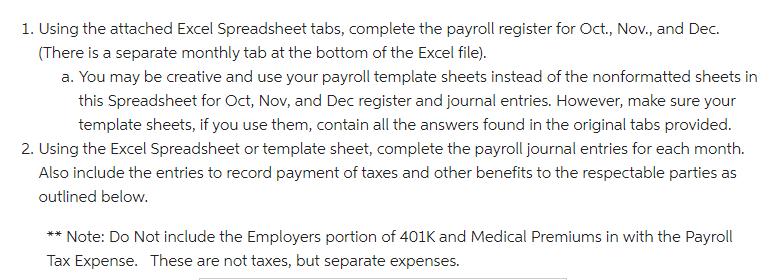

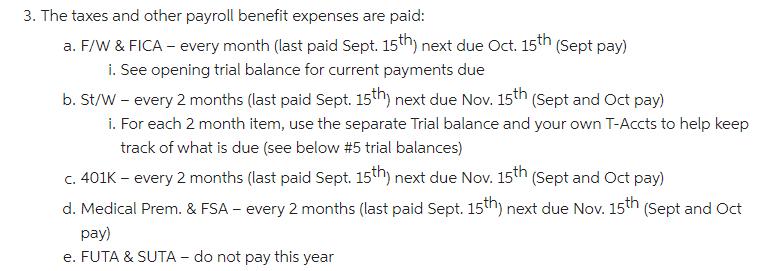

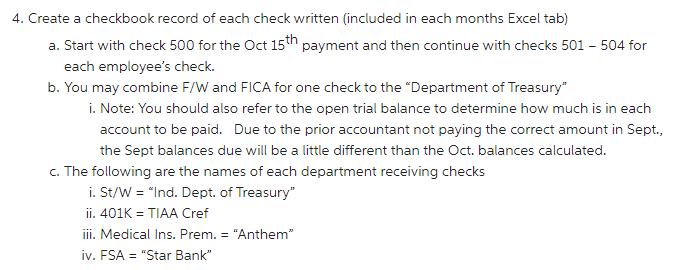

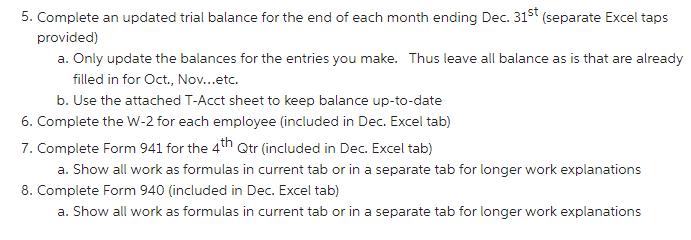

1. Using the attached Excel Spreadsheet tabs, complete the payroll register for Oct., Nov., and Dec. (There is a separate monthly tab at the bottom of the Excel file). a. You may be creative and use your payroll template sheets instead of the nonformatted sheets in this Spreadsheet for Oct, Nov, and Dec register and journal entries. However, make sure your template sheets, if you use them, contain all the answers found in the original tabs provided. 2. Using the Excel Spreadsheet or template sheet, complete the payroll journal entries for each month. Also include the entries to record payment of taxes and other benefits to the respectable parties as outlined below. Note: Do Not include the Employers portion of 401K and Medical Premiums in with the Payroll Tax Expense. These are not taxes, but separate expenses.

Step by Step Solution

3.59 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Answer i In simple terms payroll can be defined as the process of paying a companys employees It inc...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started