As the bank manager, you found several note disclosures that requires further

investigation. Provide a critique of the following accounting policies and discuss

whether or not you believe Air Canada. has adequately applied the accounting

principles:

a. Property and Equipment and Impairment (Note 6 and 4 to the financial

statements)

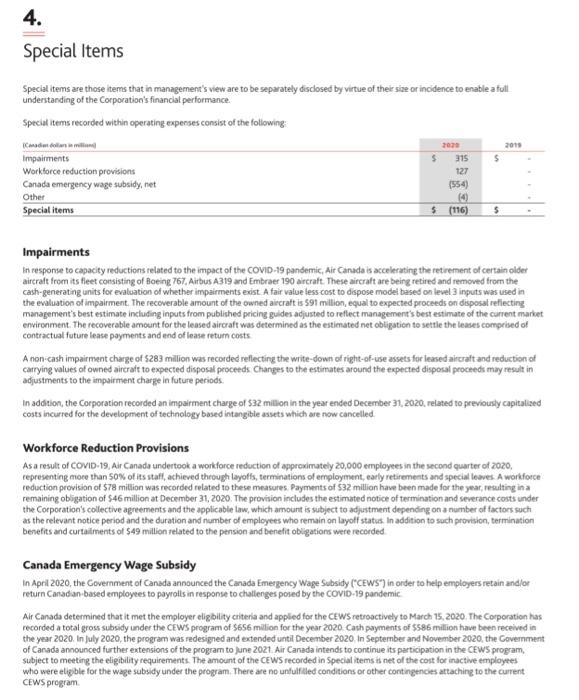

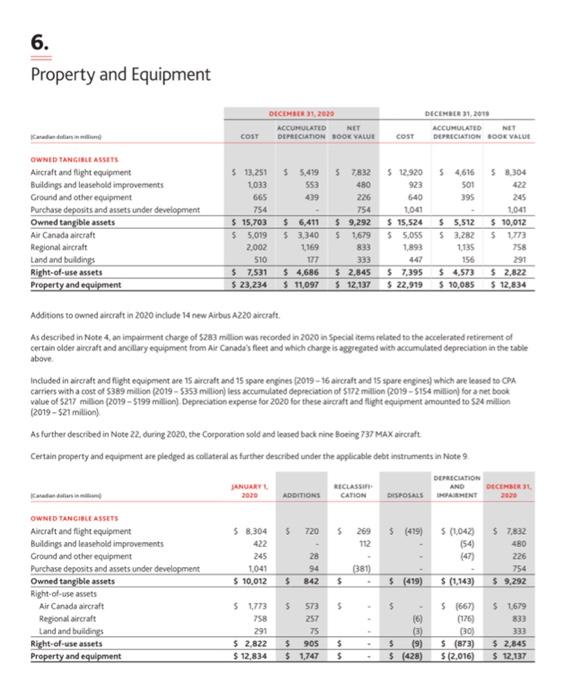

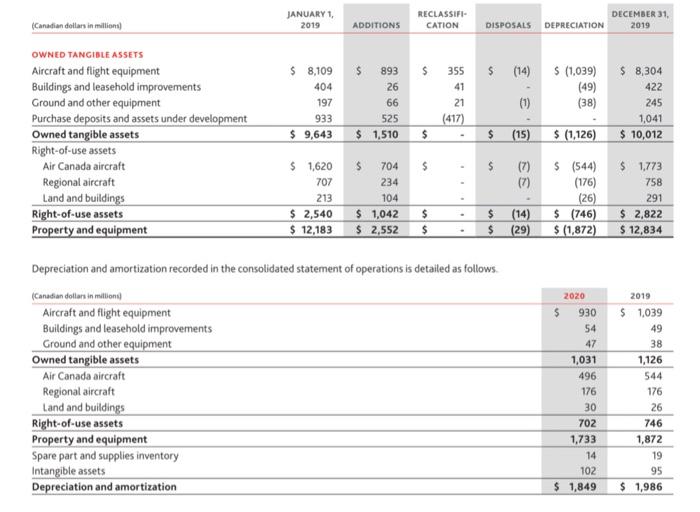

4. Special Items Special items are those items that in management's view are to be separately disclosed by virtue of the size or incidence to enable atoll understanding of the Corporation's financial performance Special items recorded within operating expenses consist of the following Canadian ini 2000 Impairments 215 $ Workforce reduction provisions 127 Canada emergency wage subsidy, net (554 Other Special items $ (116) 2011 $ Impairments In response to capacity reductions related to the impact of the COVID-19 pandemic, Air Canada is accelerating the retirement of certain older aircraft from its fleet consisting of Boeing 767. Airbus A319 and Embraer 190 aircraft. These aircraft are being retired and removed from the cash-generating units for evaluation of whether impairments exist. A fair value less cost to dispose model based on level 3 inputs was used in the evaluation of impairment. The recoverable amount of the owned aircraft is 591 million, equal to expected proceeds on disposal reflecting management's best estimate including inputs from published pricing guides adjusted to reflect management's best estimate of the current market environment. The recoverable amount for the lessed aircraft was determined as the estimated net obligation to settle the leases comprised of contractual future lease payments and end of lease return costs A non-cash impairment charge of $283 million was recorded reflecting the write-down of right-of-use assets for leased aircraft and reduction of carrying values of owned aircraft to expected disposal proceeds Changes to the estimates around the expected disposal proceeds may result in adjustments to the impairment charge in future periods. In addition, the Corporation recorded an impairment charge of $32 million in the year ended December 31, 2020. related to previously capitalised costs incurred for the development of technology based intangible assets which are now cancelled Workforce Reduction Provisions As a result of COVID-19Air Canada undertook a workforce reduction of approximately 20,000 employees in the second quarter of 2020, representing more than 50% of its staff, achieved through layoffs, terminations of employment, early retirements and special leaves A workforce reduction provision of 578 million was recorded related to these measures. Payments of $32 million have been made for the year, resulting ina remaining obligation of $46 million at December 31, 2020. The provision includes the estimated notice of termination and severance costs under the Corporation's collective agreements and the applicable law, which amount is subject to adjustment depending on a number of factors such as the relevant notice period and the duration and number of employees who remain on layoff status. In addition to such provision termination benefits and curtaiments of $49 million related to the pension and benefit obligations were recorded Canada Emergency Wage Subsidy In April 2020, the Government of Canada announced the Canada Emergency Wage Subsidy ("CEWS) in order to help employers retain and/or return Canadian-based employees to payrolls in response to challenges posed by the COVID-19 pandemic Air Canada determined that it met the employer eligibility criteria and applied for the CEWS retroactively to March 15, 2020. The Corporation has recorded a total gross subsidy under the CEWS program of $656 million for the year 2020 Cash payments of $586 million have been received in the year 2020. In July 2020, the program was redesigned and extended until December 2020 in September and November 2020, the Government of Canada announced further extensions of the program to June 2021 Air Canada intends to continue its participation in the CEWS program, Subject to meeting the eligibility requirements. The amount of the CEWS recorded in Special items is net of the cost for inactive employees who were eligible for the wage subsidy under the program. There are no unfulfilled conditions or other contingencies attaching to the current CEWS program 6. Property and Equipment DECEMBER 31, 2020 ACCUMULATED NET DEPRECIATION BOOK VALUE DECEMBER 21, 2018 ACCUMULATED NED DEPRECIATION BOOK VALUE COST COST $ 5.419 553 439 54616 501 395 OWNED TANGIREASSETS Aircraft and flight equipment Buildings and leasehold improvements Ground and other equipment Purchase deposits and assets under development Owned tangible assets Air Canada aircraft Regional aircraft Land and buildings Right-of-use assets Property and equipment 5 13.251 1033 665 754 $ 15,703 $ 5,019 2002 510 57.531 $ 23,234 $ 6,411 5 3,340 2169 57832 480 226 754 $ 9,292 5 1,679 833 333 $ 2.845 $ 12,137 $ 12.920 923 640 1041 $ 15,524 5 5.055 1,893 447 $ 7.395 $ 22,919 $ 5,512 $ 3.282 1135 156 $ 4.573 $ 10,085 5 8.304 422 245 1041 $ 10,012 5 1773 758 291 52,822 $ 12,834 $ 4,686 $ 11,097 Additions to owned aircraft in 2020 include 14 new Airbus A220 aircraft. As described in Note 4 an impairment charge of 283 million was recorded in 2020 in Special items related to the accelerated retirement of certain older aircraft and anoillary equipment from Alt Canada's fleet and which charge is aggregated with accumulated depreciation in the table above Included in aircraft and flight equipment are 15 aircraft and 15 spare engines (2019 - 16 aircraft and 15 spare engines) which are leased to CPA carriers with a cost of $389 million (2019-5353 million) less accumulated depreciation of $172 million (2019 - 5154 million) for a netbook value of $217 million (2019 - 5199 million) Depreciation expense for 2020 for these arcraft and fight equipment amounted to $24 million (2019 - 521 million) As further described in Noce 22, during 2020, the Corporation sold and leased back rine Boeing 737 MAX aircraft Certain property and equipment are pledged es. collateral as further described under the applicable debt instruments in Note 9 JANUARY 2020 DEPRECIATION AND DISPOSALSAMENT RECLASS CATION ADDITIONS DECEMBER 2020 5. 720 $ 269 112 $ (419) 5 8.304 422 245 1041 $ 10,012 5 (1042) 154 (47) $ 7,832 480 226 28 94 842 381 754 $ $ $ (419) $ (1,143) $ 9,292 OWNED TANGIBLE ASSETS Aircraft and flight equipment Buildings and leasehold improvements Ground and other equipment Purchase deposits and assets under development Owned tangible assets Right-of-use assets Air Canada aircraft Regional aircraft Land and buildings Right-of-use assets Property and equipment $ $ 1773 758 291 $ 2.822 $ 12,834 $ S73 257 75 $ 905 $ 1,747 $ - 16) (3) $ (9) $ (428) $ 667) (176) 30) $(873) $12,016) $ 1679 833 333 $ 2,845 $ 12,137 $ $ (Canadian dollars in million JANUARY 1 2019 RECLASSIFI- CATION ADDITIONS DISPOSALS DECEMBER 31 2019 DEPRECIATION $ 8,109 404 197 933 $ 9,643 $ 893 26 66 525 $ 1,510 $ 355 41 21 (417) $ $ (14) S (1,039) $ 8,304 (49) 422 (1) (38) 245 1,041 $ (15) $ (1,126) $ 10,012 OWNED TANGIBLE ASSETS Aircraft and flight equipment Buildings and leasehold improvements Ground and other equipment Purchase deposits and assets under development Owned tangible assets Right-of-use assets Air Canada aircraft Regional aircraft Land and buildings Right-of-use assets Property and equipment $ $ (7) (7) $ 1,620 707 213 $ 2,540 $ 12,183 $ 704 234 104 $ 1,042 $ 2,552 $ (544) (176) (26) $ (746) $ (1,872) $ 1.773 758 291 $ 2,822 $ 12,834 $ $ $ (14) $ (29) Depreciation and amortization recorded in the consolidated statement of operations is detailed as follows. (Canadian dollar in million Aircraft and flight equipment Buildings and leasehold improvements Ground and other equipment Owned tangible assets Air Canada aircraft Regional aircraft Land and buildings Right-of-use assets Property and equipment Spare part and supplies inventory Intangible assets Depreciation and amortization 2020 $ 930 54 47 1,031 496 176 30 702 1,733 14 102 $ 1,849 2019 $ 1,039 49 38 1.126 544 176 26 746 1,872 19 95 $ 1,986