Answered step by step

Verified Expert Solution

Question

1 Approved Answer

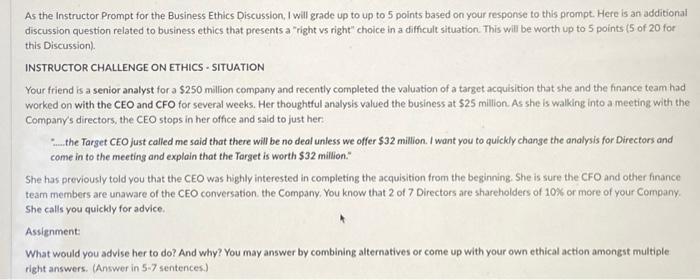

As the Instructor Prompt for the Business Ethics Discussion, I will grade up to up to 5 points based on your response to this prompt.

As the Instructor Prompt for the Business Ethics Discussion, I will grade up to up to 5 points based on your response to this prompt. Here is an additional discussion question related to business ethics that presents a "right vs right" choice in a difficult situation. This will be worth up to 5 points (5 of 20 for this Discussion). INSTRUCTOR CHALLENGE ON ETHICS - SITUATION Your friend is a senior analyst for a $250 million company and recently completed the valuation of a target acquisition that she and the finance team had worked on with the CEO and CFO for several weeks. Her thoughtful analysis valued the business at $25 million. As she is walking into a meeting with the Company's directors, the CEO stops in her office and said to just her: ".....the Target CEO just called me said that there will be no deal unless we offer $32 million. I want you to quickly change the analysis for Directors and come in to the meeting and explain that the Target is worth $32 million." She has previously told you that the CEO was highly interested in completing the acquisition from the beginning. She is sure the CFO and other finance team members are unaware of the CEO conversation. the Company. You know that of 7 Directors are shareholders of 10% or hore of your Comp She calls you quickly for advice. Assignment: What would you advise her to do? And why? You may answer by combining alternatives or come up with your own ethical action amongst multiple right answers. (Answer in 5-7 sentences.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started