Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the manager for a local outdoor apparel company, you are considering introducing a wind and waterproof jacket to complement your current market offering,

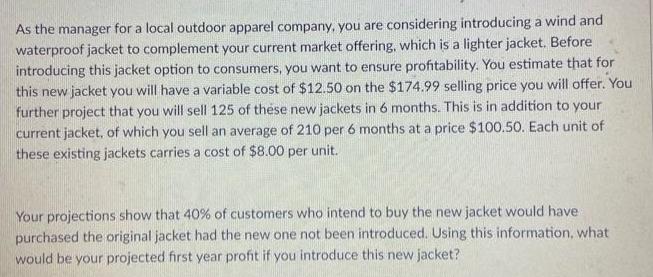

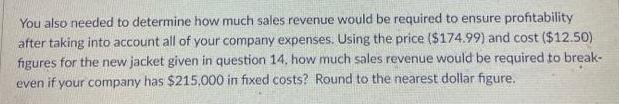

As the manager for a local outdoor apparel company, you are considering introducing a wind and waterproof jacket to complement your current market offering, which is a lighter jacket. Before introducing this jacket option to consumers, you want to ensure profitability. You estimate that for this new jacket you will have a variable cost of $12.50 on the $174.99 selling price you will offer. You further project that you will sell 125 of these new jackets in 6 months. This is in addition to your current jacket, of which you sell an average of 210 per 6 months at a price $100.50. Each unit of these existing jackets carries a cost of $8.00 per unit. Your projections show that 40% of customers who intend to buy the new jacket would have purchased the original jacket had the new one not been introduced. Using this information, what would be your projected first year profit if you introduce this new jacket? You also needed to determine how much sales revenue would be required to ensure profitability after taking into account all of your company expenses. Using the price ($174.99) and cost ($12.50) figures for the new jacket given in question 14. how much sales revenue would be required to break- even if your company has $215,000 in fixed costs? Round to the nearest dollar figure.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the projected first year profit we need to calculate the revenue and expenses associate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started