Answered step by step

Verified Expert Solution

Question

1 Approved Answer

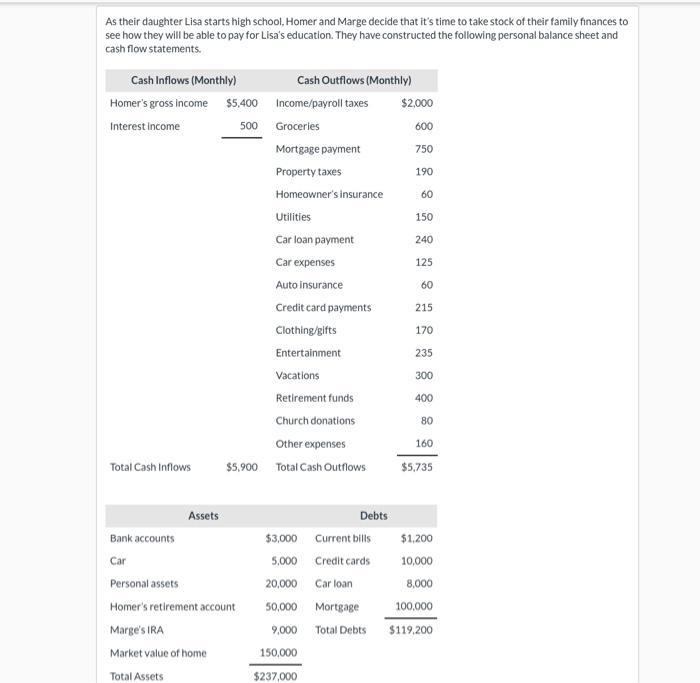

As their daughter Lisa starts high school, Homer and Marge decide that it's time to take stock of their family finances to see how

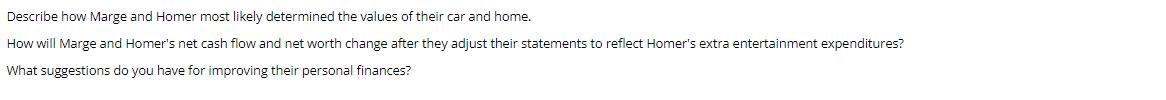

As their daughter Lisa starts high school, Homer and Marge decide that it's time to take stock of their family finances to see how they will be able to pay for Lisa's education. They have constructed the following personal balance sheet and cash flow statements. Cash Inflows (Monthly) Homer's gross income $5,400 Interest income 500 Total Cash Inflows Bank accounts Car Assets $5,900 Personal assets Homer's retirement account Marge's IRA Market value of home Total Assets Cash Outflows (Monthly) Income/payroll taxes Groceries Mortgage payment Property taxes Homeowner's insurance Utilities Car loan payment Car expenses Auto insurance Credit card payments Clothing/gifts Entertainment Vacations Retirement funds Church donations Other expenses Total Cash Outflows Debts $3,000 Current bills 5,000 Credit cards 20,000 Car loan 50,000 Mortgage 9,000 Total Debts 150,000 $237,000 $2,000 600 750 190 60 150 240 125 60 215 170 235 300 400 80 160 $5,735 $1,200 10,000 8,000 100,000 $119.200 Describe how Marge and Homer most likely determined the values of their car and home. How will Marge and Homer's net cash flow and net worth change after they adjust their statements to reflect Homer's extra entertainment expenditures? What suggestions do you have for improving their personal finances?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears that you have shared two images with text related to a financial scenario involving personal finances including cash inflows cash outflows assets and debts You are asking for an explanation ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started