Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As they do every year, John and Jane donated to several charities in 2018. They have official receipts for all their contributions: Alzheimer's Society

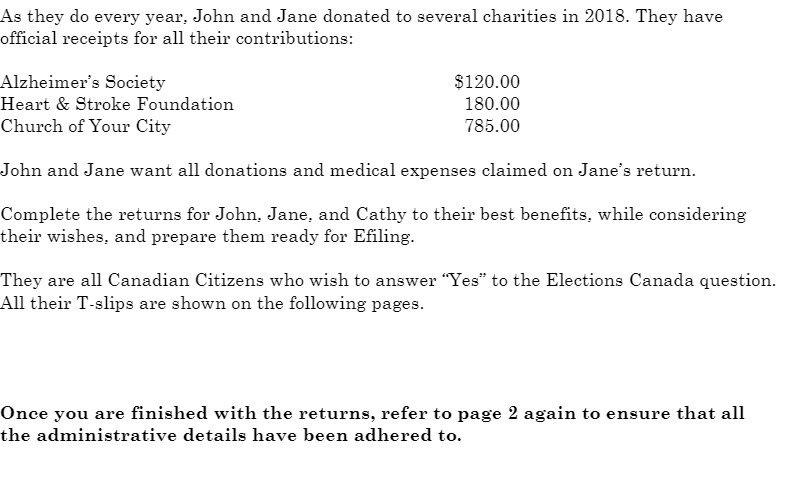

As they do every year, John and Jane donated to several charities in 2018. They have official receipts for all their contributions: Alzheimer's Society Heart & Stroke Foundation Church of Your City John and Jane want all donations and medical expenses claimed on Jane's return. Complete the returns for John, Jane, and Cathy to their best benefits, while considering their wishes, and prepare them ready for Efiling. $120.00 180.00 785.00 They are all Canadian Citizens who wish to answer "Yes" to the Elections Canada question. All their T-slips are shown on the following pages. Once you are finished with the returns, refer to page 2 again to ensure that all the administrative details have been adhered to.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Canadian Tax Returns for John Jane and Cathy 2018 Based on the information provided heres how to com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started