Answered step by step

Verified Expert Solution

Question

1 Approved Answer

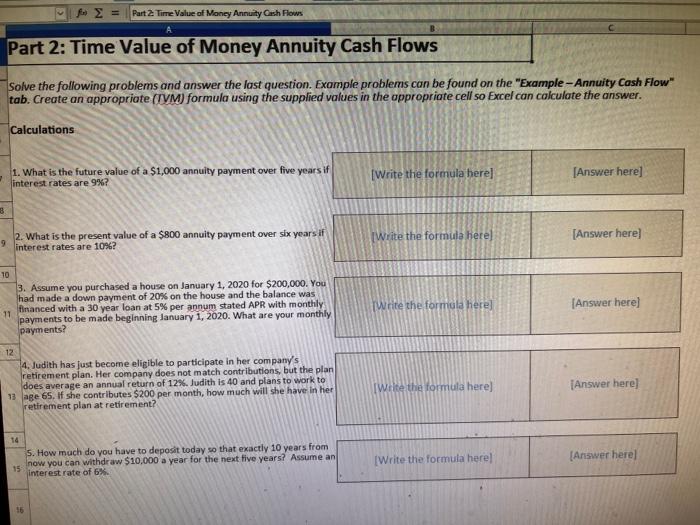

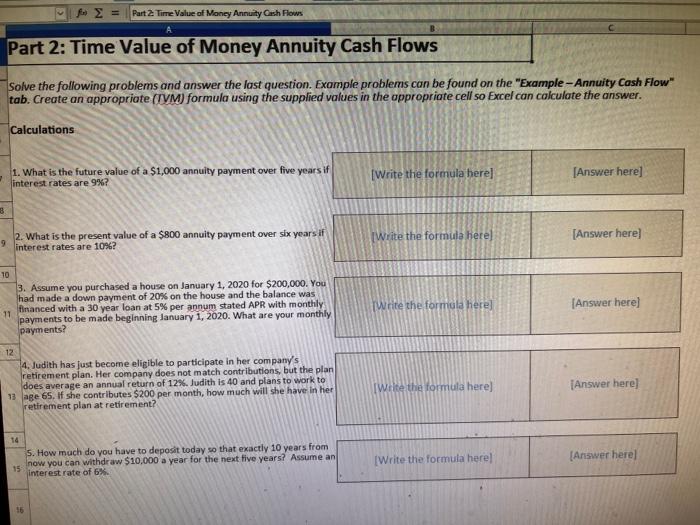

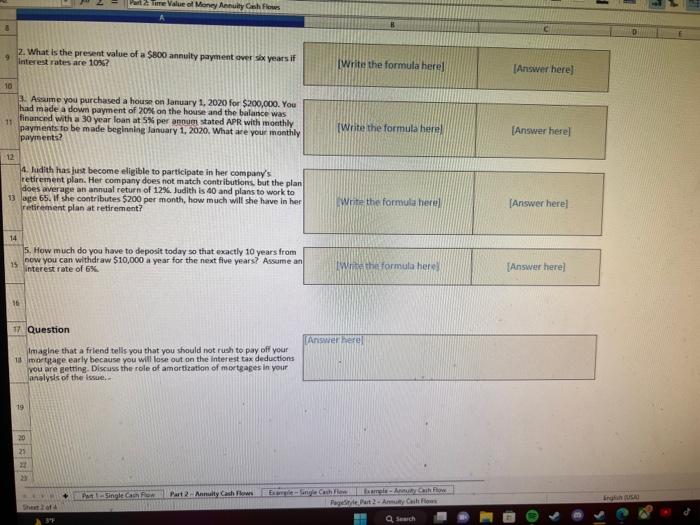

As you can see I need the excel formulas so I can input them and find out the answer. Thank you so much Part 2:

As you can see I need the excel formulas so I can input them and find out the answer. Thank you so much

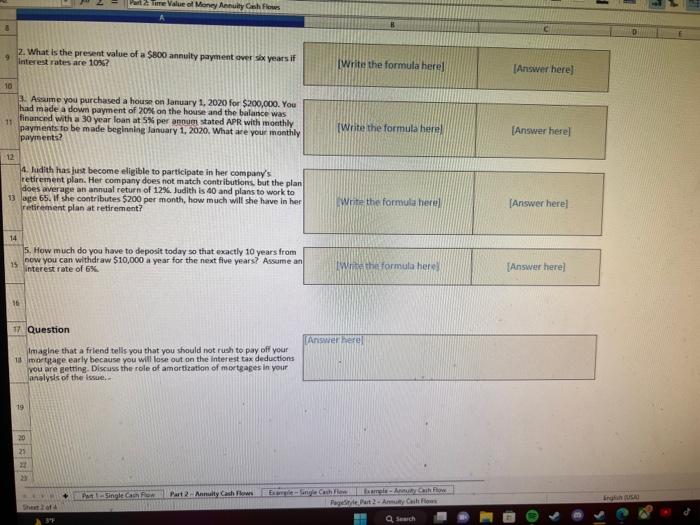

Part 2: Time Value of Money Annuity Cash Flows Solve the following problems and answer the last question. Example problems can be found on the "Example -Annuity Cash Flow" tab. Create an appropriate (TYM) formula using the supplied values in the oppropriate cell so Excel can calculate the answer. Calculations 1. What is the future value of a $1,000 annuity payment over five years if interest rates are 9% ? 2. What is the present value of a $800 annuity payment over six years if interest rates are 10% ? 3. Assume you purchased a house on January 1, 2020 for $200,000. You had made a down payment of 20% on the house and the balance was financed with a 30 year loan at 5% per annum stated APR with monthly payments to be made beginning lanuary 1, 2020. What are your monthly payments? 12 4. Judith has just become eligible to participate in her company's retirement plan. Her company does not match contributions, but the plan does average an annual return of 12%. Judith is 40 and plans to work to 13 age 65. If she contributes $200 per month, how much will she have in her [Answer here] retirement plan at retirement? 5. How mach do you have to deposit today so that exactly 10 years from now you can withdraw $10,000 a year for the next five years? Assume an interest rate of 6%. 2. What is the present value of a $800 annuity payment over shx years if interest rates are 103 s? 3. Assume yoa purchased a house on January 1, 2020 for $200,000. You had made a down payment of 20 i on the house and the balance was financed with a 30 yoar loan at 5% per annum stated APR with monthly payments to be made beginning January 1,2020 . What are your monthly payanents? 4. Iadith has just become eligible to participate in her company's retirement plan. Her company does not match contributiors, but the plan does overage an annual return of 12%. Judith is 40 and plans to work to age 65. If the contributes $200 per month, haw much wilt she have in her retirement plan at retirement? 5. How much do you have to deposit today so that exactly 10 years from now you can withdraw $10,000 a year for the next flue years? Assume ar interest rate of 63 . Question Imaglne that a friend telis you that you should not rueh to pay off your mer tiage early because you will lase out on the interest tax deductions you are getting. Discuss the role of amortization of mor tgages in your aralysis of the issue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started