As you know from Project 4, McCormick & Company is considering building a new factory in Largo, Maryland. McCormick & Company decided to offer $4,424,000 to obtain the land for this project. The new factory will require an initial investment of $350 million to build the new plant and purchase equipment.

You have been asked to continue your work from project 4 with a full analysis of the proposed factory, including the start-up costs, the projected net cash flows from operations, the tax impact of depreciation, and the cash flow impacts of changes in working capital.

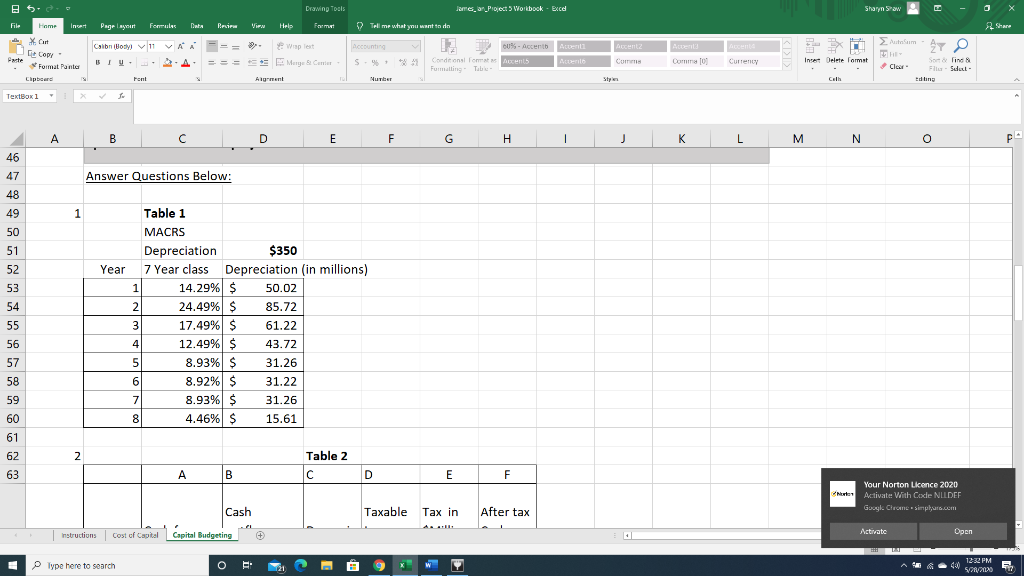

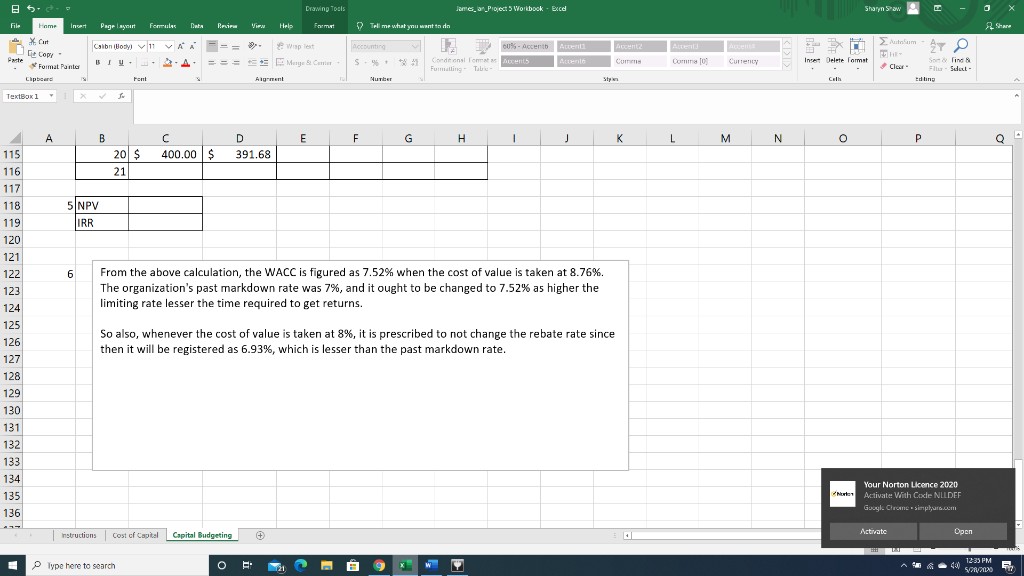

The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The correct depreciation table is included below.

The company will need to finance some of the cash to fund $17 million in accounts receivable and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts payable). The CFO wants you to consider the net cash outflows for working capital as well as the cash outflows for the plant, equipment, and land in year zero.

Note: The $17 million for accounts receivable and the $14 million for Inventory are cash outflows. The $15 million for accounts payable is a cash inflow.

The CFO has indicated that this net working capital will be recovered as a cash inflow in year 21. She also estimates that the company will be able to sell the factory, equipment, and land in year 21 for $40 million.

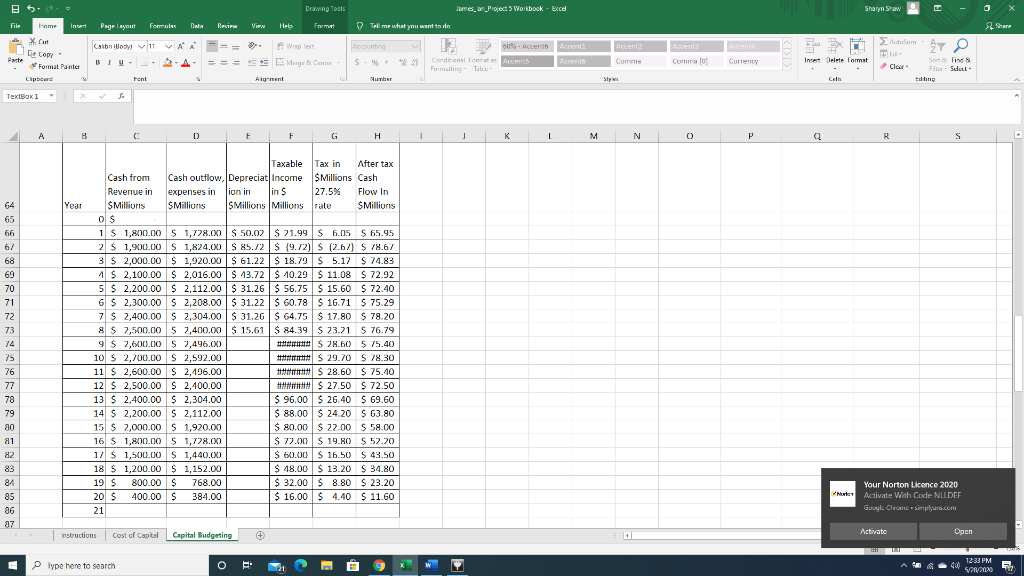

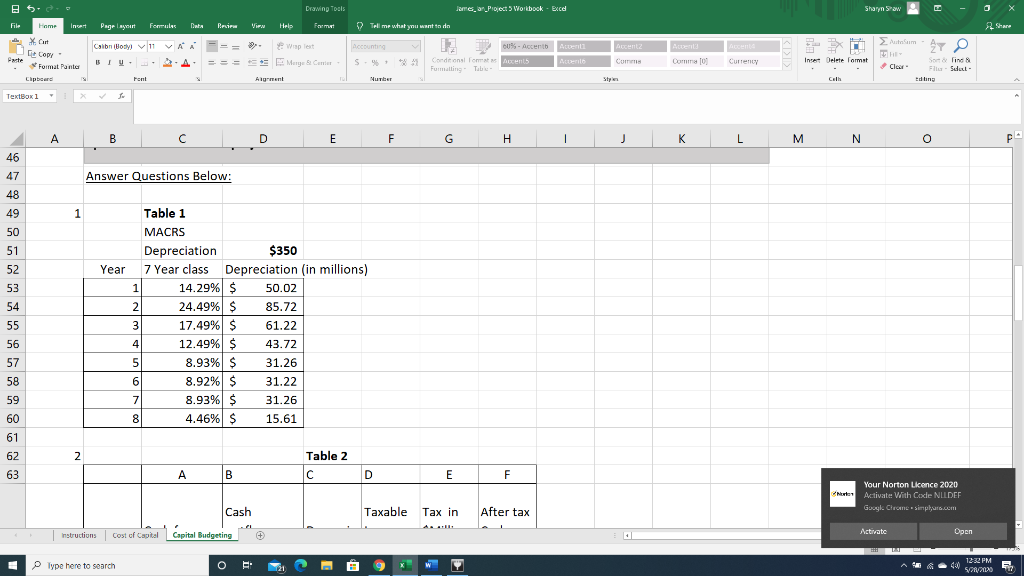

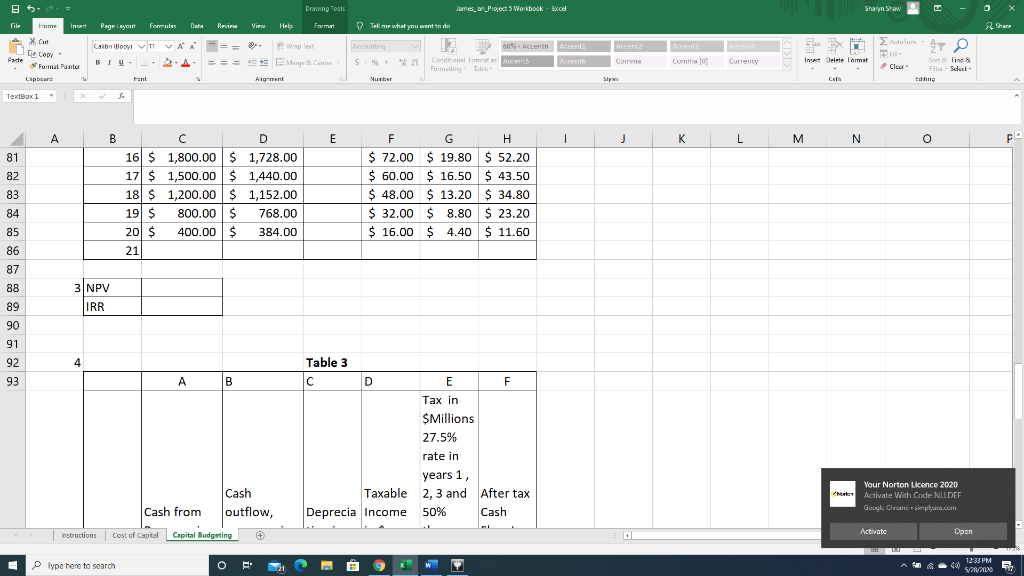

The company estimates that the cash flows from operations will be as shown in Table 2. Note: Only the cash flows related to operations (years 1-20) will generate accounting profits and thus taxable income (or losses).

Use the WACC that you recommended in question 5 of the Cost of Capital tab for the discount rate.

________________________________________________________________________________________

Questions:

1. What will be the depreciation for tax purposes each year? Complete Table 1 below to answer this question. Note: the total deprecation for tax purposes will be $350 million.

2. Create an after-tax cash flow timeline for the proposed factory in Table 2 below. Note: The CFO estimates that operations for the company will be profitable on an on-going basis. As a result, any accounting loss on this specific project will provide a tax benefit for the company overall in the year of the loss.

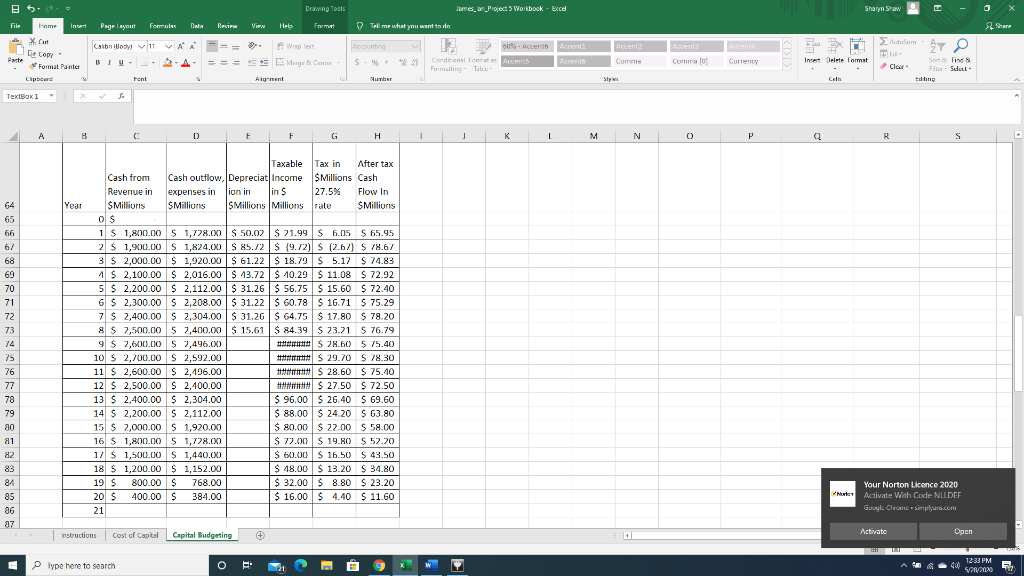

3. Calculate the NPV and IRR using the data from Table 2. Should the project be accepted?

The following questions will be used to assist in evaluating the proposed project's risk.

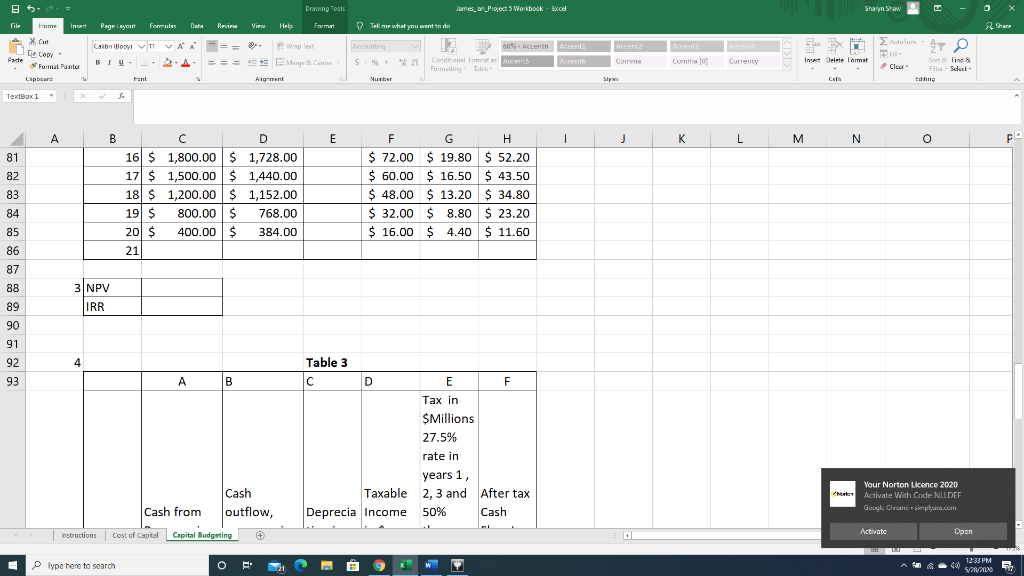

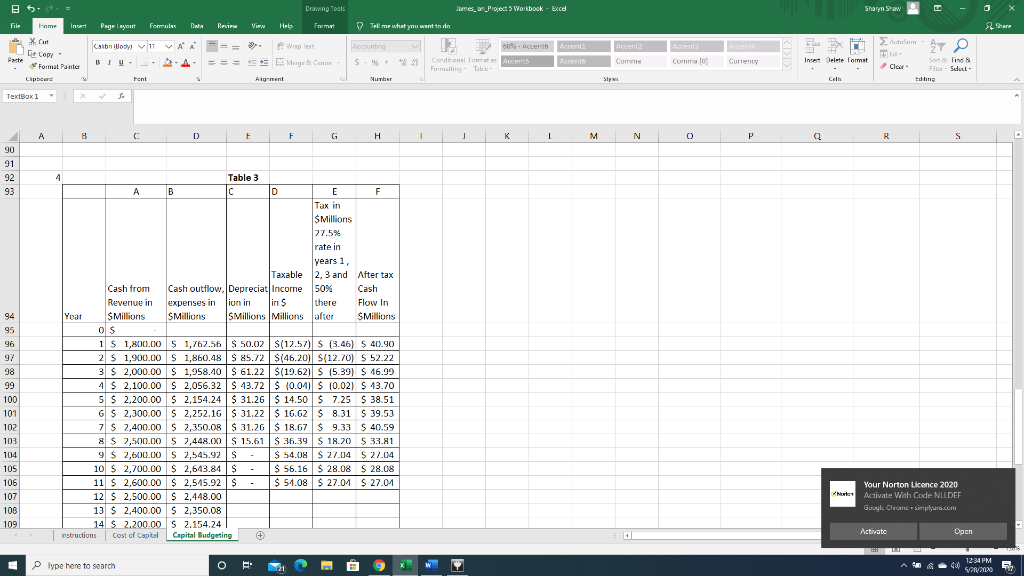

4. The CFO is particularly concerned about the potential impact of future tax increases and that the expenses may have been systematically understated. In order to undertake an objective evaluation of the project's risk, she asks you to prepare a second analysis with a less favorable set of assumptions. She asks, "What would happen to the NPV and IRR calculations if the cash outflow for expenses comes in 2% higher than estimated for the entire life of the project and if the tax rate increases to 50% (combined Federal and Maryland state rates) starting in year 4?" Create an after-tax cash flow timeline for the proposed factory with these new assumptions in Table 3 below.

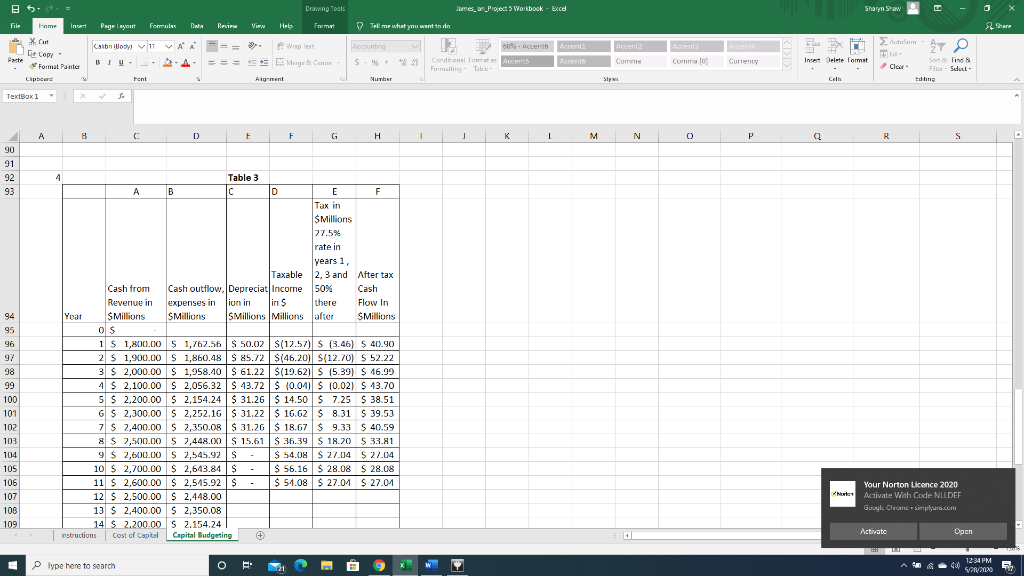

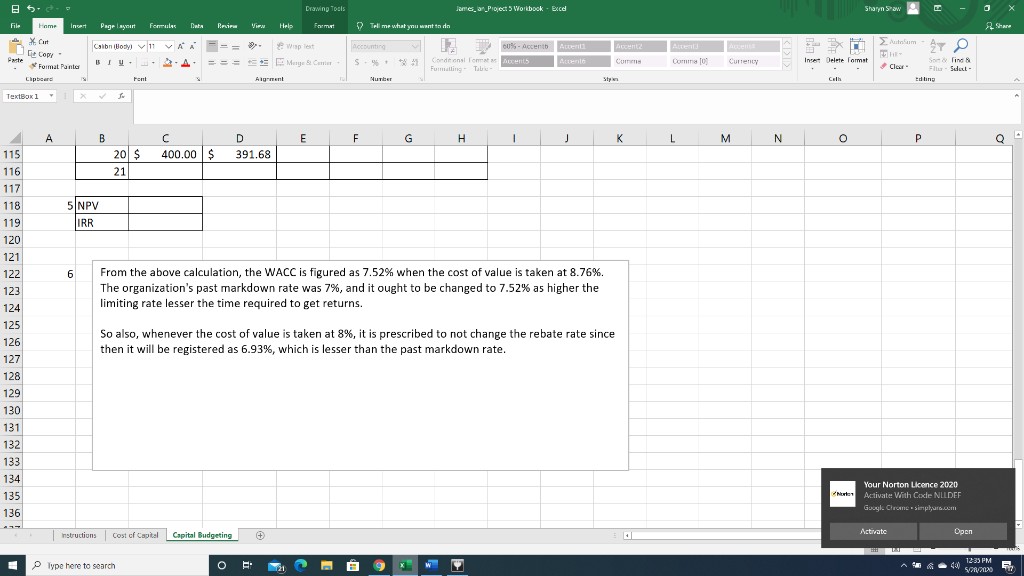

5. Calculate the NPV and IRR using the data from Table 3.

6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the risk and the potential reward of this project for McCormick.

Drawing Tools James Projects Workbook - Excel Sharyn Saw - Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wisplext Accounting Home Incert X. Ort De Copy Paste Format Pantur Chipboard Accent Com Ameri Como U, 2009- Accent Auenta Cordonloat cents Alert Fumaling To * Merge Center == S. Insert Delete commet Currency Cler Solin F-Seat- Edling Fami Algent Number Style Cell TextBox1 1 A B D E F H 1 K L M N F 46 47 Answer Questions Below: 48 49 1 50 51 Year 52 53 54 Table 1 MACRS Depreciation $350 7 Year class Depreciation (in millions) 1 14.29% $ 50.02 2 24.49% $ 85.72 3 17.49% $ 61.22 4 12.49% $ 43.72 5 8.93% $ 31.26 6 8.92% $ 31.22 7 8.93% $ 31.26 8 4.46% $ 15.61 55 56 57 58 59 60 61 2 62 63 Table 2 B D E F Notes Your Norton Lkence 2020 Activate: With Coxle NILDEF Google Chrome simply.com Cash Taxable Tax in After tax Instructions Activate Open Cost of Capital Capital Budgeting Type here to search O F 9 1232 PM 5128/2020 Drawing Tools James Projects Workbook - Excel Sharyn Saw Home Incert Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wsplet Accounting Atvenu X. Ort De Copy Format Pantur Accent Com Ameri Como 27 O ute 60%- Accent Cordons formats S Fummalling To = * Merge Center S. ALTI Curry Insert Delete commet Cler So find F-Seat- Edling Chpber Font Algent Number Style Calh TextBox1 X A B D E IF H 1 - J M N 0 Q P B S Year 64 65 66 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Taxable Tax in After tax Cash from Cash outflow, Depreciat Income Millions Cash Revenue in expenses in ion in in 27.5% Flow In SMillions SMillions SMillions Millions rale SMillions OS 1 $ 1,800.00 $ 1,728.00 $ 50.07 $ 71.99 $ 6.05 5 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72 $ 19.72) $ (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 $ 61.22 $ 18.79 $ 5.17 $ 74.83 1 $ 2,100.00 $ 2,016.00 $ 13.72 | $ 10.29 $ 11.08 $72.92 5 $ 2,200.00 $ 2,112.00$ 31.26 $ 56.75 $ 15.60 $ 72.40 6 $ 2,300.00 $ 2,208.00 $ 31.22 $ 60.78 $ 16.71 $ 75.29 7 $ 2,400.00 $ 2,304.00 $ 31.26 $ 64.75 $ 17.80 $ 78.20 8 $ 2,500.00 $ 2,400.00 $ 15.61 $ 84.39 $ 23.21 $ 76.79 9 $ 2,600.00 $ 2,496.00 ### $ 28.60 $ 75.40 10 $ 2,700.00 $ 2,592.00 ### $ 29.70 $ 78.30 11 S 2,600.00 $ 2,196.00 #### $ 28.60 $ 75.40 12 $ 2.500.00 $ 2,400.00 #### $ 27.50 $ 72.50 13 $ 2,400.00 $ 2,304.00 $ 96.00 $26.40 69.60 14 $ 2,200.00 $ 2,112.00 $ 88.00 $ 24.20 S 63.80 15 $ 2,000.00 $ 1,920.00 $ 80.00 $ 22.00 $ 58.00 16 $ 1,800.00 S 1,728.00 $ 79.00 $ 19.80 5 57.20 1/ $ 1,500.00 $ 1,440.00 $ 60.00 $ 16.50 $ 43.50 18 S 1,200.00 $ 1,152.00 $ 48.00 $ 13.20 $ 34.80 19 S 800.00 $ 768.00 $ 32.00 $ 8.80 $ 23.20 2015 400.00 $ 384.00 $ 16.00 $ 4.40 $ 11.60 21 83 81 85 86 87 Newton Your Norton Licence 2020 Activate: With Coxle NLLDEF Google Chrome simply.com Instructions Cost of Capital Capital Budgeting + Activate Open Type here to search O P 9 12:33 PM 521/2013 Drawing Tools James Projects Workbook - Excel Sharyn Saw - Home Incert Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wraplet Accounting X. Ort De Copy Format Pantur Chipboard 00% Accent Atten Cardens formats Formatting Til Accent Com Paste Awent Como S. Curreny Insert Delete commet Cler Solin F-Seat- Edling Font Algent Number Calh TextBox1 B E 1 K L M N F 81 82 83 D 16 $ 1,800.00 $ 1,728.00 17 $ 1,500.00 $ 1,440.00 18 $ 1,200.00 $ 1,152.00 191 $ 800.00 $ 768.00 20 $ 400.00 $ 384.00 21 F G H $ 72.00 $ 19.80 $ 52.20 $ 60.00 $ 16.50 $ 43.50 $ 48.00 $ 13.20 $ 34.80 $ 32.00 $ 8.80 $ 23.20 $ 16.00 $ 4.40 $ 11.50 84 85 86 87 88 3 NPV IRR 89 90 91 92 4 Table 3 93 A B D E F Tax in $Millions 27.5% rate in years 1, Taxable 2,3 and After tax Deprecia Income 50% Cash Murter Cash outflow, Your Norton Lkonce 2020 Activate: With Coxle NILDEF Google Chrome simply.com Cash from Instructions Activate Capital Budgeting Cost of Capital Open Type here to search O 9 12:33 PM 5/28/20120 Drawing Tools James Projects Workbook - Excel Sharyn Saw Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wraplet Accounting Home Incert X. Ort De Copy Format Pantur Chipboard Accent Com Awent Como 27 O UBAccent Auvenil Cordons formats AS ALTI Fummalling To ute = S. Curry Insert Delete commet Cler So find F-Seat- Edling Font Algent Number Style Calh TextBox1 X A C D F F . - 1 J N 0 B S 90 91 92 93 94 95 96 97 98 99 100 101 102 103 4. Table 3 A B Ic ID E F Tax in SMillions 27.5% rate in years 1, Taxable 2,3 and After tax Cash from Cash outflow, Depreciat Income 50% Cash Revenue in expenses in lion in in $ there Flow In Year SMillions SMillions SMillions Millions after SMillions OS 1 $ 1,800.00 $ 1,762.56 $ 50.02 $(12.57) $ (3.46) $40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 $(46.20) ${12.70) $ 52.22 3 $ 2,000.00 $ 1,958.40 $ 61.22 $(19.62) S (5.39) S 16.99 4 $ 2,100.00 $ 2,056.32 $ 43.72 $ 10.04) $ (0.02) $ 43.70 5 $ 2,200.00 $ 2,154.24 $ 31.26 $ 14.50 $ 7.25 $38.51 G $ 2,300.00 $ 2,252.16 $ 31.22 $ 16.62 $ 8.31 S 39.53 7 $ 2,400.00 $ 2,350.08 $ 31.26 $ 18.67 $ 9.33 $ 40.59 8 $ 7,500.00 $ 7,448.00 $ 15.51 $ 36.39 $18.20 $ 33.81 9 $ 2,600.00 $ 2,545.92 S $ 54.08 $ 27.04 $ 27.04 10 $ 2,700.00 $ 2,643.84S $ 56.16 $ 28.08 S 28.08 11 $ 2,600.00 $ 2,515.92 $ $ 51.08 $ 27.01 $ 27.01 12 $ 2.500.00 $ 2,448.00 13 $ 2,400.00 $ 2,350.08 14 $ 2.200.00 5 2.154.24 Instructions Cost of Capital Capital Budgeting + 104 105 106 107 108 109 Newton Your Norton Licence 2020 Activate With Code NLLDEF Google Chrome simply.com Activate Open Type here to search O E. P 9 12:34 PM 521/21123 Drawing Tools James Projects Workbook - Excel Sharyn Saw - 0 Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA == 9 Wisplext Accounting Home Incert X. Ort De Copy Paste Format Pantur Chpber Accent Com 2008. Accento Atenta Cordons for DLS Fumaling To Ameri Como 27 O S. Currency Insert Delete commet Cler So find Fl-Set- Edling Font Alignment Nu er Style Calh TextBo 1 B E F G 1 j L M N o P Q C 400.00 $ D 391.68 20 $ 21 115 116 117 118 119 120 121 5 NPV IRR 122 6 From the above calculation, the WACC is figured as 7.52% when the cost of value is taken at 8.76%. The organization's past markdown rate was 7%, and it ought to be changed to 7.52% as higher the limiting rate lesser the time required to get returns. So also, whenever the cost of value is taken at 8%, it is prescribed to not change the rebate rate since then it will be registered as 6.93%, which is lesser than the past markdown rate. 123 124 125 126 127 128 129 130 131 132 133 134 135 136 Newton Your Norton Lkonce 2020 Activate With Code NLLDEF Google Chrome simply.com Instructions Cost of Capital Capital Budgeting Activate Open Type here to search O E. 9 x w 1233 PM 521/21123 Drawing Tools James Projects Workbook - Excel Sharyn Saw - Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wisplext Accounting Home Incert X. Ort De Copy Paste Format Pantur Chipboard Accent Com Ameri Como U, 2009- Accent Auenta Cordonloat cents Alert Fumaling To * Merge Center == S. Insert Delete commet Currency Cler Solin F-Seat- Edling Fami Algent Number Style Cell TextBox1 1 A B D E F H 1 K L M N F 46 47 Answer Questions Below: 48 49 1 50 51 Year 52 53 54 Table 1 MACRS Depreciation $350 7 Year class Depreciation (in millions) 1 14.29% $ 50.02 2 24.49% $ 85.72 3 17.49% $ 61.22 4 12.49% $ 43.72 5 8.93% $ 31.26 6 8.92% $ 31.22 7 8.93% $ 31.26 8 4.46% $ 15.61 55 56 57 58 59 60 61 2 62 63 Table 2 B D E F Notes Your Norton Lkence 2020 Activate: With Coxle NILDEF Google Chrome simply.com Cash Taxable Tax in After tax Instructions Activate Open Cost of Capital Capital Budgeting Type here to search O F 9 1232 PM 5128/2020 Drawing Tools James Projects Workbook - Excel Sharyn Saw Home Incert Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wsplet Accounting Atvenu X. Ort De Copy Format Pantur Accent Com Ameri Como 27 O ute 60%- Accent Cordons formats S Fummalling To = * Merge Center S. ALTI Curry Insert Delete commet Cler So find F-Seat- Edling Chpber Font Algent Number Style Calh TextBox1 X A B D E IF H 1 - J M N 0 Q P B S Year 64 65 66 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Taxable Tax in After tax Cash from Cash outflow, Depreciat Income Millions Cash Revenue in expenses in ion in in 27.5% Flow In SMillions SMillions SMillions Millions rale SMillions OS 1 $ 1,800.00 $ 1,728.00 $ 50.07 $ 71.99 $ 6.05 5 65.95 2 $ 1,900.00 $ 1,824.00 $ 85.72 $ 19.72) $ (2.67) $ 78.67 3 $ 2,000.00 $ 1,920.00 $ 61.22 $ 18.79 $ 5.17 $ 74.83 1 $ 2,100.00 $ 2,016.00 $ 13.72 | $ 10.29 $ 11.08 $72.92 5 $ 2,200.00 $ 2,112.00$ 31.26 $ 56.75 $ 15.60 $ 72.40 6 $ 2,300.00 $ 2,208.00 $ 31.22 $ 60.78 $ 16.71 $ 75.29 7 $ 2,400.00 $ 2,304.00 $ 31.26 $ 64.75 $ 17.80 $ 78.20 8 $ 2,500.00 $ 2,400.00 $ 15.61 $ 84.39 $ 23.21 $ 76.79 9 $ 2,600.00 $ 2,496.00 ### $ 28.60 $ 75.40 10 $ 2,700.00 $ 2,592.00 ### $ 29.70 $ 78.30 11 S 2,600.00 $ 2,196.00 #### $ 28.60 $ 75.40 12 $ 2.500.00 $ 2,400.00 #### $ 27.50 $ 72.50 13 $ 2,400.00 $ 2,304.00 $ 96.00 $26.40 69.60 14 $ 2,200.00 $ 2,112.00 $ 88.00 $ 24.20 S 63.80 15 $ 2,000.00 $ 1,920.00 $ 80.00 $ 22.00 $ 58.00 16 $ 1,800.00 S 1,728.00 $ 79.00 $ 19.80 5 57.20 1/ $ 1,500.00 $ 1,440.00 $ 60.00 $ 16.50 $ 43.50 18 S 1,200.00 $ 1,152.00 $ 48.00 $ 13.20 $ 34.80 19 S 800.00 $ 768.00 $ 32.00 $ 8.80 $ 23.20 2015 400.00 $ 384.00 $ 16.00 $ 4.40 $ 11.60 21 83 81 85 86 87 Newton Your Norton Licence 2020 Activate: With Coxle NLLDEF Google Chrome simply.com Instructions Cost of Capital Capital Budgeting + Activate Open Type here to search O P 9 12:33 PM 521/2013 Drawing Tools James Projects Workbook - Excel Sharyn Saw - Home Incert Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wraplet Accounting X. Ort De Copy Format Pantur Chipboard 00% Accent Atten Cardens formats Formatting Til Accent Com Paste Awent Como S. Curreny Insert Delete commet Cler Solin F-Seat- Edling Font Algent Number Calh TextBox1 B E 1 K L M N F 81 82 83 D 16 $ 1,800.00 $ 1,728.00 17 $ 1,500.00 $ 1,440.00 18 $ 1,200.00 $ 1,152.00 191 $ 800.00 $ 768.00 20 $ 400.00 $ 384.00 21 F G H $ 72.00 $ 19.80 $ 52.20 $ 60.00 $ 16.50 $ 43.50 $ 48.00 $ 13.20 $ 34.80 $ 32.00 $ 8.80 $ 23.20 $ 16.00 $ 4.40 $ 11.50 84 85 86 87 88 3 NPV IRR 89 90 91 92 4 Table 3 93 A B D E F Tax in $Millions 27.5% rate in years 1, Taxable 2,3 and After tax Deprecia Income 50% Cash Murter Cash outflow, Your Norton Lkonce 2020 Activate: With Coxle NILDEF Google Chrome simply.com Cash from Instructions Activate Capital Budgeting Cost of Capital Open Type here to search O 9 12:33 PM 5/28/20120 Drawing Tools James Projects Workbook - Excel Sharyn Saw Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA === 9 Wraplet Accounting Home Incert X. Ort De Copy Format Pantur Chipboard Accent Com Awent Como 27 O UBAccent Auvenil Cordons formats AS ALTI Fummalling To ute = S. Curry Insert Delete commet Cler So find F-Seat- Edling Font Algent Number Style Calh TextBox1 X A C D F F . - 1 J N 0 B S 90 91 92 93 94 95 96 97 98 99 100 101 102 103 4. Table 3 A B Ic ID E F Tax in SMillions 27.5% rate in years 1, Taxable 2,3 and After tax Cash from Cash outflow, Depreciat Income 50% Cash Revenue in expenses in lion in in $ there Flow In Year SMillions SMillions SMillions Millions after SMillions OS 1 $ 1,800.00 $ 1,762.56 $ 50.02 $(12.57) $ (3.46) $40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 $(46.20) ${12.70) $ 52.22 3 $ 2,000.00 $ 1,958.40 $ 61.22 $(19.62) S (5.39) S 16.99 4 $ 2,100.00 $ 2,056.32 $ 43.72 $ 10.04) $ (0.02) $ 43.70 5 $ 2,200.00 $ 2,154.24 $ 31.26 $ 14.50 $ 7.25 $38.51 G $ 2,300.00 $ 2,252.16 $ 31.22 $ 16.62 $ 8.31 S 39.53 7 $ 2,400.00 $ 2,350.08 $ 31.26 $ 18.67 $ 9.33 $ 40.59 8 $ 7,500.00 $ 7,448.00 $ 15.51 $ 36.39 $18.20 $ 33.81 9 $ 2,600.00 $ 2,545.92 S $ 54.08 $ 27.04 $ 27.04 10 $ 2,700.00 $ 2,643.84S $ 56.16 $ 28.08 S 28.08 11 $ 2,600.00 $ 2,515.92 $ $ 51.08 $ 27.01 $ 27.01 12 $ 2.500.00 $ 2,448.00 13 $ 2,400.00 $ 2,350.08 14 $ 2.200.00 5 2.154.24 Instructions Cost of Capital Capital Budgeting + 104 105 106 107 108 109 Newton Your Norton Licence 2020 Activate With Code NLLDEF Google Chrome simply.com Activate Open Type here to search O E. P 9 12:34 PM 521/21123 Drawing Tools James Projects Workbook - Excel Sharyn Saw - 0 Page 1 Formule Data Beiru Viru Hels Format Tell me what you want to do Share Autom Calon Body 11 WA == 9 Wisplext Accounting Home Incert X. Ort De Copy Paste Format Pantur Chpber Accent Com 2008. Accento Atenta Cordons for DLS Fumaling To Ameri Como 27 O S. Currency Insert Delete commet Cler So find Fl-Set- Edling Font Alignment Nu er Style Calh TextBo 1 B E F G 1 j L M N o P Q C 400.00 $ D 391.68 20 $ 21 115 116 117 118 119 120 121 5 NPV IRR 122 6 From the above calculation, the WACC is figured as 7.52% when the cost of value is taken at 8.76%. The organization's past markdown rate was 7%, and it ought to be changed to 7.52% as higher the limiting rate lesser the time required to get returns. So also, whenever the cost of value is taken at 8%, it is prescribed to not change the rebate rate since then it will be registered as 6.93%, which is lesser than the past markdown rate. 123 124 125 126 127 128 129 130 131 132 133 134 135 136 Newton Your Norton Lkonce 2020 Activate With Code NLLDEF Google Chrome simply.com Instructions Cost of Capital Capital Budgeting Activate Open Type here to search O E. 9 x w 1233 PM 521/21123