As you see I chose Activision Blizzard, Capital one, Exxon Mobil, Starbucks, Timberland companies. So you should continue working with them.

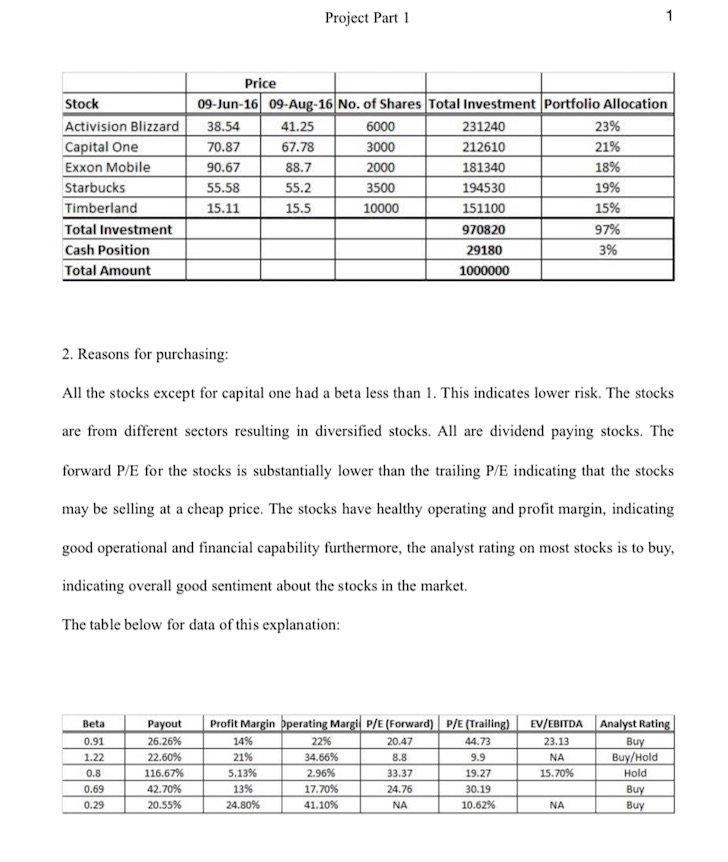

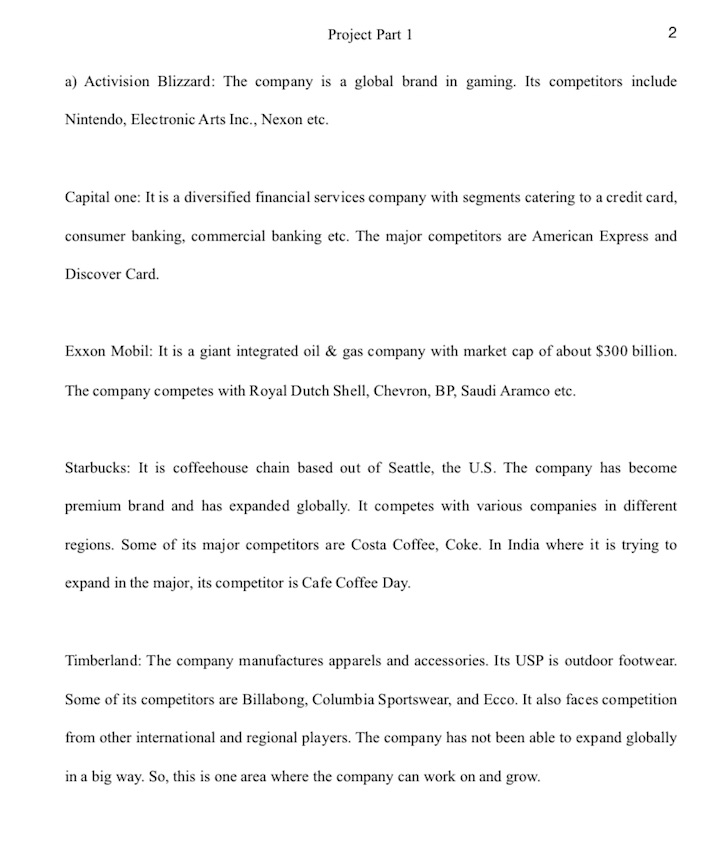

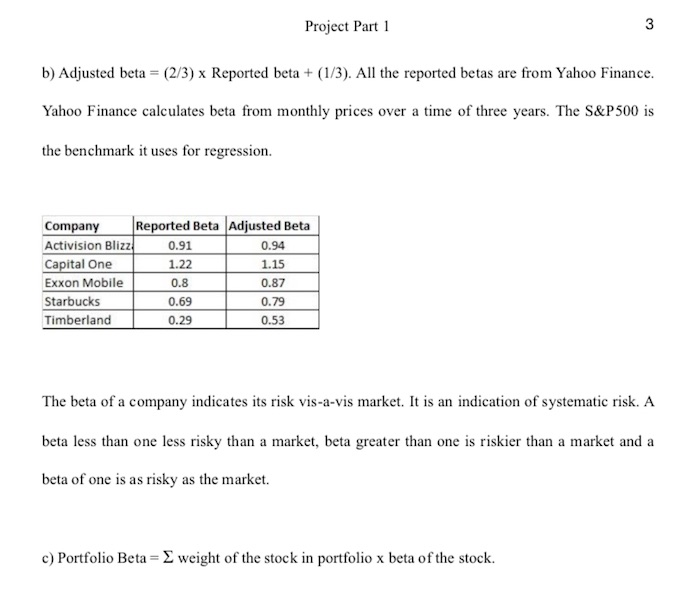

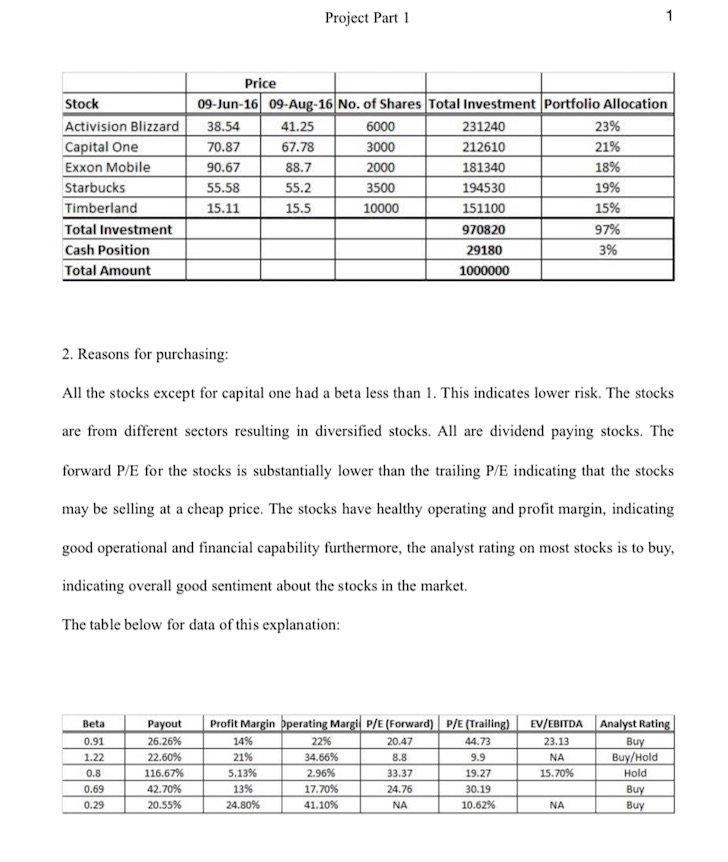

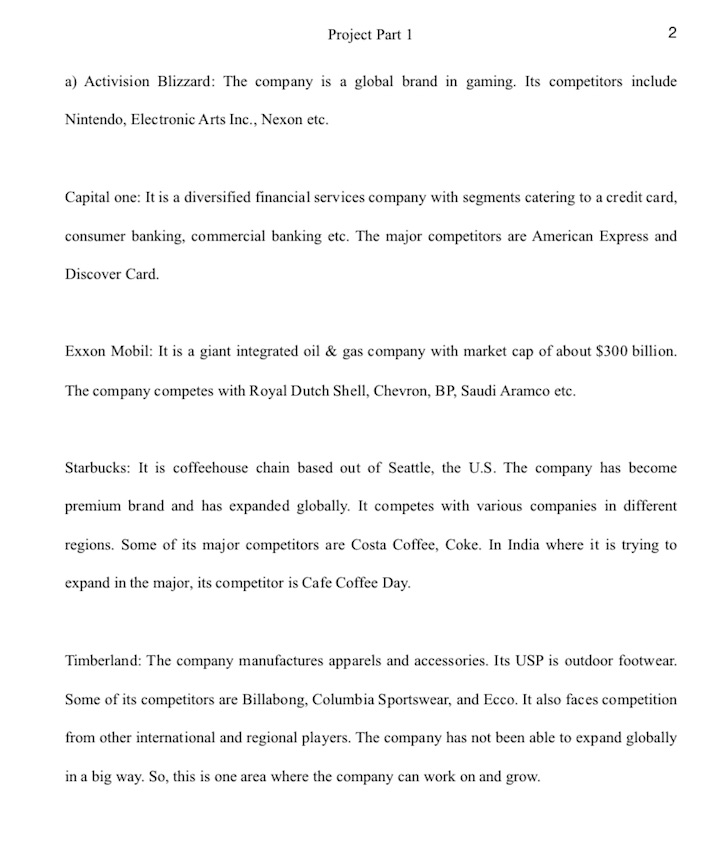

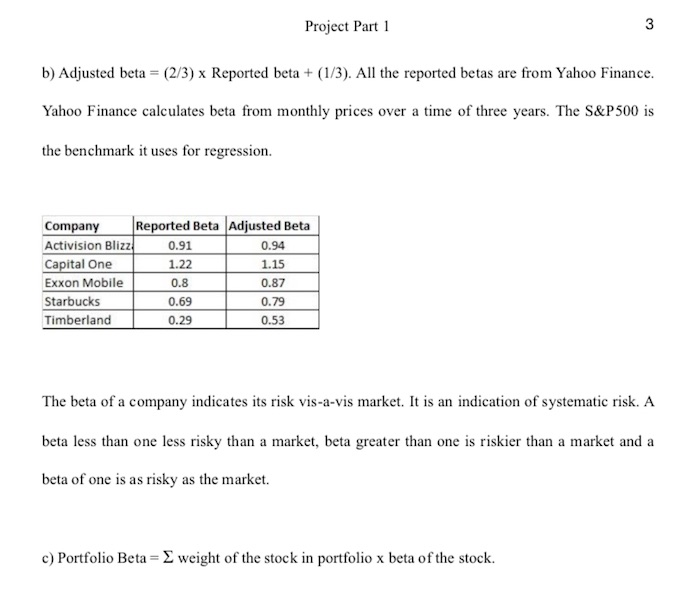

Work on Project Part 4 Project Part 4, Final Project Submission: Assessment of your portfolio. Due: Thursday of week 14, 12/06/2018 (This Part is of 40% of your Project grade) For this Part, you will be making a report to your investment committee that discusses and summarizes the performance of your stock portfolio. Use closing prices as of Thursday of Week 13, November 29, to calculate your returns. What is the final market value of your portfolio (including dividends received and added to non-interest earning cash)? If the final market value of your portfolio is less than 1,000,000, your portfolio lost money Provide a graph of the daily stock prices (high, low, and closing) for each of your stocks. Include the volume on each graph, with the scale shown on the right side of the graph. Be sure to label the graphs! Provide a graph of the value of your portfolio and the value of the closing S&P 500 if $1,000,000 were invested in that initially. This is the normalized value. By normalized, you have scaled the S&P 500 closing prices so that its price on the first day ($1,000,000) is the same as the portfolio's closing price on that first day In the final section of your report, recommend for or against the inclusion of each of these stocks in the portfolio and defend your recommendation. Use the information you have obtained in Part B to support your argument. Calculations: Use the closing price of your stocks on Thursday of Week 13, November 29, to calculate your returns. 1. Report the "purchase" and "sale" price of your stocks from the beginning and end of the semester along with any dividends you might have received. Calculate the buy and-hold return of each stock [(MVend - MVbeginning+ DIV) / MVbeginningl and the buy-and-hold return on your portfolio. 2. Determine the final market value of your portfolio (including dividends received). If the final market value of your portfolio is less than $1,000,000, your investment lost money. 3. Calculate the market value of a. Your portfolio for each day (including cash). suggest that you do this by adding up the daily closing market values of your assets held and the cash you hold, including the total dividends received up to date b. The S&P 500 index portfolio over this same period assuming you keep the same amount in cash. We are using the S&P 500 index as our proxy for the market. 4, plot the daily market value of your portfolio and the daily market value of the S&P 500 using your calculations in #3. 5. Using the market values you calculated in #3, calculate the daily returns (percent) for a. your portfolio b. The S&P 500 index portfolio. 6. Using your calculations in #5, calculate a. The average daily return and the standard deviation of daily returns for both the S&P S00 index and your portfolio b. your portfolio's beta by calculating the covariance of your portfolio's daily returns with the S&P 500's daily returns and dividing that by the variance of the S&P 500 Write-up: Assume that you are preparing a relatively short report (maximum of 10 pages double-spaced) for your investment committee. You will be graded on the quality of your writing as well as the quality of your analysis. Do not simply answer the following questions-this should be financial report! These questions are intended to provide guidance. 1. Introduction 2. Comment on the individual and portfolio returns and on any information/events (market-wide or firm-specific) that may have contributed to the performance of your stocks. Describe and explain any trades you made. (Suggested length: a short, concise 3. From your calculations, if you held the S&P 500 instead of your stocks, how much money would you have ended up with? Would 4. Based on your calculations for standard deviation and beta, how risky was your portfolio compared to the index? Again, analyze 5. Finally, what are your plans going forward? That is, if this class continued and you had the chance to alter your portfolio holdings paragraph for each stock). you have been better or worse off to hold the index? Analyze the reasons for any differences. the causes of the differences. now, would you choose to sell any of your stocks or would you want to keep holding them? What will you tell the investment committee? Be explicit. Deliverables: 1. Your report (8-10 pages double-spaced, 12 pt. font) plus graphs. 2. Spreadsheet of returns and calculations, and market value plot 2-pages maximum make it neat and readable Project Part 1 Price Stock Activision Blizzar Capital One Exxon Mobile Starbucks Timberland Total Investment Cash Position Total Amount 09-Jun-16 09-Aug-16 No. of Shares Total Investment Portfolio Allocation 38.54 70.87 90.67 55.58 15.11 41.25 67.78 88.7 55.2 15.5 6000 3000 2000 3500 10000 231240 212610 181340 194530 151100 970820 29180 1000000 23% 21% 18% 19% 15% 97% 3% 2. Reasons for purchasing All the stocks except for capital one had a beta less than 1. This indicates lower risk. The stocks are from different sectors resulting in diversified stocks. All are dividend paying stocks. The forward P/E for the stocks is substantially lower than the trailing P/E indicating that the stocks may be selling at a cheap price. The stocks have healthy operating and profit margin, indicating good operational and financial capability furthermore, the analyst rating on most stocks is to buy, indicating overall good sentiment about the stocks in the market The table below for data of this explanation Beta 0.91 1.22 0.8 0.69 0.29 Pa 26.26% 22.60% 116.67% 42.70% 20.55% rating Margi P/E (Forward) P/E (Trailing) EV/EBITDA Analyst Rati 44.73 9.9 19.27 30.19 10.62% Profit 14% 21% 5.13% 13% 24.80% 22% 34.66% 2.96% 17.70% 41.10% 20.47 8.8 33.37 24.76 NA 23.13 NA 15.70% /Hold Hold NA Project Part 1 2 a) Activision Blizzard: The company is a global brand in gaming. Its competitors include Nintendo, Electronic Arts Inc., Nexon etc. Capital one: It is a diversified financial services company with segments catering to a credit card, consumer banking, commercial banking etc. The major competitors are American Express and Discover Card. Exxon Mobil: It is a giant integrated oil & gas company with market cap of about $300 billion. The company competes with Royal Dutch Shell, Chevron, BP, Saudi Aramco etc. Starbucks: I is coffeehouse chain based out of Seattle, the U.S. The company has become premium brand and has expanded globally. It competes with various companies in different regions. Some of its major competitors are Costa Coffee, Coke. In India where it is trying to expand in the major, ts competitor is Cafe Coffee Day. Timberland: The company manufactures apparels and accessories. Its USP is outdoor footwear. Some of its competitors are Billabong, Columbia Sportswear, and Ecco. It also faces competition from other international and regional players. The company has not been able to expand globally in a big way. So, this is one area where the company can work on and grow. Project Part 1 b) Adjusted beta (2/3) x Reported beta + 1/3 All the reported betas are from Yahoo Finance Yahoo Finance calculates beta from monthly prices over a time of three years. The S&P500 is the benchmark it uses for regression Company Reported Beta Adjusted Beta Activision Blizz Capital One Exxon Mobile Starbucks Timberland 0.91 1.22 0.8 0.69 0.29 0.94 1.15 0.87 0.79 0.53 The beta of a company indicates its risk vis-a-vis market. It is an indication of systematic risk. A beta less than one less risky than a market, beta greater than one is riskier than a market and a beta of one is as risky as the market. c) Portfolio Beta- weight of the stock in portfolio x beta of the stock. Work on Project Part 4 Project Part 4, Final Project Submission: Assessment of your portfolio. Due: Thursday of week 14, 12/06/2018 (This Part is of 40% of your Project grade) For this Part, you will be making a report to your investment committee that discusses and summarizes the performance of your stock portfolio. Use closing prices as of Thursday of Week 13, November 29, to calculate your returns. What is the final market value of your portfolio (including dividends received and added to non-interest earning cash)? If the final market value of your portfolio is less than 1,000,000, your portfolio lost money Provide a graph of the daily stock prices (high, low, and closing) for each of your stocks. Include the volume on each graph, with the scale shown on the right side of the graph. Be sure to label the graphs! Provide a graph of the value of your portfolio and the value of the closing S&P 500 if $1,000,000 were invested in that initially. This is the normalized value. By normalized, you have scaled the S&P 500 closing prices so that its price on the first day ($1,000,000) is the same as the portfolio's closing price on that first day In the final section of your report, recommend for or against the inclusion of each of these stocks in the portfolio and defend your recommendation. Use the information you have obtained in Part B to support your argument. Calculations: Use the closing price of your stocks on Thursday of Week 13, November 29, to calculate your returns. 1. Report the "purchase" and "sale" price of your stocks from the beginning and end of the semester along with any dividends you might have received. Calculate the buy and-hold return of each stock [(MVend - MVbeginning+ DIV) / MVbeginningl and the buy-and-hold return on your portfolio. 2. Determine the final market value of your portfolio (including dividends received). If the final market value of your portfolio is less than $1,000,000, your investment lost money. 3. Calculate the market value of a. Your portfolio for each day (including cash). suggest that you do this by adding up the daily closing market values of your assets held and the cash you hold, including the total dividends received up to date b. The S&P 500 index portfolio over this same period assuming you keep the same amount in cash. We are using the S&P 500 index as our proxy for the market. 4, plot the daily market value of your portfolio and the daily market value of the S&P 500 using your calculations in #3. 5. Using the market values you calculated in #3, calculate the daily returns (percent) for a. your portfolio b. The S&P 500 index portfolio. 6. Using your calculations in #5, calculate a. The average daily return and the standard deviation of daily returns for both the S&P S00 index and your portfolio b. your portfolio's beta by calculating the covariance of your portfolio's daily returns with the S&P 500's daily returns and dividing that by the variance of the S&P 500 Write-up: Assume that you are preparing a relatively short report (maximum of 10 pages double-spaced) for your investment committee. You will be graded on the quality of your writing as well as the quality of your analysis. Do not simply answer the following questions-this should be financial report! These questions are intended to provide guidance. 1. Introduction 2. Comment on the individual and portfolio returns and on any information/events (market-wide or firm-specific) that may have contributed to the performance of your stocks. Describe and explain any trades you made. (Suggested length: a short, concise 3. From your calculations, if you held the S&P 500 instead of your stocks, how much money would you have ended up with? Would 4. Based on your calculations for standard deviation and beta, how risky was your portfolio compared to the index? Again, analyze 5. Finally, what are your plans going forward? That is, if this class continued and you had the chance to alter your portfolio holdings paragraph for each stock). you have been better or worse off to hold the index? Analyze the reasons for any differences. the causes of the differences. now, would you choose to sell any of your stocks or would you want to keep holding them? What will you tell the investment committee? Be explicit. Deliverables: 1. Your report (8-10 pages double-spaced, 12 pt. font) plus graphs. 2. Spreadsheet of returns and calculations, and market value plot 2-pages maximum make it neat and readable Project Part 1 Price Stock Activision Blizzar Capital One Exxon Mobile Starbucks Timberland Total Investment Cash Position Total Amount 09-Jun-16 09-Aug-16 No. of Shares Total Investment Portfolio Allocation 38.54 70.87 90.67 55.58 15.11 41.25 67.78 88.7 55.2 15.5 6000 3000 2000 3500 10000 231240 212610 181340 194530 151100 970820 29180 1000000 23% 21% 18% 19% 15% 97% 3% 2. Reasons for purchasing All the stocks except for capital one had a beta less than 1. This indicates lower risk. The stocks are from different sectors resulting in diversified stocks. All are dividend paying stocks. The forward P/E for the stocks is substantially lower than the trailing P/E indicating that the stocks may be selling at a cheap price. The stocks have healthy operating and profit margin, indicating good operational and financial capability furthermore, the analyst rating on most stocks is to buy, indicating overall good sentiment about the stocks in the market The table below for data of this explanation Beta 0.91 1.22 0.8 0.69 0.29 Pa 26.26% 22.60% 116.67% 42.70% 20.55% rating Margi P/E (Forward) P/E (Trailing) EV/EBITDA Analyst Rati 44.73 9.9 19.27 30.19 10.62% Profit 14% 21% 5.13% 13% 24.80% 22% 34.66% 2.96% 17.70% 41.10% 20.47 8.8 33.37 24.76 NA 23.13 NA 15.70% /Hold Hold NA Project Part 1 2 a) Activision Blizzard: The company is a global brand in gaming. Its competitors include Nintendo, Electronic Arts Inc., Nexon etc. Capital one: It is a diversified financial services company with segments catering to a credit card, consumer banking, commercial banking etc. The major competitors are American Express and Discover Card. Exxon Mobil: It is a giant integrated oil & gas company with market cap of about $300 billion. The company competes with Royal Dutch Shell, Chevron, BP, Saudi Aramco etc. Starbucks: I is coffeehouse chain based out of Seattle, the U.S. The company has become premium brand and has expanded globally. It competes with various companies in different regions. Some of its major competitors are Costa Coffee, Coke. In India where it is trying to expand in the major, ts competitor is Cafe Coffee Day. Timberland: The company manufactures apparels and accessories. Its USP is outdoor footwear. Some of its competitors are Billabong, Columbia Sportswear, and Ecco. It also faces competition from other international and regional players. The company has not been able to expand globally in a big way. So, this is one area where the company can work on and grow. Project Part 1 b) Adjusted beta (2/3) x Reported beta + 1/3 All the reported betas are from Yahoo Finance Yahoo Finance calculates beta from monthly prices over a time of three years. The S&P500 is the benchmark it uses for regression Company Reported Beta Adjusted Beta Activision Blizz Capital One Exxon Mobile Starbucks Timberland 0.91 1.22 0.8 0.69 0.29 0.94 1.15 0.87 0.79 0.53 The beta of a company indicates its risk vis-a-vis market. It is an indication of systematic risk. A beta less than one less risky than a market, beta greater than one is riskier than a market and a beta of one is as risky as the market. c) Portfolio Beta- weight of the stock in portfolio x beta of the stock