Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As you're preparing to leave and get to work on the memo, adjusting entries, and financial statements, Josh remembers something else he'd like help

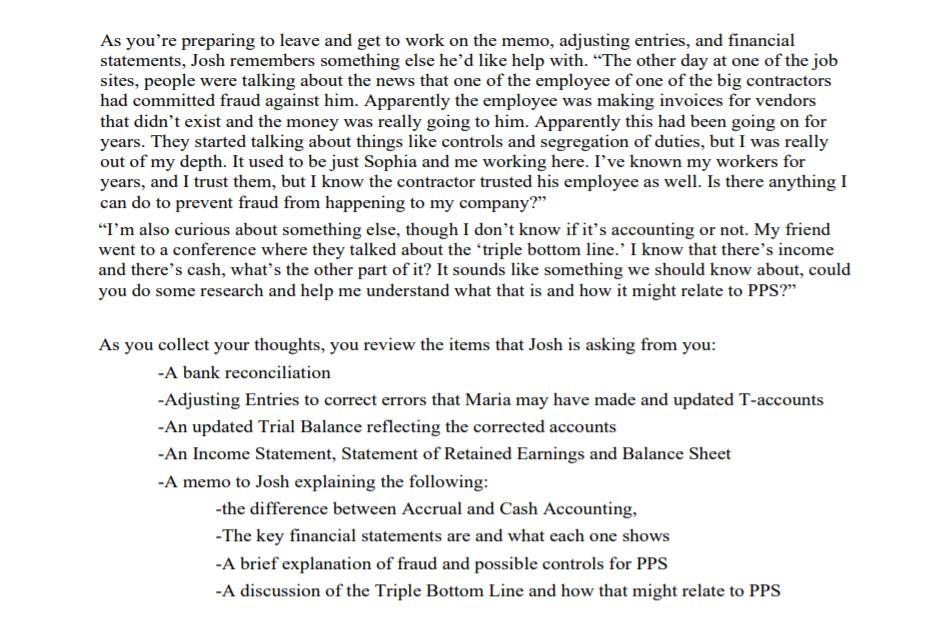

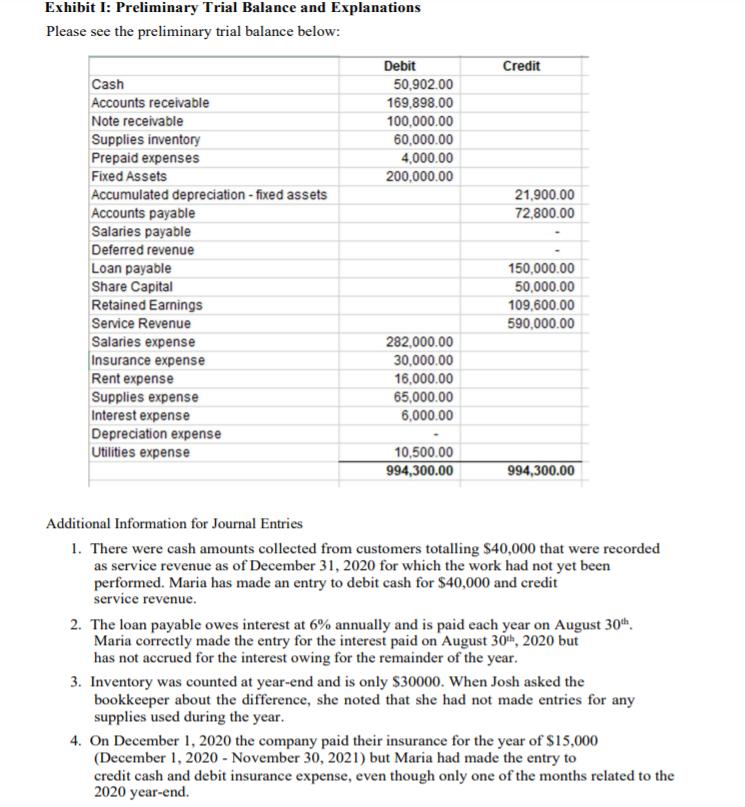

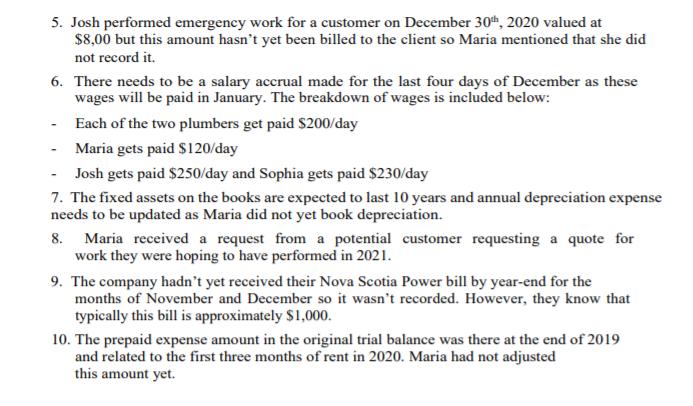

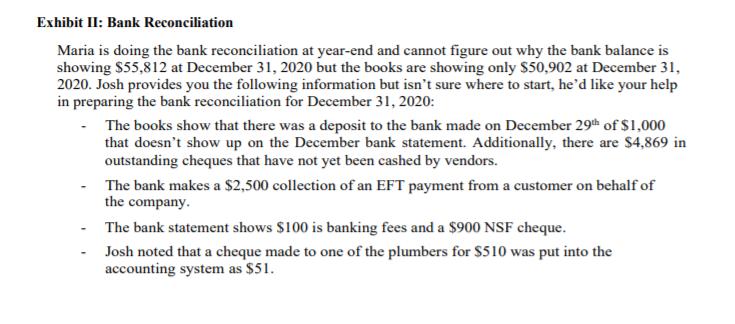

As you're preparing to leave and get to work on the memo, adjusting entries, and financial statements, Josh remembers something else he'd like help with. "The other day at one of the job sites, people were talking about the news that one of the employee of one of the big contractors had committed fraud against him. Apparently the employee was making invoices for vendors that didn't exist and the money was really going to him. Apparently this had been going on for years. They started talking about things like controls and segregation of duties, but I was really out of my depth. It used to be just Sophia and me working here. I've known my workers for years, and I trust them, but I know the contractor trusted his employee as well. Is there anything I can do to prevent fraud from happening to my company?" "I'm also curious about something else, though I don't know if it's accounting or not. My friend went to a conference where they talked about the 'triple bottom line.' I know that there's income and there's cash, what's the other part of it? It sounds like something we should know about, could you do some research and help me understand what that is and how it might relate to PPS?" As you collect your thoughts, you review the items that Josh is asking from you: -A bank reconciliation -Adjusting Entries to correct errors that Maria may have made and updated T-accounts -An updated Trial Balance reflecting the corrected accounts -An Income Statement, Statement of Retained Earnings and Balance Sheet -A memo to Josh explaining the following: -the difference between Accrual and Cash Accounting, -The key financial statements are and what each one shows -A brief explanation of fraud and possible controls for PPS -A discussion of the Triple Bottom Line and how that might relate to PPS Exhibit I: Preliminary Trial Balance and Explanations Please see the preliminary trial balance below: Cash Accounts receivable Note receivable Supplies inventory Prepaid expenses Fixed Assets Accumulated depreciation - fixed assets Accounts payable Salaries payable Deferred revenue Loan payable Share Capital Retained Earnings Service Revenue Salaries expense Insurance expense Rent expense Supplies expense Interest expense Depreciation expense Utilities expense Debit 50,902.00 169,898.00 100,000.00 60,000.00 4,000.00 200,000.00 282,000.00 30,000.00 16,000.00 65,000.00 6,000.00 10,500.00 994,300.00 Credit 21,900.00 72,800.00 150,000.00 50,000.00 109,600.00 590,000.00 994,300.00 Additional Information for Journal Entries 1. There were cash amounts collected from customers totalling $40,000 that were recorded as service revenue as of December 31, 2020 for which the work had not yet been performed. Maria has made an entry to debit cash for $40,000 and credit service revenue. 2. The loan payable owes interest at 6% annually and is paid each year on August 30th Maria correctly made the entry for the interest paid on August 30th, 2020 but has not accrued for the interest owing for the remainder of the year. 3. Inventory was counted at year-end and is only $30000. When Josh asked the bookkeeper about the difference, she noted that she had not made entries for any supplies used during the year. 4. On December 1, 2020 the company paid their insurance for the year of $15,000 (December 1, 2020 - November 30, 2021) but Maria had made the entry to credit cash and debit insurance expense, even though only one of the months related to the 2020 year-end. 5. Josh performed emergency work for a customer on December 30th, 2020 valued at $8,00 but this amount hasn't yet been billed to the client so Maria mentioned that she did not record it. 6. There needs to be a salary accrual made for the last four days of December as these wages will be paid in January. The breakdown of wages is included below: Each of the two plumbers get paid $200/day Maria gets paid $120/day - Josh gets paid $250/day and Sophia gets paid $230/day 7. The fixed assets on the books are expected to last 10 years and annual depreciation expense needs to be updated as Maria did not yet book depreciation. 8. Maria received a request from a potential customer requesting a quote for work they were hoping to have performed in 2021. 9. The company hadn't yet received their Nova Scotia Power bill by year-end for the months of November and December so it wasn't recorded. However, they know that typically this bill is approximately $1,000. 10. The prepaid expense amount in the original trial balance was there at the end of 2019 and related to the first three months of rent in 2020. Maria had not adjusted this amount yet. Exhibit II: Bank Reconciliation Maria is doing the bank reconciliation at year-end and cannot figure out why the bank balance is showing $55,812 at December 31, 2020 but the books are showing only $50,902 at December 31, 2020. Josh provides you the following information but isn't sure where to start, he'd like your help in preparing the bank reconciliation for December 31, 2020: The books show that there was a deposit to the bank made on December 29th of $1,000 that doesn't show up on the December bank statement. Additionally, there are $4,869 in outstanding cheques that have not yet been cashed by vendors. The bank makes a $2,500 collection of an EFT payment from a customer on behalf of the company. The bank statement shows $100 is banking fees and a $900 NSF cheque. Josh noted that a cheque made to one of the plumbers for $510 was put into the accounting system as $51.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Bank Reconciliation Statement Bank Reconciliation Statement As on December 31 2020 Description Amount Amount Balance as Per Cash Book on Dec 31 2020 50902 Adjustments Add Outstanding Cheques 4869 Ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started