asap

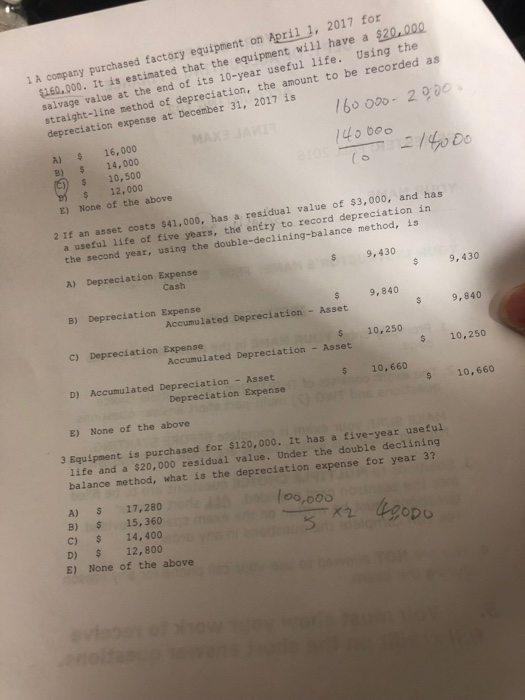

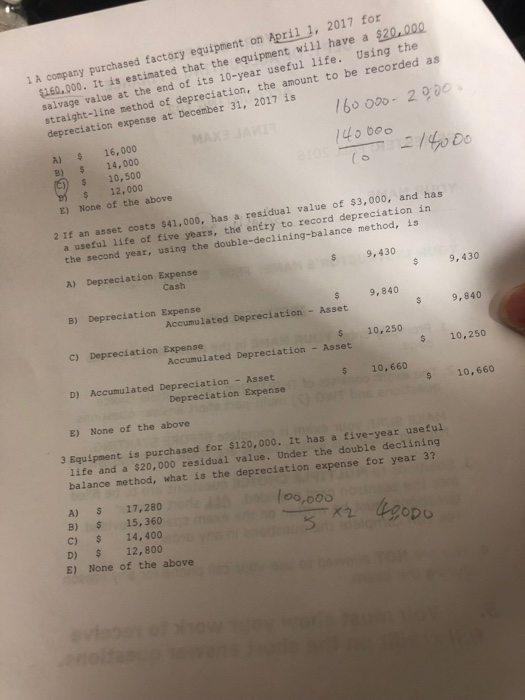

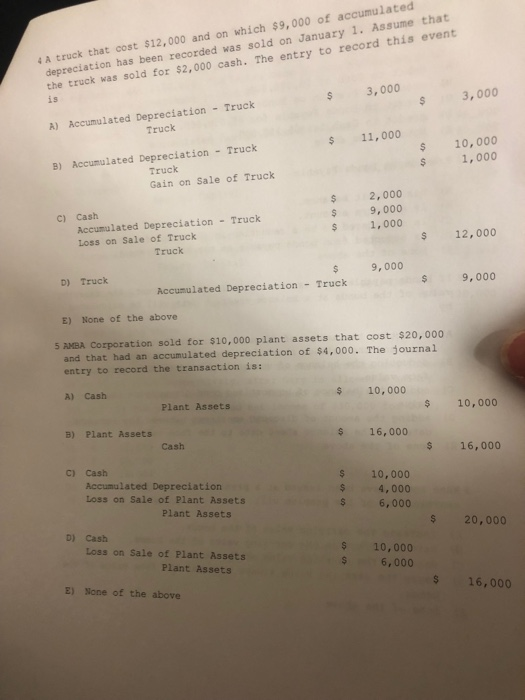

1 A company purchased factory equipment on April 1, 2017 for salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2017 is $160.000. It is estimated that the equipment will have a $20,000 160000-29 to boo A) 16,000 B) $14,000 Do s 10,500 s 12,000 E) None of the above 2 If an asset costs $41,000, has a residual value of s3,000, and has a useful life of tive years, the entry to record depreciation in the second year, using the double-declining-balance method, is A) Depreciation Expense 9, 430 Cash $9,430 B) Depreciation Expense $ 9,840 Accumulated Depreciation Asset $ 9,840 C) Depreciation Expense s 10,250 Accumulated Depreciation Asset $ 10,250 D) Accumulated Depreciation - Asset 10, 660 Depreciation Expense 10,660 E) None of the above 3 Equipment is purchased for $120,000. It has a five-year useful life and a $20,000 residual value. Under the double declining balance method, what is the depreciation expense for year 32 A) $17,280 B) 15, 360 C) s 14,400 D) 12,800 oo,00o x2 5 E) None of the above anuary 1. Assume that depreciation has been recorded was sold on J the truck was sold for $2,00 i s hat cost $12,000 and on which $9,000 of accumulated 4 A truck t 0 cash. The entry to record this event $ 3,000 $ 3,000 A) Accumulated Depreciation Truck Truck $ 11,000 s 10,000 $ 1,000 B) Accumulated Depreciation Truck Truck Gain on Sale of Truck $ 2,000 $ 9,000 $ 1,000 C) Cash Accumulated Depreciation Truck Loss on Sale of Truck s 12,000 Truck D) Truck $ 9,000 Accunulated Depreciation Truck $9,000 E) None of the above 5 AMBA Corporation sold for $10, 000 plant assets that cost $20,000 and that had an accumulated depreciation of $4,000. The journal entry to record the transaction is: A) Cash s 10,000 s16,000 $ 10,000 Plant Assets $ 10,000 B) Plant Assets Cash 16,000 ci Cash Accunulated Depreciation Loss on Sale of Plant Assets $ 4,000 6,000 Plant Assets D) Cash s 20,000 Loss on Sale of Plant Assets s 10,000 $ 6,000 Plant Assets E) None of the above s 16,000