ASAP

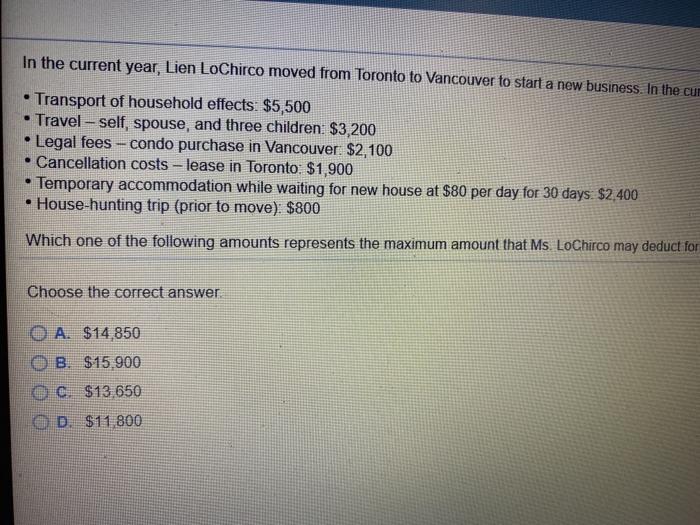

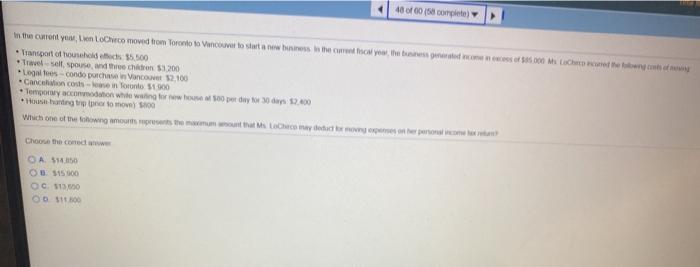

18 of 60 158 complete) in the current you in the moved from Toronto Vance to start when your pred 5.000 M Chow Transport of households 55.500 Trusell Spouse, and the chatron 53200 Logates-condo purchase Von 12.100 Cancion con los 500 Tempo y cotion when the per day to da 2.400 Hoshanting trip to move 100 Which one of the town ons Choose the core www A540 OD 515 000 OC 513 OD 5110 In the current year, Lien LoChirco moved from Toronto to Vancouver to start a new business. In the cur . Transport of household effects: $5,500 Travel - self, spouse, and three children: $3,200 Legal fees - condo purchase in Vancouver: $2,100 Cancellation costs - lease in Toronto: $1,900 Temporary accommodation while waiting for new house at $80 per day for 30 days: $2,400 House-hunting trip (prior to move): $800 Which one of the following amounts represents the maximum amount that Ms. LoChirco may deduct for Choose the correct answer A. $14,850 O B. $15.900 0 $13,650 D. $11 800 Cancel Ent fiscal year, the business generated income in excess of $85,000. Ms. LoChirco incurred the folowing costs of moving moving expenses on her personal income tax return? 18 of 60 158 complete) in the current you in the moved from Toronto Vance to start when your pred 5.000 M Chow Transport of households 55.500 Trusell Spouse, and the chatron 53200 Logates-condo purchase Von 12.100 Cancion con los 500 Tempo y cotion when the per day to da 2.400 Hoshanting trip to move 100 Which one of the town ons Choose the core www A540 OD 515 000 OC 513 OD 5110 In the current year, Lien LoChirco moved from Toronto to Vancouver to start a new business. In the cur . Transport of household effects: $5,500 Travel - self, spouse, and three children: $3,200 Legal fees - condo purchase in Vancouver: $2,100 Cancellation costs - lease in Toronto: $1,900 Temporary accommodation while waiting for new house at $80 per day for 30 days: $2,400 House-hunting trip (prior to move): $800 Which one of the following amounts represents the maximum amount that Ms. LoChirco may deduct for Choose the correct answer A. $14,850 O B. $15.900 0 $13,650 D. $11 800 Cancel Ent fiscal year, the business generated income in excess of $85,000. Ms. LoChirco incurred the folowing costs of moving moving expenses on her personal income tax return

ASAP

ASAP