Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASAP! 36. For a car with a cost basis of $35,000 and a salvage value of $5,000, what would the annual depreciation expense be. using

ASAP!

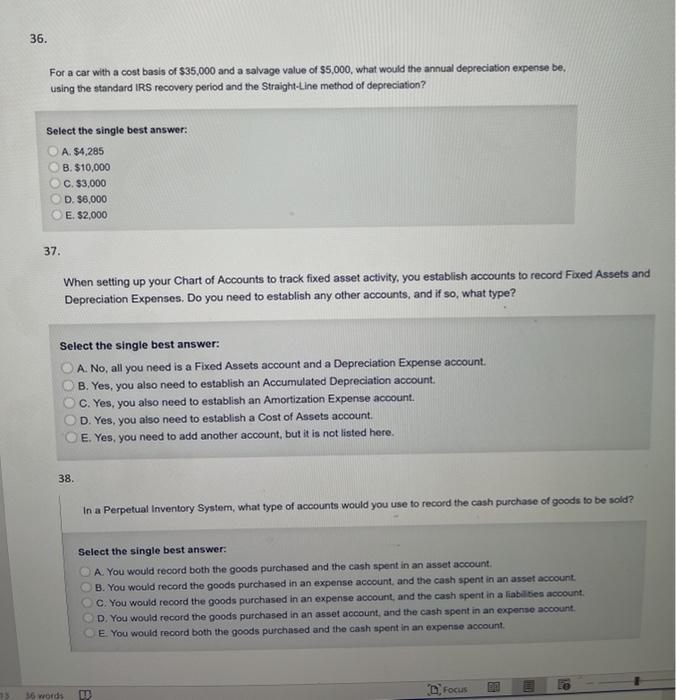

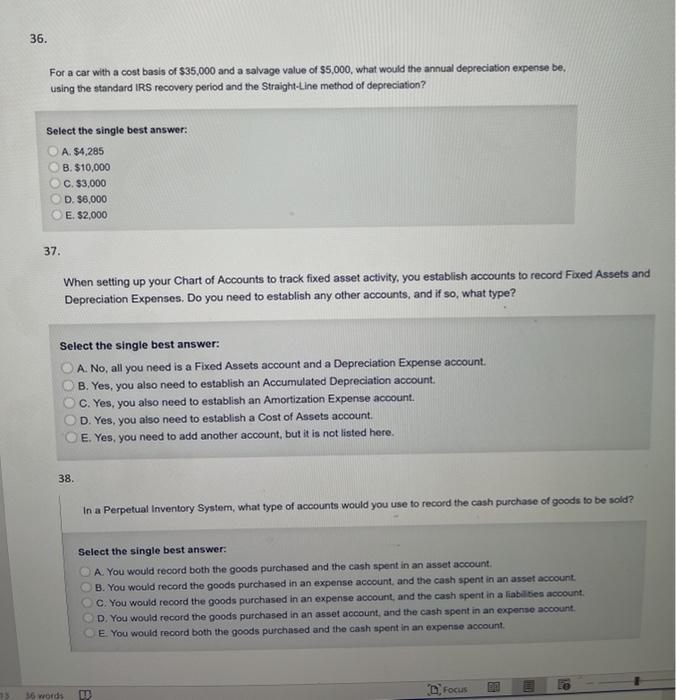

36. For a car with a cost basis of $35,000 and a salvage value of $5,000, what would the annual depreciation expense be. using the standard IRS recovery period and the Straight-Line method of depreciation? Select the single best answer: A. $4,285 B. $10,000 C. $3,000 D. $6,000 E $2,000 37. When setting up your Chart of Accounts to track fixed asset activity, you establish accounts to record Fixed Assets and Depreciation Expenses. Do you need to establish any other accounts, and if so, what type? Select the single best answer: A. No, all you need is a Fixed Assets account and a Depreciation Expense account. B. Yes, you also need to establish an Accumulated Depreciation account. C. Yes, you also need to establish an Amortization Expense account. D. Yes, you also need to establish a Cost of Assets account E. Yes, you need to add another account, but it is not listed here 38 In a Perpetual Inventory System, what type of accounts would you use to record the cash purchase of goods to be sold? Select the single best answer: A. You would record both the goods purchased and the cash spent in an asset account. B. You would record the goods purchased in an expense account, and the cash spent in an asset account C. You would record the goods purchased in an expense account, and the cash spent in a liabilities account, D. You would record the goods purchased in an asset account, and the cash spent in an expense account. E. You would record both the goods purchased and the cash spent in an expense account. D. Focus 36 words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started