ASAP HELP NEEDED,

THERE ARE A COUPLE OF PARTS TO THE QUESTION

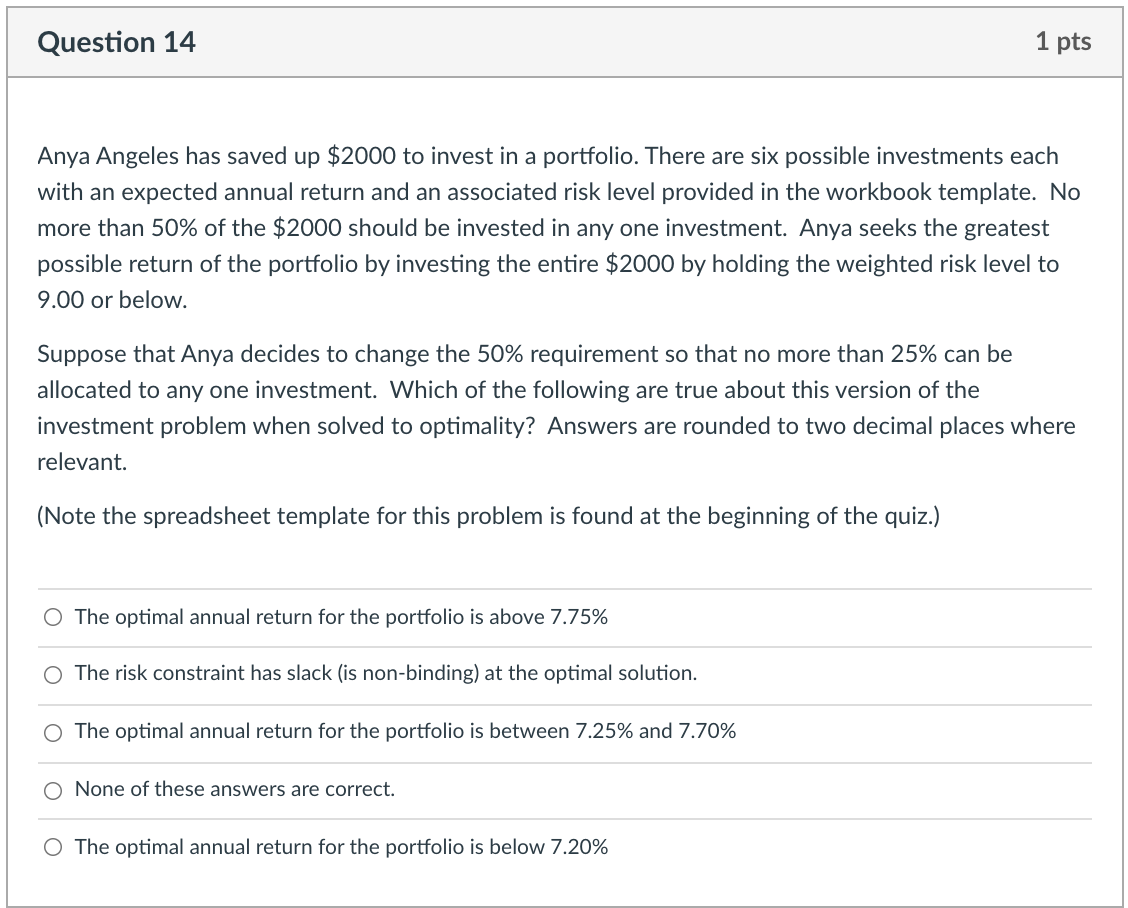

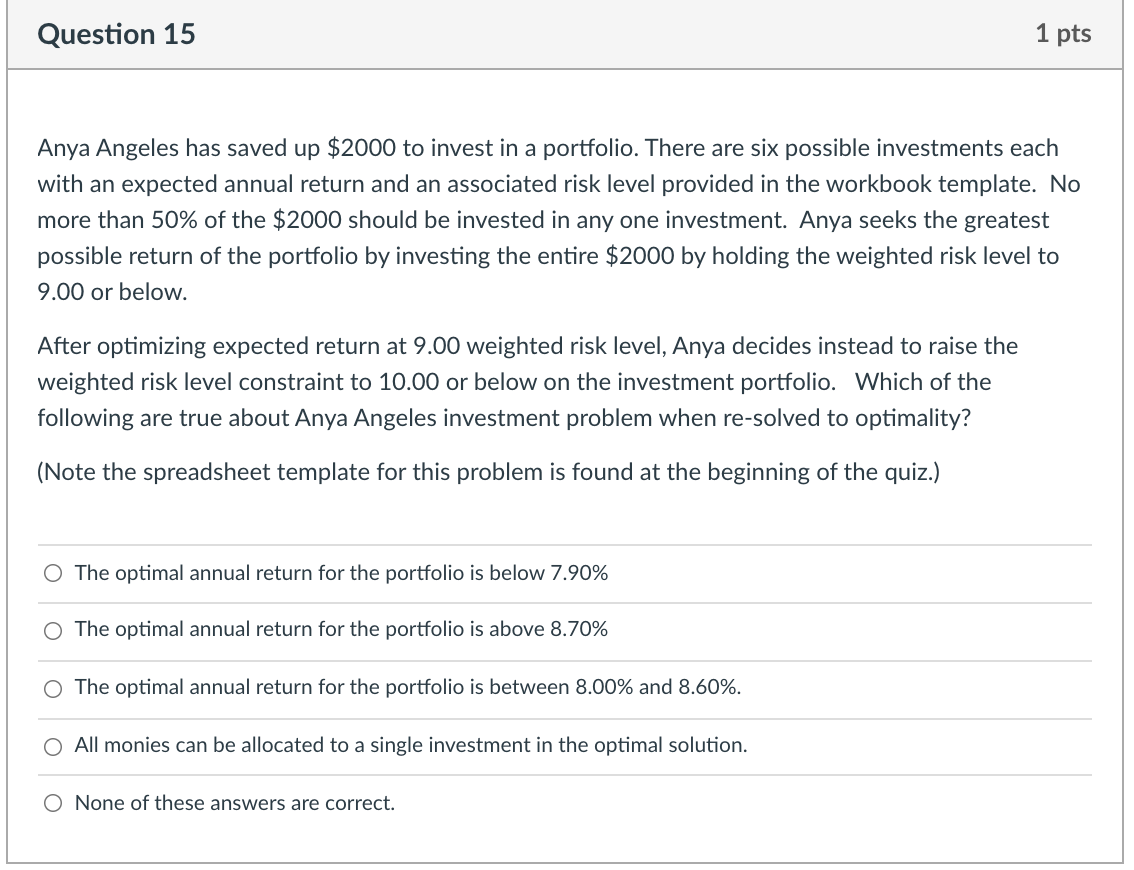

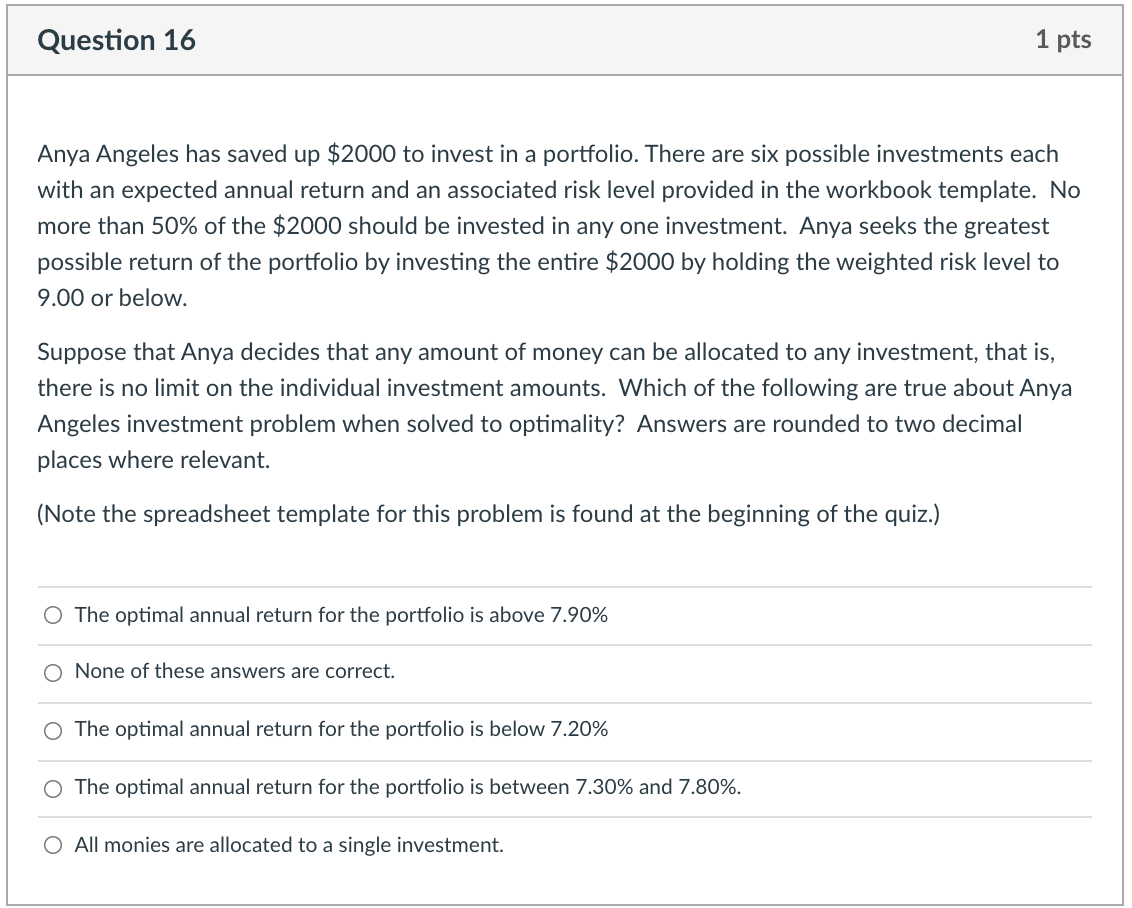

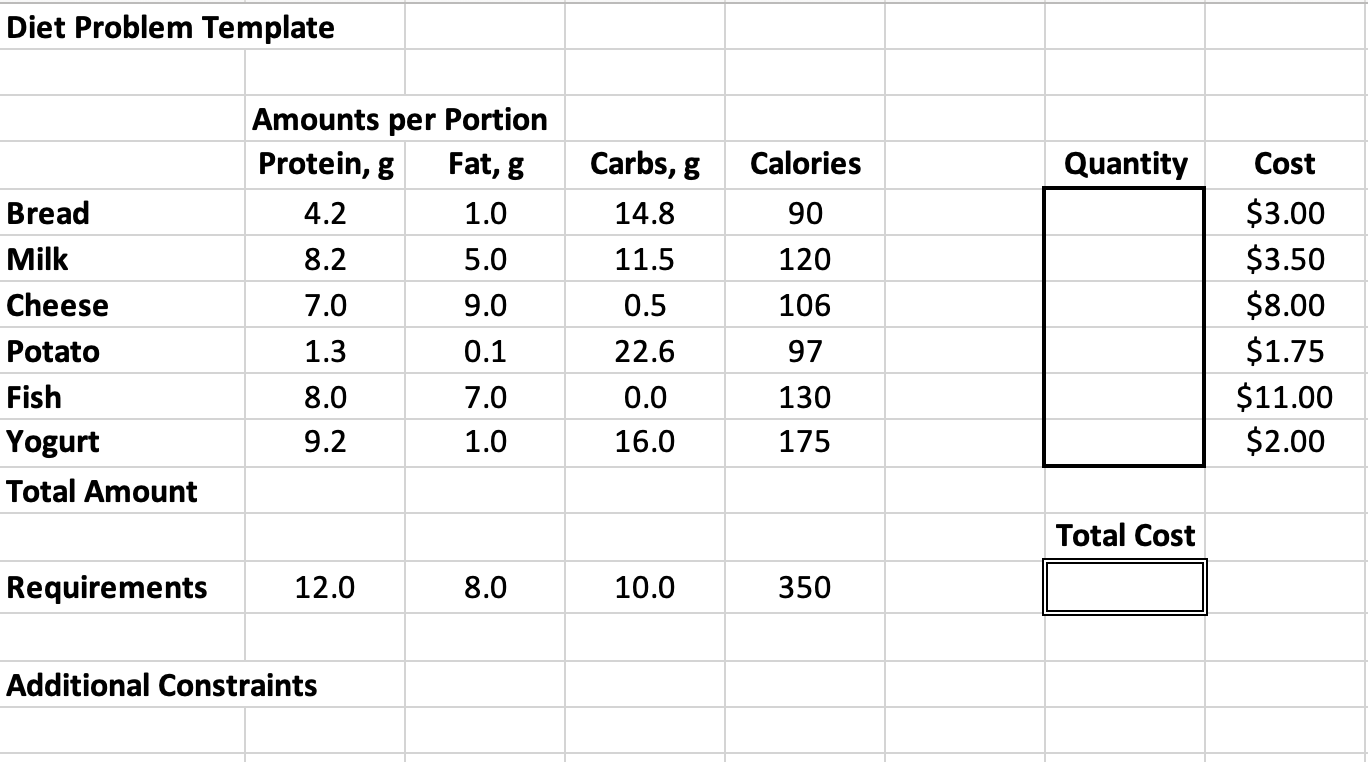

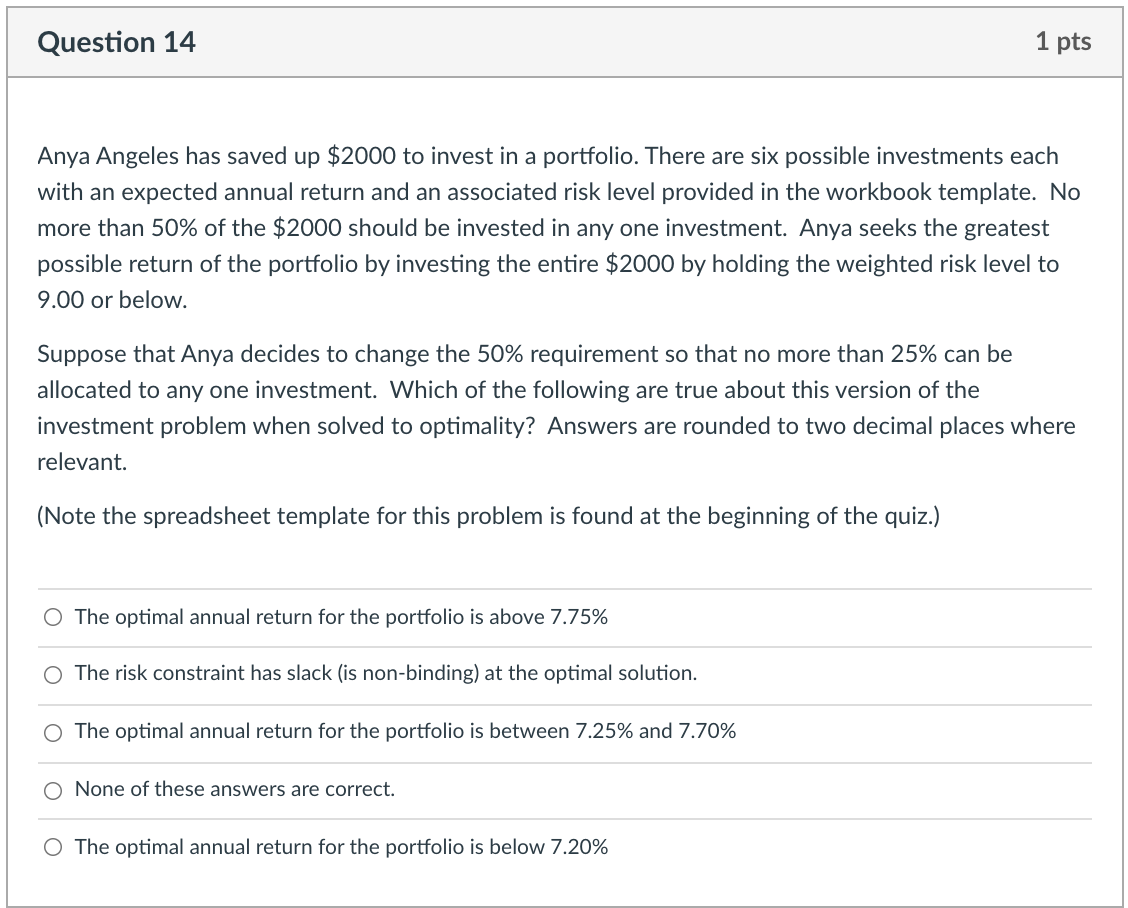

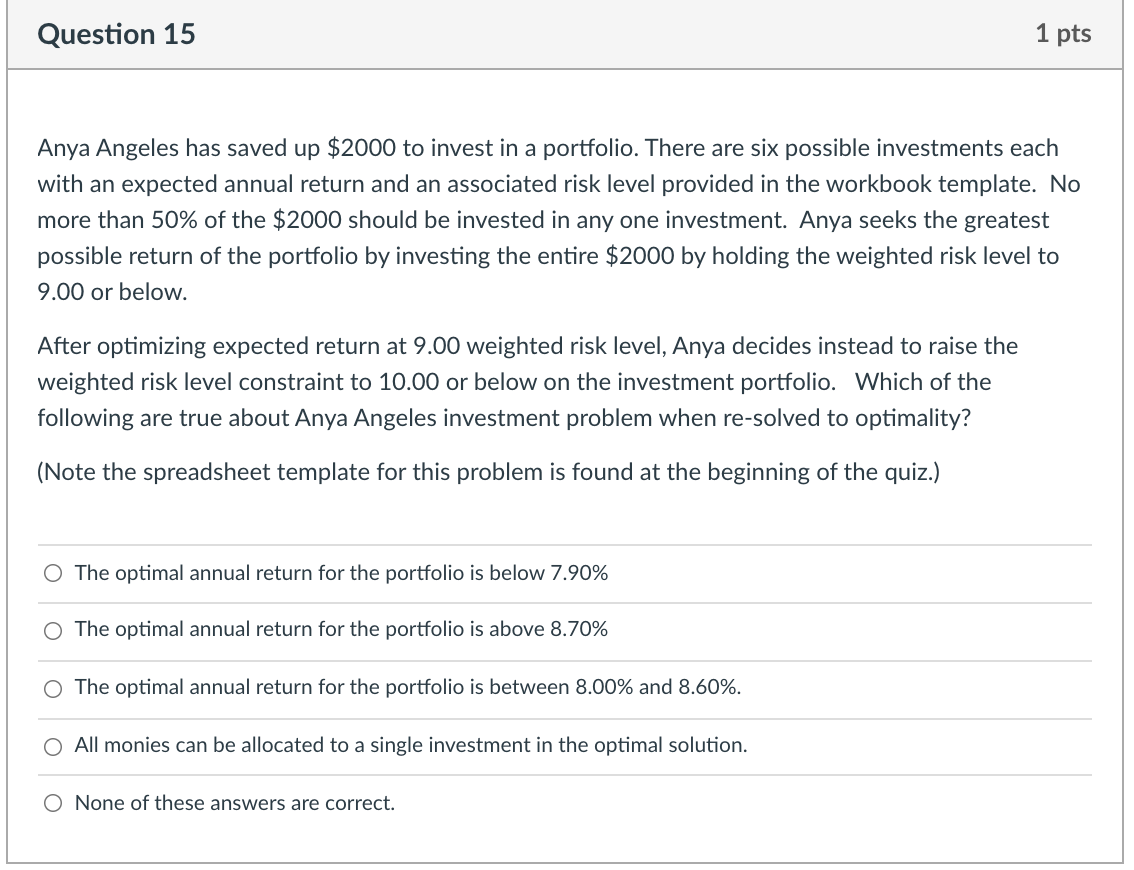

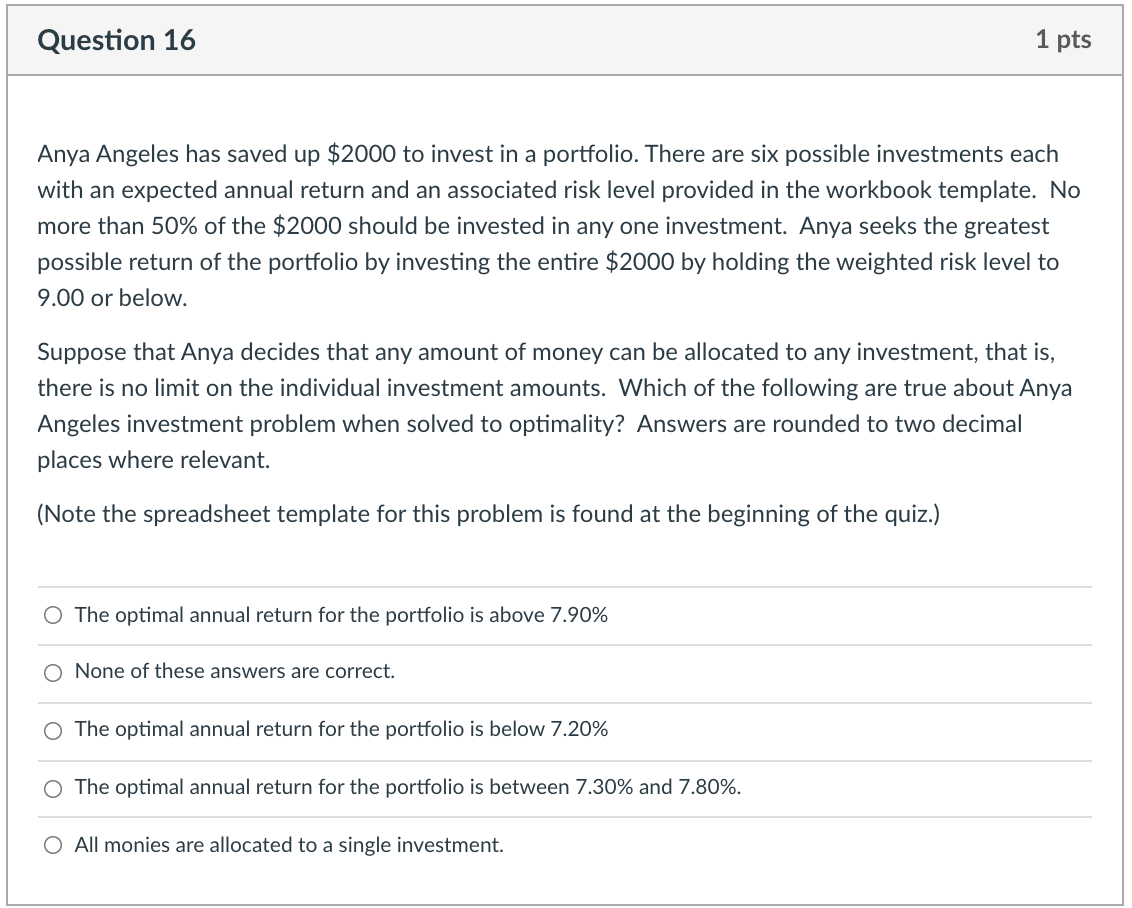

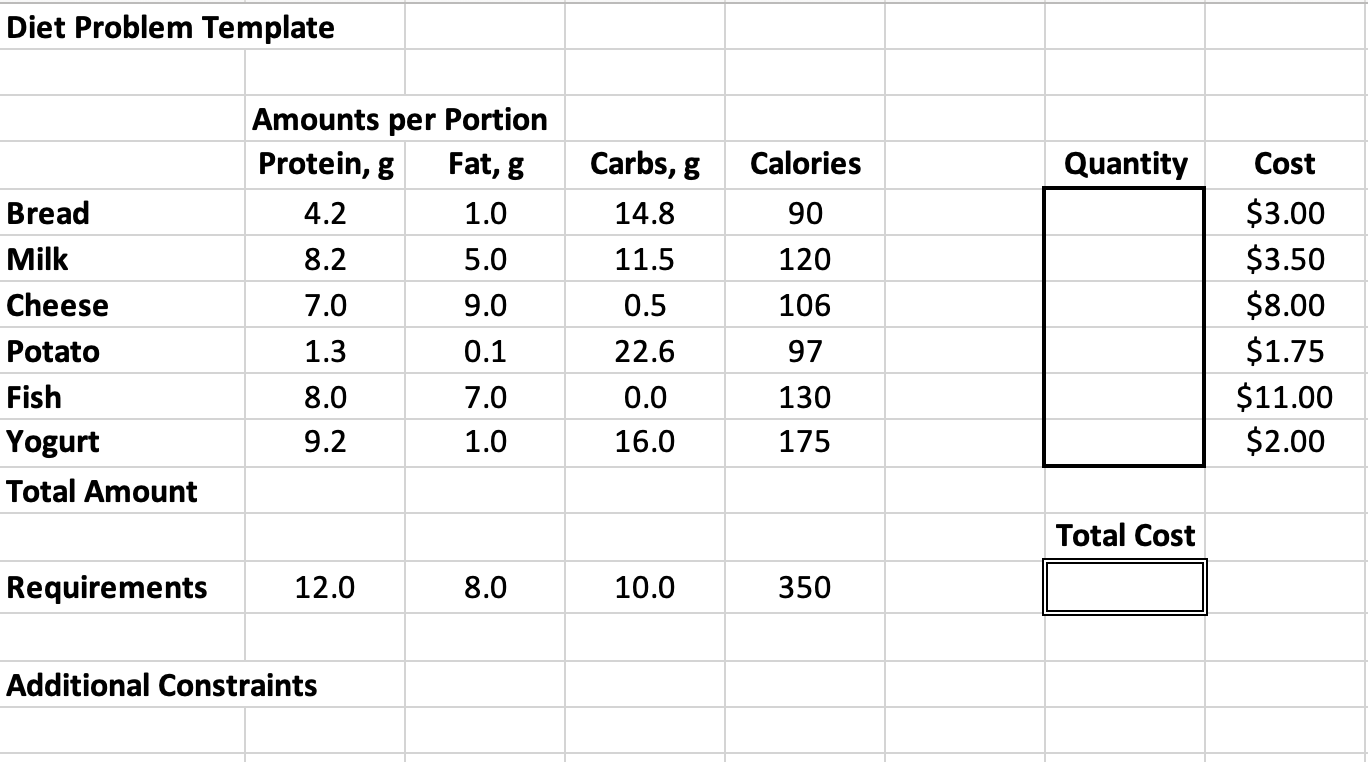

Question 14 1 pts Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments each with an expected annual return and an associated risk level provided in the workbook template. No more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000 by holding the weighted risk level to 9.00 or below. Suppose that Anya decides to change the 50% requirement so that no more than 25% can be allocated to any one investment. Which of the following are true about this version of the investment problem when solved to optimality? Answers are rounded to two decimal places where relevant. (Note the spreadsheet template for this problem is found at the beginning of the quiz.) O The optimal annual return for the portfolio is above 7.75% O The risk constraint has slack (is non-binding) at the optimal solution. The optimal annual return for the portfolio is between 7.25% and 7.70% O None of these answers are correct. O The optimal annual return for the portfolio is below 7.20% Question 15 1 pts Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments each with an expected annual return and an associated risk level provided in the workbook template. No more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000 by holding the weighted risk level to 9.00 or below. After optimizing expected return at 9.00 weighted risk level, Anya decides instead to raise the weighted risk level constraint to 10.00 or below on the investment portfolio. Which of the following are true about Anya Angeles investment problem when re-solved to optimality? (Note the spreadsheet template for this problem is found at the beginning of the quiz.) 0 The optimal annual return for the portfolio is below 7.90% O The optimal annual return for the portfolio is above 8.70% O The optimal annual return for the portfolio is between 8.00% and 8.60%. O All monies can be allocated to a single investment in the optimal solution. O None of these answers are correct. Question 16 1 pts Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments each with an expected annual return and an associated risk level provided in the workbook template. No more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000 by holding the weighted risk level to 9.00 or below. Suppose that Anya decides that any amount of money can be allocated to any investment, that is, there is no limit on the individual investment amounts. Which of the following are true about Anya Angeles investment problem when solved to optimality? Answers are rounded to two decimal places where relevant. (Note the spreadsheet template for this problem is found at the beginning of the quiz.) O The optimal annual return for the portfolio is above 7.90% O None of these answers are correct. O The optimal annual return for the portfolio is below 7.20% The optimal annual return for the portfolio is between 7.30% and 7.80%. All monies are allocated to a single investment. Diet Problem Template Calories Quantity Carbs, 8 14.8 11.5 Amounts per Portion Protein, g Fat, g 4.2 1.0 8.2 5.0 9.0 1.3 0.1 8.0 7.0 9.2 1.0 7.0 Bread Milk Cheese Potato Fish Yogurt Total Amount 0.5 90 120 106 97 130 175 Cost $3.00 $3.50 $8.00 $1.75 $11.00 $2.00 22.6 0.0 16.0 Total Cost Requirements 12.0 8.0 10.0 350 Additional Constraints Question 14 1 pts Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments each with an expected annual return and an associated risk level provided in the workbook template. No more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000 by holding the weighted risk level to 9.00 or below. Suppose that Anya decides to change the 50% requirement so that no more than 25% can be allocated to any one investment. Which of the following are true about this version of the investment problem when solved to optimality? Answers are rounded to two decimal places where relevant. (Note the spreadsheet template for this problem is found at the beginning of the quiz.) O The optimal annual return for the portfolio is above 7.75% O The risk constraint has slack (is non-binding) at the optimal solution. The optimal annual return for the portfolio is between 7.25% and 7.70% O None of these answers are correct. O The optimal annual return for the portfolio is below 7.20% Question 15 1 pts Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments each with an expected annual return and an associated risk level provided in the workbook template. No more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000 by holding the weighted risk level to 9.00 or below. After optimizing expected return at 9.00 weighted risk level, Anya decides instead to raise the weighted risk level constraint to 10.00 or below on the investment portfolio. Which of the following are true about Anya Angeles investment problem when re-solved to optimality? (Note the spreadsheet template for this problem is found at the beginning of the quiz.) 0 The optimal annual return for the portfolio is below 7.90% O The optimal annual return for the portfolio is above 8.70% O The optimal annual return for the portfolio is between 8.00% and 8.60%. O All monies can be allocated to a single investment in the optimal solution. O None of these answers are correct. Question 16 1 pts Anya Angeles has saved up $2000 to invest in a portfolio. There are six possible investments each with an expected annual return and an associated risk level provided in the workbook template. No more than 50% of the $2000 should be invested in any one investment. Anya seeks the greatest possible return of the portfolio by investing the entire $2000 by holding the weighted risk level to 9.00 or below. Suppose that Anya decides that any amount of money can be allocated to any investment, that is, there is no limit on the individual investment amounts. Which of the following are true about Anya Angeles investment problem when solved to optimality? Answers are rounded to two decimal places where relevant. (Note the spreadsheet template for this problem is found at the beginning of the quiz.) O The optimal annual return for the portfolio is above 7.90% O None of these answers are correct. O The optimal annual return for the portfolio is below 7.20% The optimal annual return for the portfolio is between 7.30% and 7.80%. All monies are allocated to a single investment. Diet Problem Template Calories Quantity Carbs, 8 14.8 11.5 Amounts per Portion Protein, g Fat, g 4.2 1.0 8.2 5.0 9.0 1.3 0.1 8.0 7.0 9.2 1.0 7.0 Bread Milk Cheese Potato Fish Yogurt Total Amount 0.5 90 120 106 97 130 175 Cost $3.00 $3.50 $8.00 $1.75 $11.00 $2.00 22.6 0.0 16.0 Total Cost Requirements 12.0 8.0 10.0 350 Additional Constraints