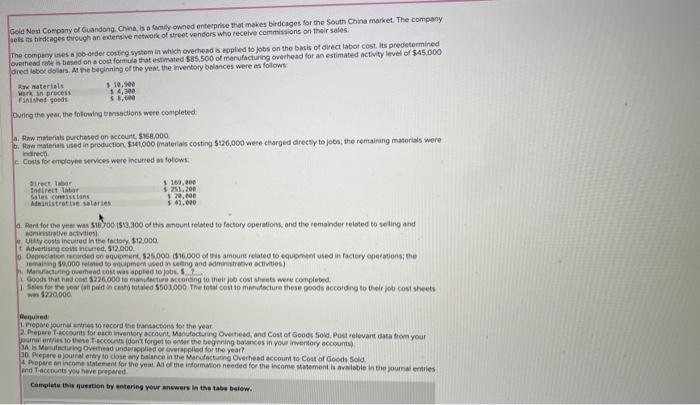

ASAP!! I need help with this question please.

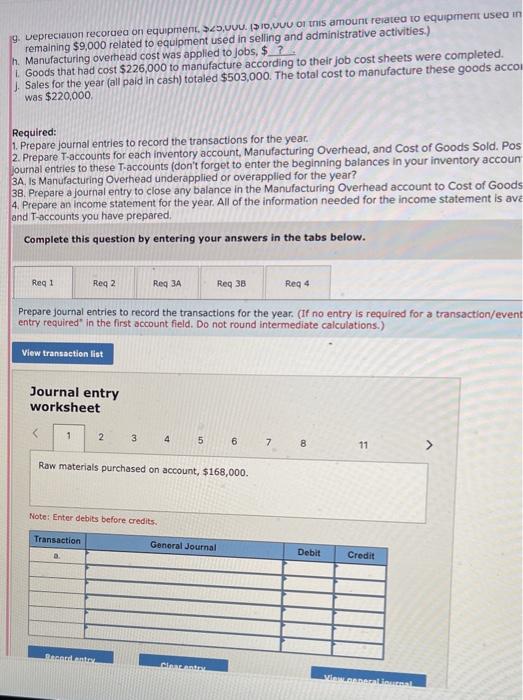

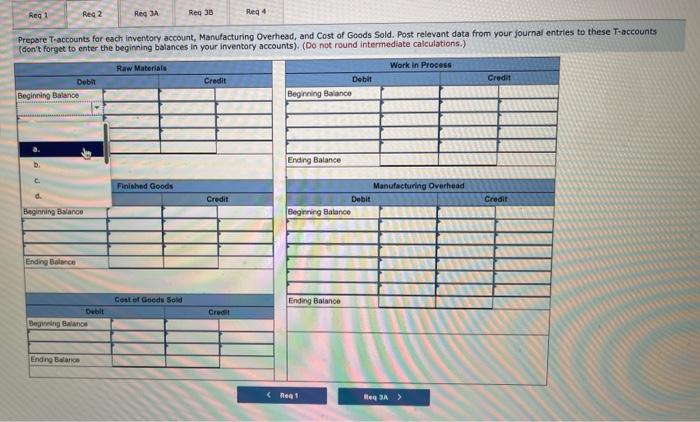

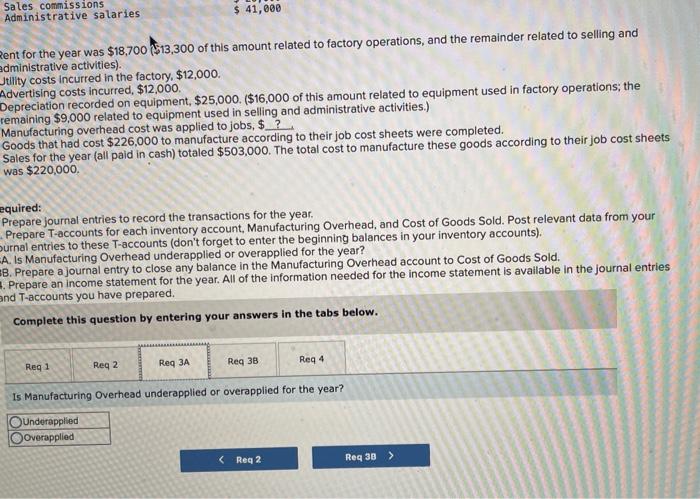

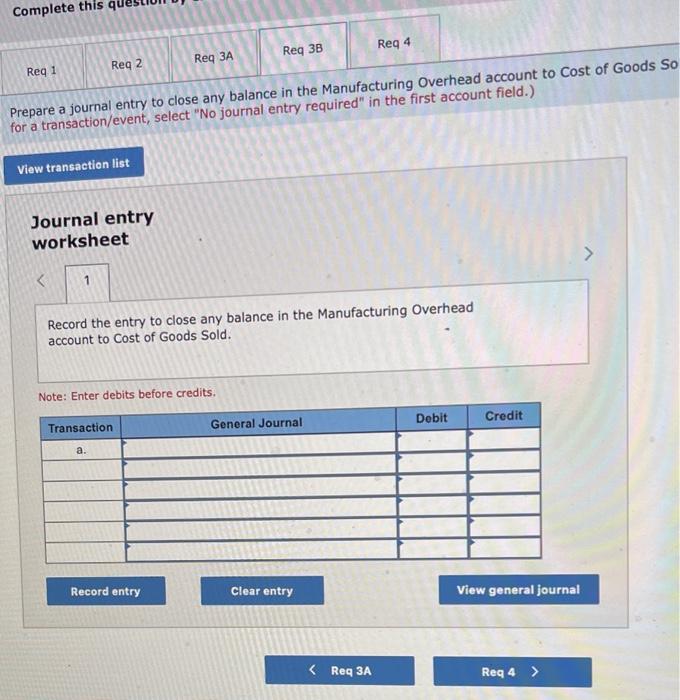

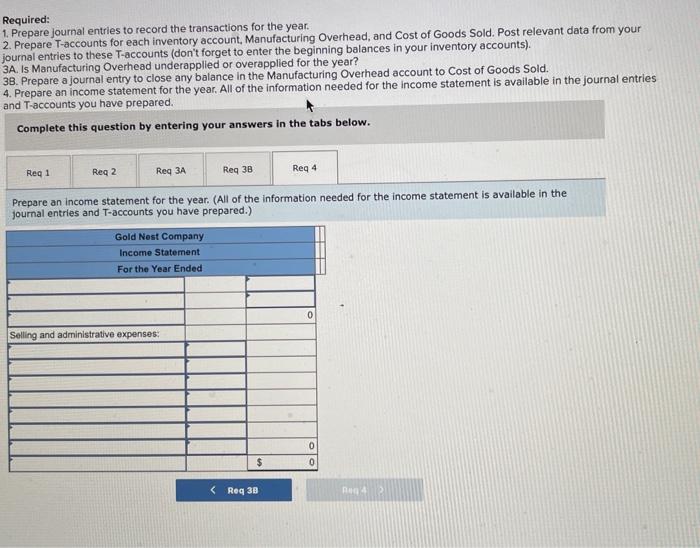

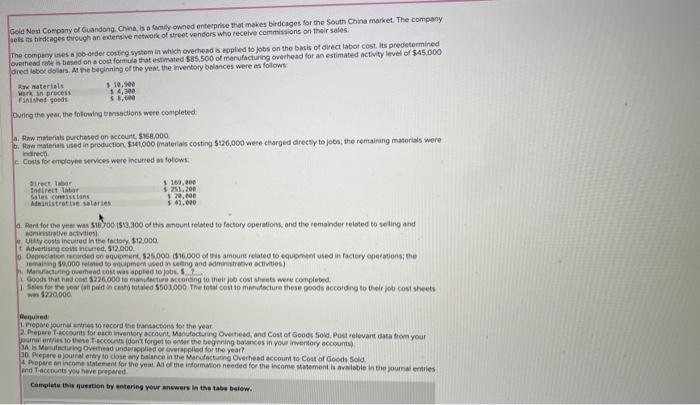

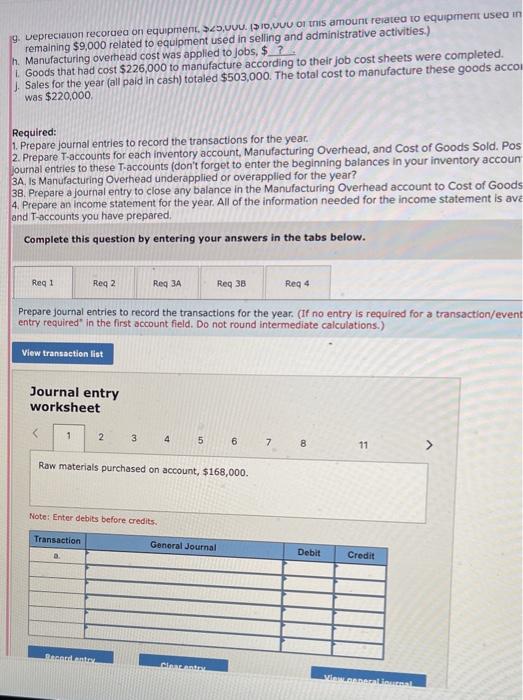

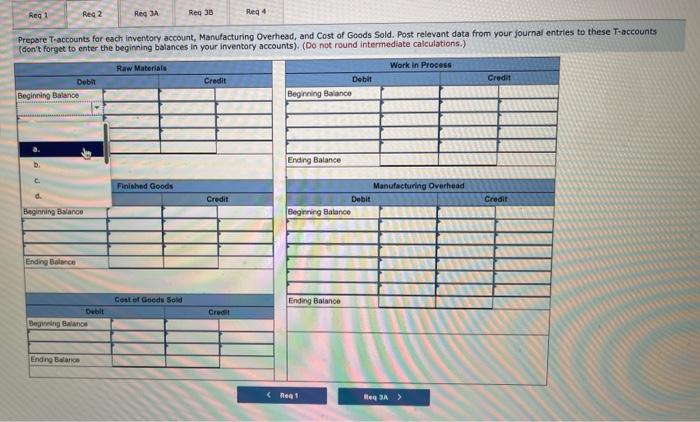

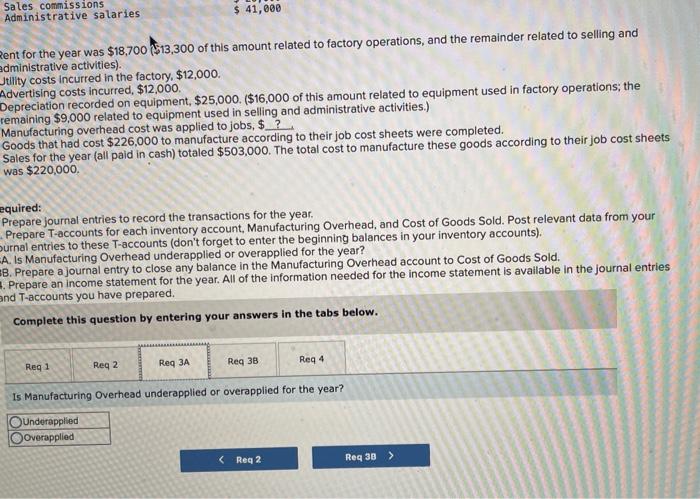

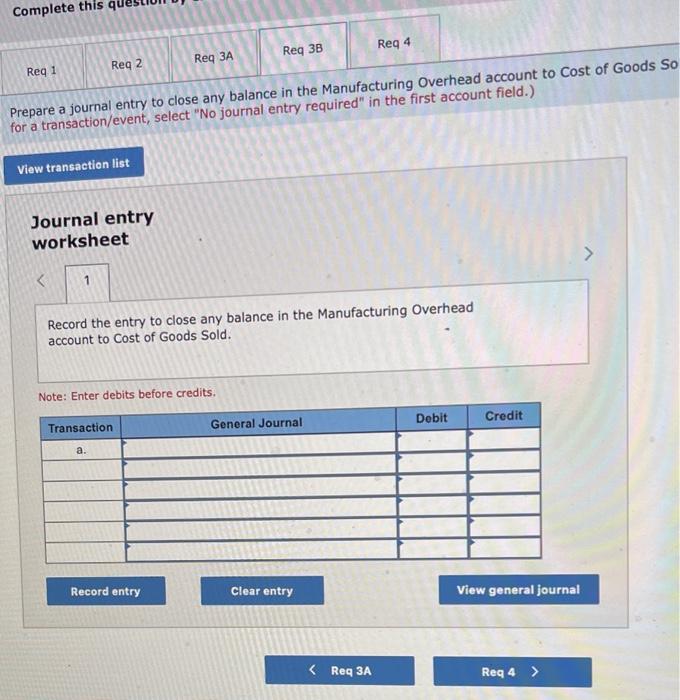

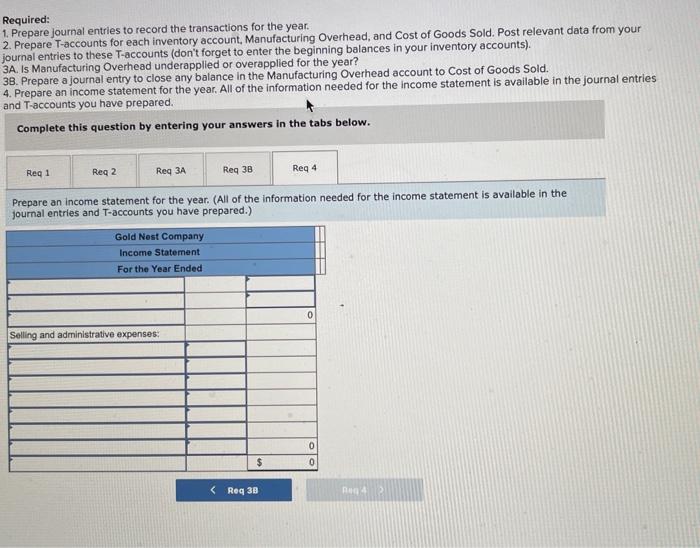

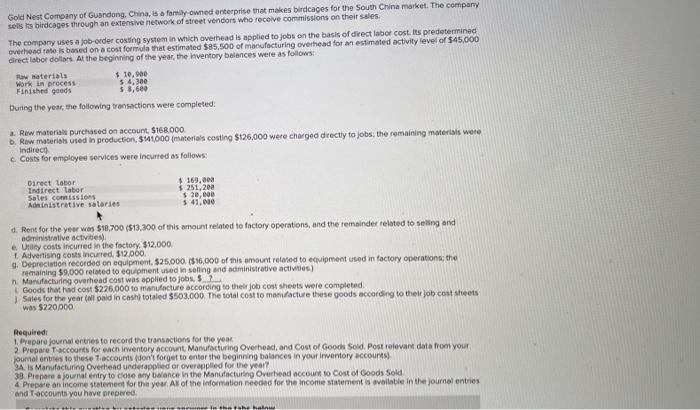

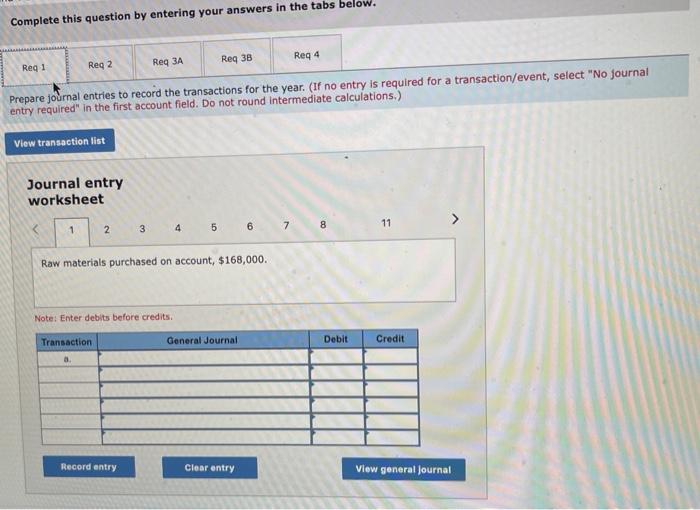

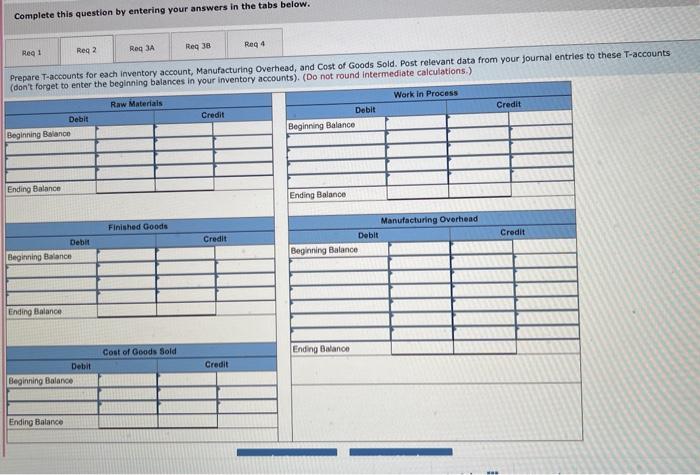

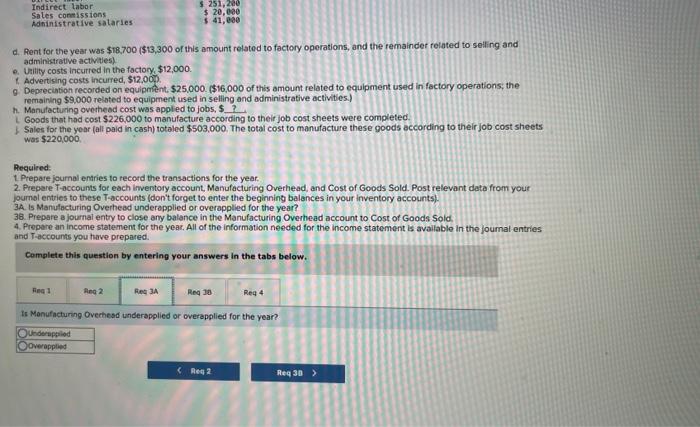

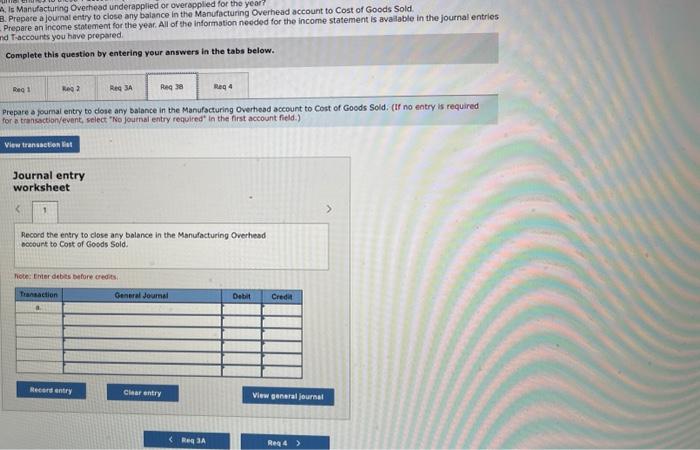

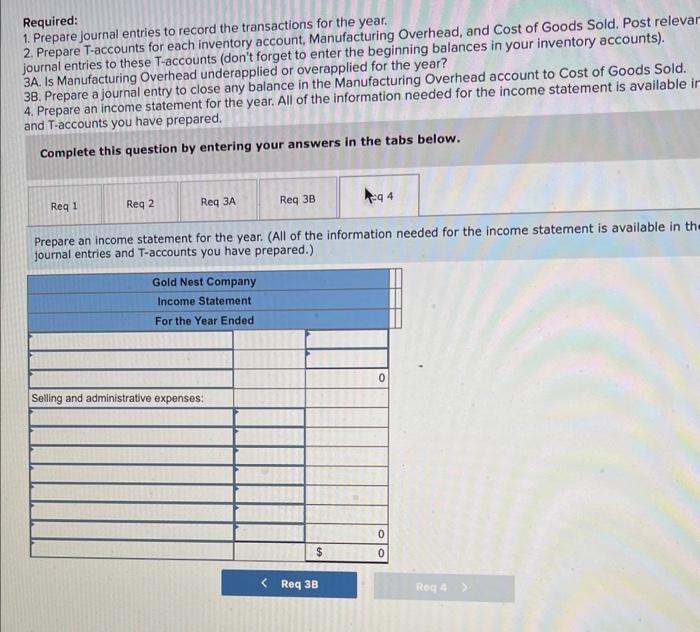

Dola Nest Cotrpany of Ciandong. Crind, is a tamily ownod enterprise that makes birdcages for the South Crina market. The company teks rs tiraknges tvevoh an ederwive retwork of treet venders who recetve commissions on their sales: The compery utes a jo-order costerg sywem in which overhesd is appled to jobs on the besis cf diect labor cost, lis predetermined oveineod reft is besed on s cost forthula trat estrated $85.500 of menufacturing overhead for an estimated activity level of $45,000 dred laboc dolas. Ma the beginning of the yeat, the iventory boiances were as follows: During the year, the foldwing terasations were contipleted a. Raw materals purchased on accourt. 5168,000 . b. Fowe maierialt ised in preduction $101000 (materias costing 5t26,000 wete charged arecty to jobs; the temaining materials were c. Covs for enteleyer services were incured at folows. Ricminstipteve activitiest 4. Utthy costs incuted h the factory $12,000 t. Aoverting costa incused, $12.000 ienaiting 7.000 related to eeupment wed in ceeng and administreive ectivites) 7. Marsiaciuing owertheed wost was appled to jobs. 8 ? 1. Gopeds that het cont 1226000 to hanvecture Accorting to theil job cost sheets mere conpleted. sin1200000 Aequired end Taccounta yoy neve propered 9. vepreciation recorded on equipment, $20,u. $10,04 oi this amount related to equipment used in remaining $9,000 related to equipment used in selling and administrative activities.) h. Manufacturing overhead cost was applied to jobs, \$? i. Goods that had cost $226,000 to manufacture according to their job cost sheets were completed. j. Sales for the year (all paid in cash) totaled $503,000. The total cost to manufacture these goods accol was $220,000. Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Pos oumal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accoun 3A. Is Manufacturing Overhead underapplied or overapplied for the year? 38. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods 4. Prepare an income statement for the year. All of the information needed for the income statement is ave and T-accounts you have prepared. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the transactions for the year. (If no entry is required for a transaction/event entry required" in the first occount field. Do not round intermediate calculations.) Journal entry worksheet Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don't forget to enter the beginning baiances in your inventory accounts). (Do not round intermediate calculations.) ent for the year was $18,700($13,300 of this amount related to factory operations, and the remainder related to selling and dministrative activities). Jtility costs incurred in the factory, $12,000. Advertising costs incurred, $12,000. Depreciation recorded on equipment, $25,000. $16,000 of this amount related to equipment used in factory operations; the remaining $9,000 related to equipment used in selling and administrative activities.) Manufacturing overhead cost was applied to jobs, $ ? Goods that had cost $226,000 to manufacture according to their job cost sheets were completed. Sales for the year (all paid in cash) totaled $503,000. The total cost to manufacture these goods according to their job cost sheets was $220,000. quired: Prepare journal entries to record the transactions for the year. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your urnal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts). A. Is Manufacturing Overhead underapplied or overapplied for the year? B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries ind T-accounts you have prepared. Complete this question by entering your answers in the tabs below. Is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. Note: Enter debits before credits. Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your ournal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts). 3A. Is Manufacturing Overhead underapplied or overapplied for the year? 38. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries and T-accounts you have prepared. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year. (All of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.) Gold Nest Company of Guandong. China, is a fornay owned erterprise that makes birdcages for the South China market. The cempariy selis ris birdcages through an extensive network of street vendors who recelve cormissions on their sales: The compsoy uses a jos-order cosing system in which averinead is applied to jobs en the basis of drect labor cost its predetermined evetieed tase is bosed on a cost formula that estimated $85,500 of manufacturing overhead for an estimated activily level of 545,000 cirect labor dollors. At the beginning of the year, the kventory beiances weite as follows; Duting the year, she following transactions were completed: a. Rew materias purchased on account $168000 b. Rew materists used in preduction, 5 t41000 (materials costing $126,000 were chacged drectly to jobs; the remaining materisis wete indirecy c. Costs for employed secvices were incurted as fallows: d. Rent for the yewr wes $10,700 (\$13,300 af this ampunt reiated to faciory operations, and the rembinder related to seting and adminstralive activities). e. Unily costs incurred in the foctory, $12.000. 1. Adventising costs incured, $12,000. 9. Deprecietion recorded en equipment, $25,000. $16,000 of this amount related to equipment used in factory operations; the recaaining $9,000 related to equipment used in selling and administrative activities) in. Masuifacturing overhead cost was applied to jobs, 3 ? Goods thet had coss $226000 to manhifacture accoreing to thes job cost sheets were completed. 3) Sales for the year (wit poid in casty totaled $503.000. The total cost to macidacture these goods according to theit job cost slieets was $220000 Required t 1. Prepare jounal enties to record the tiansactions for the yeac. 2 Piepare Taccourts for each imentery account, Manufacturing Overhead, and Cost of Goods Sood. Post relevant data from your purnal entestes to these Tiaccounts dent forget to enter the beginning balances in your inventory accounst. 34. is Manufacturing Overtead underapplied or overaplied for the year?, 39. Prenare o journal entry to cose any teasce in the Manutacturing Overtead account to Cost of Coods 50 id. 4 Prepaie an income stetemeet for the year. Al of the information neesed for the income siatement is availatie in the journal entries and Taccounts you have nrepered. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the transactions for the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don's forget to enter the beginning balances in your inventory accounts). (Do not round intermediate calculations.) d. Pent for the year was $18,700($13,300 of this amount related to factory operations, and the remainder felated to selling and administratwe activitles) e. Uitity costs incurred in the factory, $12,000. 1. Advertising costs incurred, 512.00p. 9 Deprecintion recorded on equipmetent, $25,000. (\$16,000 of this amount related to equipment used in factory operations; the remaining $9,000 related to equipment used in selling and administrative activities.) h. Manufacturing ovetheed cost was appled to jobs, $ ? Loods that had cost $226.000 to manufacture according to their job cost sheets were completed. bales for the year (all paid in cash) totaled $503,000. The totar cost to manufacture these goods according to their job cost sheets was $220,000 Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts fot each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your purnol entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts). 3A. is Manulacturing Overhead underapplied or overapplied for the year? 36. Prepare a journal entry to ciose any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4. Prepare an income statement for the year. All of the information needed for the income statement is available in the journal entries and Taccounts you have prepared. Complete this question by entering your answers in the tabs below. is Monufacturng Ovechesd underapplied or overepplied for the year? 4. Is Manufacturing Ovechead underapplied or overopplied for the year? 3. Prepare a joumat entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold Prepare an income statement for the year. All of the information noeded for the income statement is avalable in the journal entries ad Taccounts you have propared. Complete this question by entering your answers in the tabs below. Prepare a joumal entry to dose any balance in the Manufacturing Overheod account to Cost of Goods Sold. (If no entry is required for a transactionyevent, select "No joutnal entry required' in the first account field.) Journal entry worksheet Record the entry to close any balance in the Manufacturing Orechesd mocourt to Cont of Goods Sold. hote: Enter debits nofore oredits. Required: 1. Prepare journal entries to record the transactions for the year. 2. Prepare T-accounts for each inventory account, Manufacturing Overhead, and Cost of Goods Sold. Post relevar journal entries to these T-accounts (don't forget to enter the beginning balances in your inventory accounts). 3A. Is Manufacturing Overhead underapplied or overapplied for the year? 3B. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold. 4. Prepare an income statement for the year. All of the information needed for the income statement is available in and T-accounts you have prepared. Complete this question by entering your answers in the tabs below. Prepare an income statement for the year. (All of the information needed for the income statement is available in th journal entries and T-accounts you have prepared.)