Question

ASAP ***JUST NEED FIT PART*** PLEASE SHOW WORK The names of the employees of Matson Office Systems and their regular salaries are shown in the

ASAP

***JUST NEED "FIT" PART***

PLEASE SHOW WORK

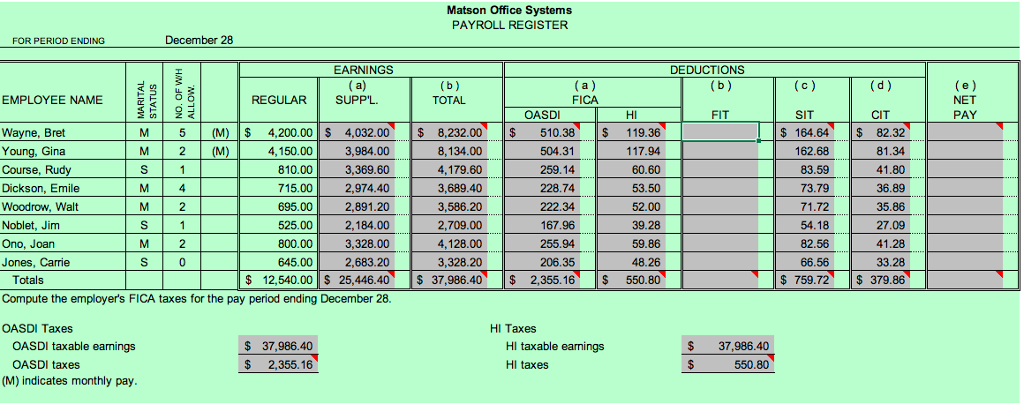

The names of the employees of Matson Office Systems and their regular salaries are shown in the following payroll register. Note that Wayne and Young are paid monthly on the last payday, while all others are paid weekly.

In addition to the regular salaries, the company pays an annual bonus based on the amount of earnings for the year. For the current year, the bonus amounts to 8% of the annual salary paid to each employee. The bonus is to be paid along with the regular salaries on December 28, but the amount of the bonus and the amount of the regular salary will be shown separately on each employee's earnings statement. Assume that all employees received their regular salary during the entire year.

Prepare the payroll for the pay period ending December 28, showing the following for each employee:

Use the wage-bracket method to withhold federal income tax from the regular salaries.

Withhold a flat 25% on the annual bonus.

Total salaries and bonuses are subject to a 2% state income tax and a 1% city income tax.

Enter all amounts as positive numbers. Round your answers to the nearest cent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started