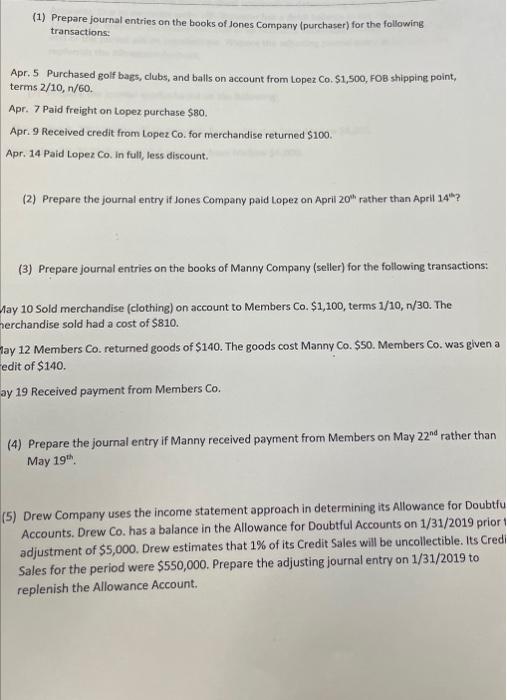

May 10 Sold merchandise (clothing) on account to Members Co. $1,100, terms 1/10,n/30. The merchandise sold had a cost of $810. May 12 Members Co. returned goods of $140. The goods cost Manny Co. $50. Members Co. was given a credit of $140. May 19 Received payment from Members Co. (4) Prepare the journal entry if Manny received payment from Members on May 22nd rather than May 19th. (5) Drew Company uses the income statement approach in determining its Allowance for Doubtful Accounts. Drew Co. has a balance in the Allowance for Doubtful Accounts on 1/31/2019 prior to adjustment of $5,000. Drew estimates that 1% of its Credit Sales will be uncollectible. Its Credit Sales for the period were $550,000. Prepare the adjusting journal entry on 1/31/2019 to replenish the Allowance Account. (6) Brewster Company uses the balance sheet approach in determining its Allowance for Doubtful Accounts. Due to excessive write-offs Brewster has a debit balance in the Allowance of $4,000 at 1/31/2019. Brewster estimates that 10% of its Accounts Receivable balance of $50,000 at the end of the period will be uncollectible. Prepare the adjusting journal entry at 1/31/2019 to replenish the Allowance Account. (7) Prepare the journal entries based on the following: November 3, 2019 Wrote off an Accounts Receivable due from Mellow $6,000. November 30, 2019 Received full payment from Mellow $6,000. (1) Prepare journal entries on the books of Jones Company (purchaser) for the following transactions: Apr. 5 Purchased golf baes, clubs, and balls on account from Lopez Co. 11,500 , FOB shipping point, terms 2/10,n/60. Apr. 7 Paid freight on topez purchase $80. Apr. 9 Received credit from Lopez Co. for merchandise returned $100. Apr. 14 Paid Lopez Co. in full, less discount. (2) Prepare the journal entry if Jones Company paid Lopez on April 20th rather than April 14th? ? (3) Prepare joumal entries on the books of Manny Company (seller) for the following transactions: May 10 Sold merchandise (clothing) on account to Members Co. $1,100, terms 1/10,n/30. The herchandise sold had a cost of $810. lay 12 Members Co. returned goods of $140. The goods cost Manny Co. $50. Members Co. was given a edit of $140. ay 19 Received payment from Members Co. (4) Prepare the joumal entry if Manny received payment from Members on May 22nd rather than May 19th (5) Drew Company uses the income statement approach in determining its Allowance for Doubtfu Accounts. Drew Co. has a balance in the Allowance for Doubtful Accounts on 1/31/2019 prior 1 adjustment of $5,000. Drew estimates that 1% of its Credit Sales will be uncollectible. Its Credi Sales for the period were $550,000. Prepare the adjusting journal entry on 1/31/2019 to replenish the Allowance Account