ASAP please

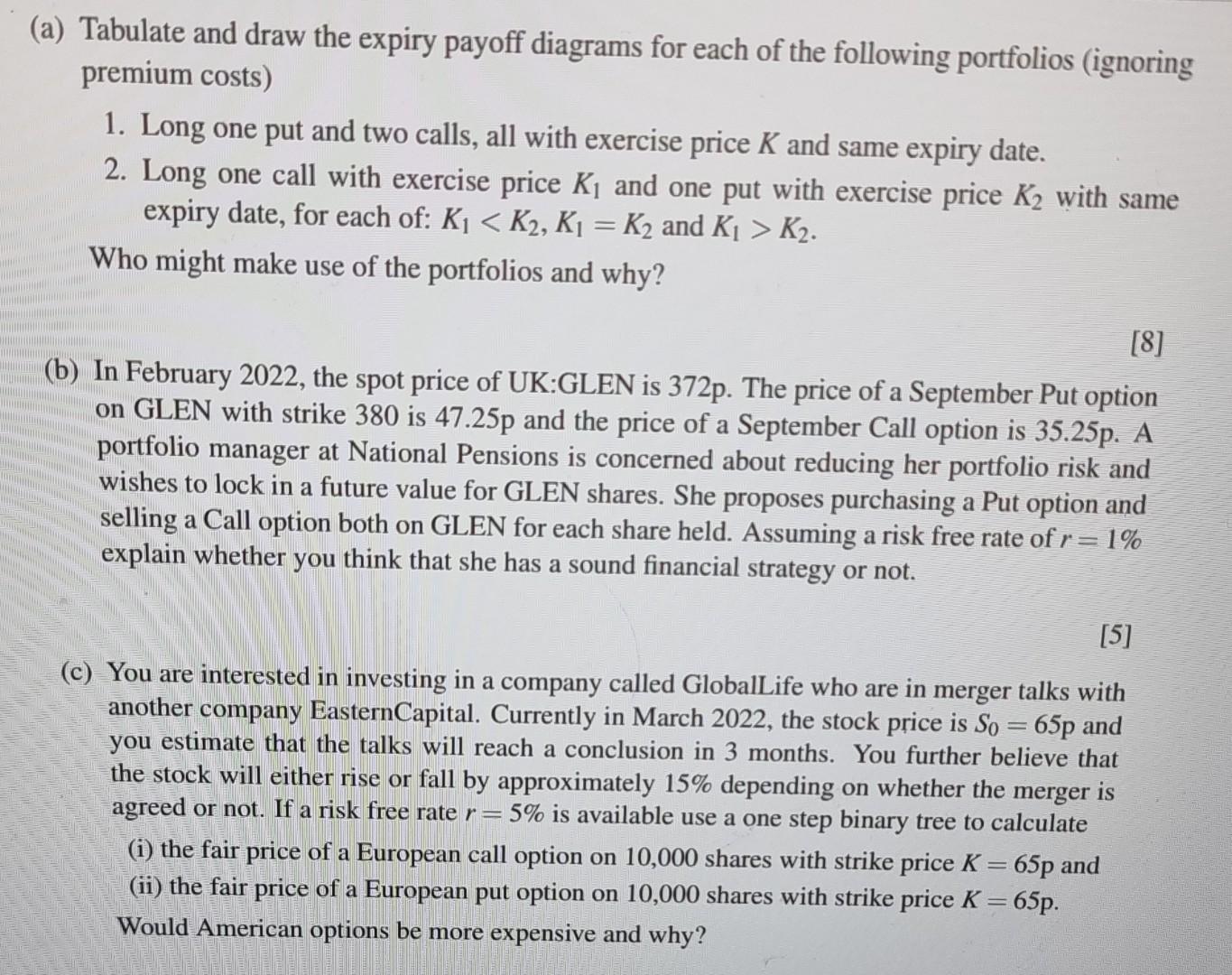

(a) Tabulate and draw the expiry payoff diagrams for each of the following portfolios (ignoring premium costs) 1. Long one put and two calls, all with exercise price K and same expiry date. 2. Long one call with exercise price Ki and one put with exercise price K2 with same expiry date, for each of: Ki

K2. Who might make use of the portfolios and why? [8] (b) In February 2022, the spot price of UK:GLEN is 372p. The price of a September Put option on GLEN with strike 380 is 47.25p and the price of a September Call option is 35.25p. A portfolio manager at National Pensions is concerned about reducing her portfolio risk and wishes to lock in a future value for GLEN shares. She proposes purchasing a Put option and selling a Call option both on GLEN for each share held. Assuming a risk free rate of r= 1% explain whether you think that she has a sound financial strategy or not. a a [5] (c) You are interested in investing in a company called GlobalLife who are in merger talks with another company EasternCapital. Currently in March 2022, the stock price is So = 65p and you estimate that the talks will reach a conclusion in 3 months. You further believe that the stock will either rise or fall by approximately 15% depending on whether the merger is agreed or not. If a risk free rate r= 5% is available use a one step binary tree to calculate (i) the fair price of a European call option on 10,000 shares with strike price K = 65p and (ii) the fair price of a European put option on 10,000 shares with strike price K = 65p. Would American options be more expensive and why? -- (a) Tabulate and draw the expiry payoff diagrams for each of the following portfolios (ignoring premium costs) 1. Long one put and two calls, all with exercise price K and same expiry date. 2. Long one call with exercise price Ki and one put with exercise price K2 with same expiry date, for each of: Ki K2. Who might make use of the portfolios and why? [8] (b) In February 2022, the spot price of UK:GLEN is 372p. The price of a September Put option on GLEN with strike 380 is 47.25p and the price of a September Call option is 35.25p. A portfolio manager at National Pensions is concerned about reducing her portfolio risk and wishes to lock in a future value for GLEN shares. She proposes purchasing a Put option and selling a Call option both on GLEN for each share held. Assuming a risk free rate of r= 1% explain whether you think that she has a sound financial strategy or not. a a [5] (c) You are interested in investing in a company called GlobalLife who are in merger talks with another company EasternCapital. Currently in March 2022, the stock price is So = 65p and you estimate that the talks will reach a conclusion in 3 months. You further believe that the stock will either rise or fall by approximately 15% depending on whether the merger is agreed or not. If a risk free rate r= 5% is available use a one step binary tree to calculate (i) the fair price of a European call option on 10,000 shares with strike price K = 65p and (ii) the fair price of a European put option on 10,000 shares with strike price K = 65p. Would American options be more expensive and why