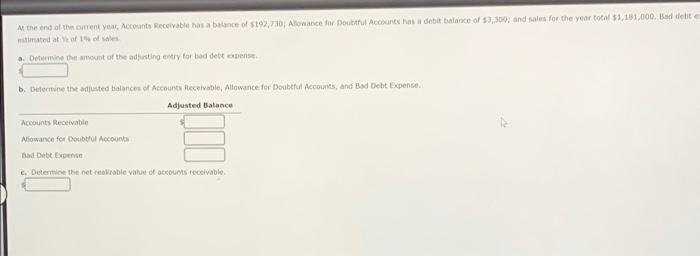

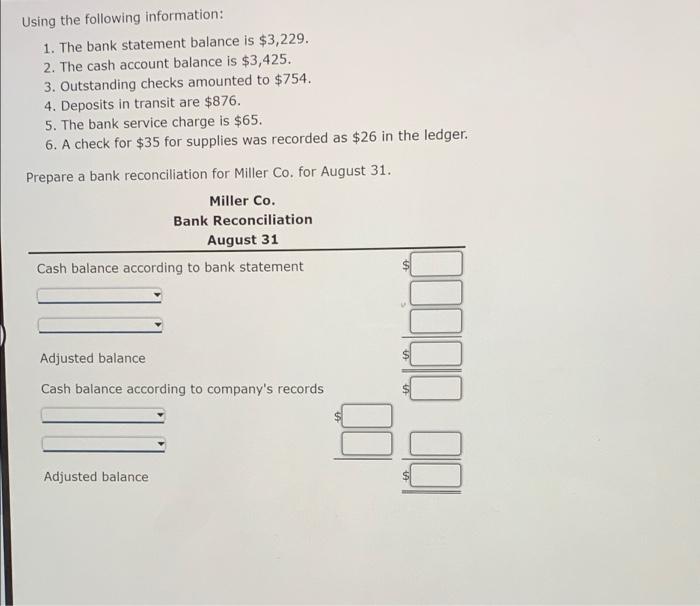

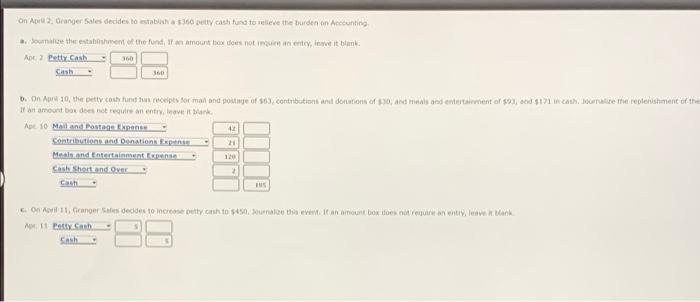

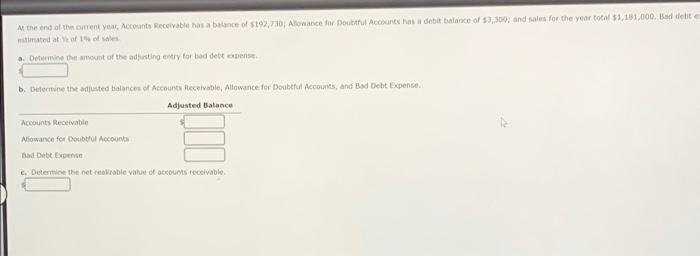

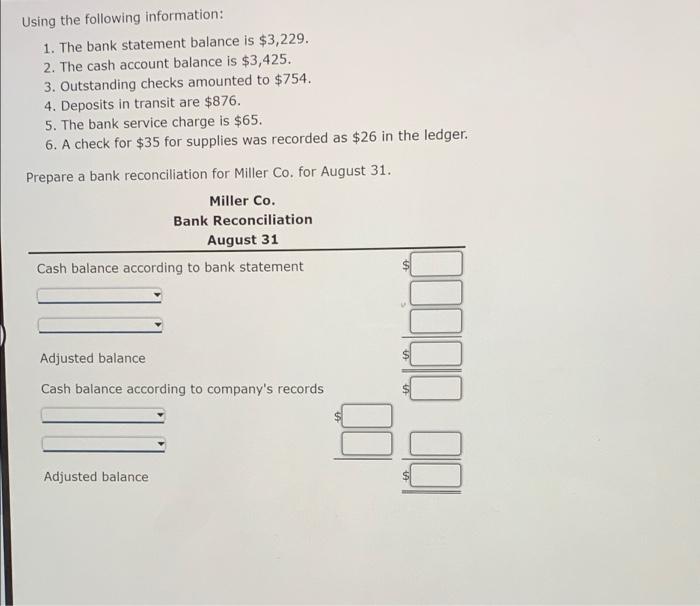

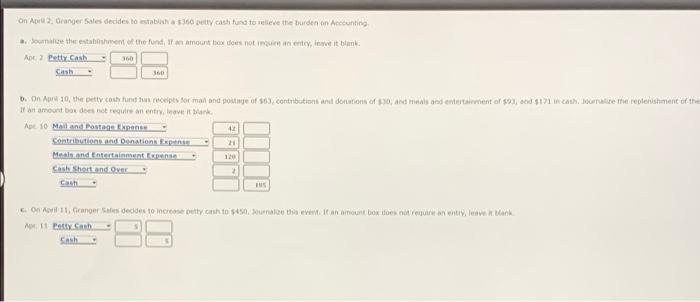

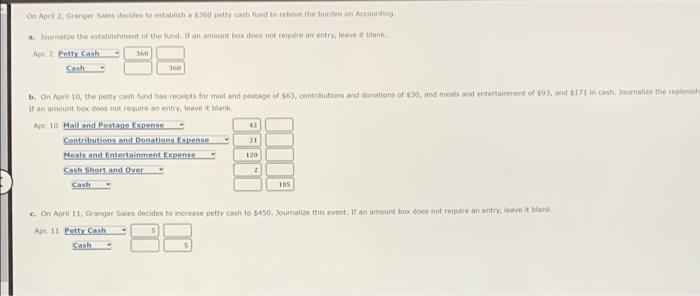

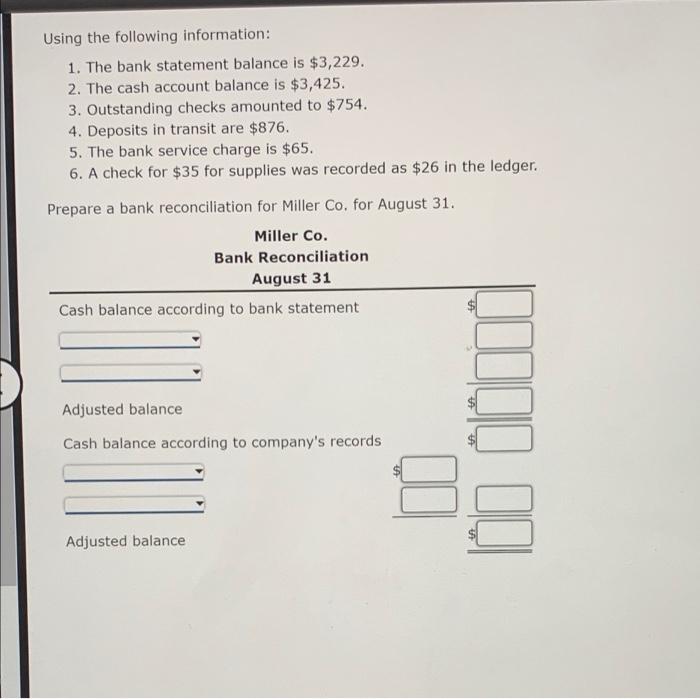

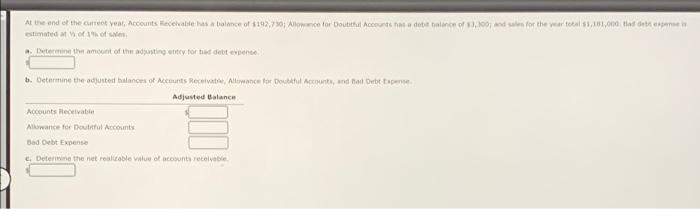

At the end of the current year, Accounts Receivable as a balance of 192,736; Almance for Doubtful Accounts detit balance of 53,300, and sales for the year total 51,181,000. Bod debte med at off ale Determine the amount of the adjusting entry for bad debe expense b. Determine the adjusted balance of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense Adjusted Balance Accounts Receivable Niowance for Doubtful Accounts ad Debt Expense c. Determine the net reakable value of accounts receivable Using the following information: 1. The bank statement balance is $3,229. 2. The cash account balance is $3,425. 3. Outstanding checks amounted to $754. 4. Deposits in transit are $876. 5. The bank service charge is $65. 6. A check for $35 for supplies was recorded as $26 in the ledger. Prepare a bank reconciliation for Miller Co. for August 31. Miller Co. Bank Reconciliation August 31 Cash balance according to bank statement Adjusted balance DIJI OD Cash balance according to company's records Adjusted balance On Art. Granger Sales decides to establish a 16 petty cash und to relieve the burden on Accounting Joure the establem of the fund, Iran amount to does not require an entry, inweit blond Ape Petty Cash Son Cash On Ar 10, the petty courtune hon receipts for mal and postage of , contributined and donationin er 30, and meals and entertabonent of $83, oed $17neath bourraipe the replenishment of the If an amount box does not require an entry leave it bank Ape 10 Mailand Postage penge 42 Contribution and Donations pense 2 Meals and Entertainment Cash Short and Ox HUS 2 con 11, Granger as decides to increase petty canh 10450, Journaise this event it an amount bow does not remunen en eve bank o Petranh Cash On April 2. de Sales decides totalisha petty cash fund to relieve the burden on Accounting Sourate the establishment of the fund famount does not require an entry, leave it took A Petty cash Cash b. On April 10, the petty cash und hors for mall and postage of $63, contributions and donations of $50, and meals and entertainment of 95, wd 17 inch Joumate the replenih If an amount to do not require et lavet bank Ane 10 Maitland Postage tento Contribution and Donation Expense Meals and Entertainment Expense 120 Canh short and over 2 Cash On April 11, Granger Sales decides to increase petty cash to $450. Journalize this event. If an amount box does not require an entry leave it bank 11 Petty Cash Cash 5 Using the following information: 1. The bank statement balance is $3,229. 2. The cash account balance is $3,425. 3. Outstanding checks amounted to $754. 4. Deposits in transit are $876. 5. The bank service charge is $65. 6. A check for $35 for supplies was recorded as $26 in the ledger. Prepare a bank reconciliation for Miller Co, for August 31. Miller Co. Bank Reconciliation August 31 Cash balance according to bank statement Adjusted balance los dimi Cash balance according to company's records Adjusted balance At the end of the current year, accounts lacetalde has a balance of $193,720, Algence for Doutittat Accounts as a detit hataron of 83,109and sales for the year total 58,182.000 af orbe despre estimated to Determine the amount of the adjusting entry for but dettepete b. Determine the adjusted balances of iemants Receivati, Allowance for Doutatul counts, and fint Orbetare Adjusted Balance Accounts Receivas Allowance for Dutiful Accounts Bad Oet Expense Determine the netrable value of accounts receivable