Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASAP PLEASE!!! Objective Short Answer 20. In tax year 2022 taxpayer T had $75,000 of taxable income: $25,000 from wages, $10,000 from short-term capital gains

ASAP PLEASE!!!

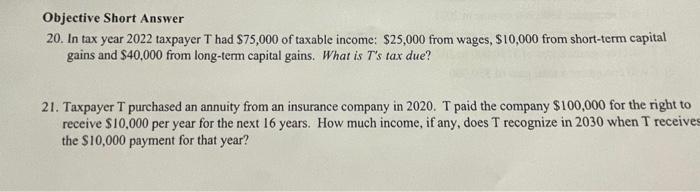

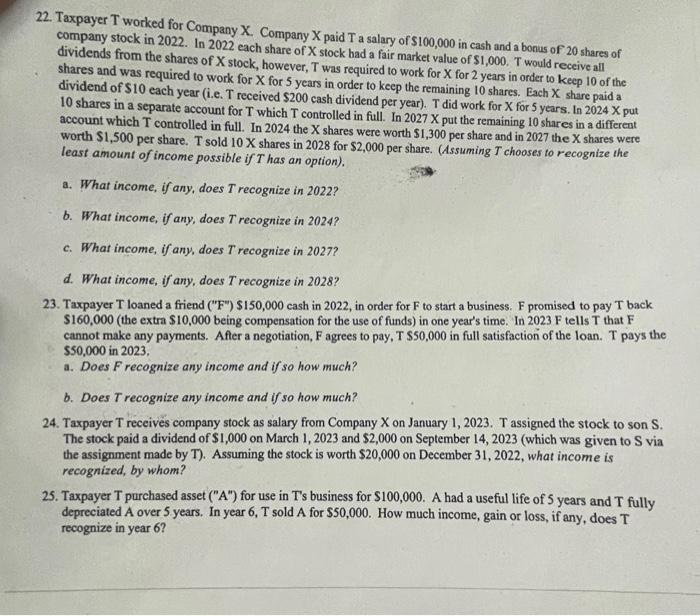

Objective Short Answer 20. In tax year 2022 taxpayer T had $75,000 of taxable income: $25,000 from wages, $10,000 from short-term capital gains and $40,000 from long-term capital gains. What is T 's tax due? 21. Taxpayer T purchased an annuity from an insurance company in 2020. T paid the company $100,000 for the right to receive $10,000 per year for the next 16 years. How much income, if any, does T recognize in 2030 when T receiv the $10,000 payment for that year? 22. Taxpayer T worked for Company X. Company X paid T a salary of $100,000 in cash and a bonus of 20 shares of company stock in 2022. In 2022 each share of X stock had a fair market value of $1,000. T would receive all dividends from the shares of X stock, however, T was required to work for X for 2 years in order to keep 10 of the shares and was required to work for X for 5 years in order to keep the remaining 10 shares. Each X share paid a dividend of $10 each year (i.e. T received $200 cash dividend per year). T did work for X for 5 years. ln2024X put account which T controlled in full. In 2024 the X shares were worth $1,300 per share and in 2027 the X shares were worth $1,500 per share. T sold 10X shares in 2028 for $2,000 per share. (Assuming T chooses to recognize the least amount of income possible if T has an option). a. What income, if any, does T recognize in 2022? b. What income, if any, does T recognize in 2024 ? c. What income, if any, does T recognize in 2027 ? d. What income, if any, does T recognize in 2028? 23. Taxpayer T loaned a friend ("F") $150,000 cash in 2022 , in order for F to start a business. F promised to pay T back $160,000 (the extra $10,000 being compensation for the use of funds) in one year's time. In 2023F tells T that F cannot make any payments. After a negotiation, F agrees to pay, T $50,000 in full satisfaction of the loan. T pays the $50,000 in 2023 , a. Does F recognize any income and if so how much? b. Does Trecognize any income and if so how much? 24. Taxpayer T receives company stock as salary from Company X on January 1,2023 . T assigned the stock to son S. The stock paid a dividend of $1,000 on March 1, 2023 and $2,000 on September 14, 2023 (which was given to S via the assignment made by T). Assuming the stock is worth $20,000 on December 31,2022 , what income is recognized, by whom? 25. Taxpayer T purchased asset ("A") for use in T's business for $100,000. A had a useful life of 5 years and T fully depreciated A over 5 years. In year 6,T sold A for $50,000. How much income, gain or loss, if any, does T recognize in year 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started