Answered step by step

Verified Expert Solution

Question

1 Approved Answer

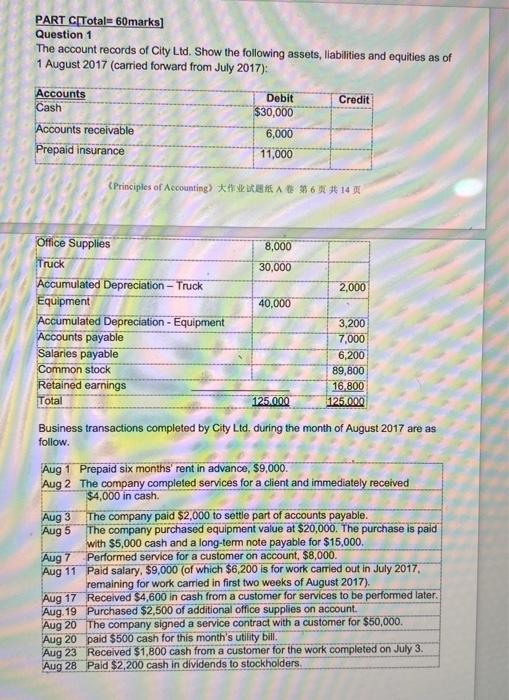

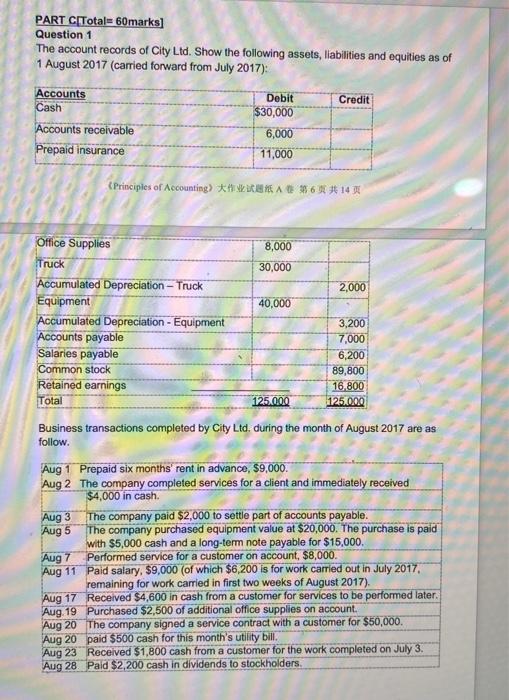

asap please PART C[Total =60 marks] Question 1 The account records of City Ltd. Show the following assets, liabilities and equities as of 1 August

asap please

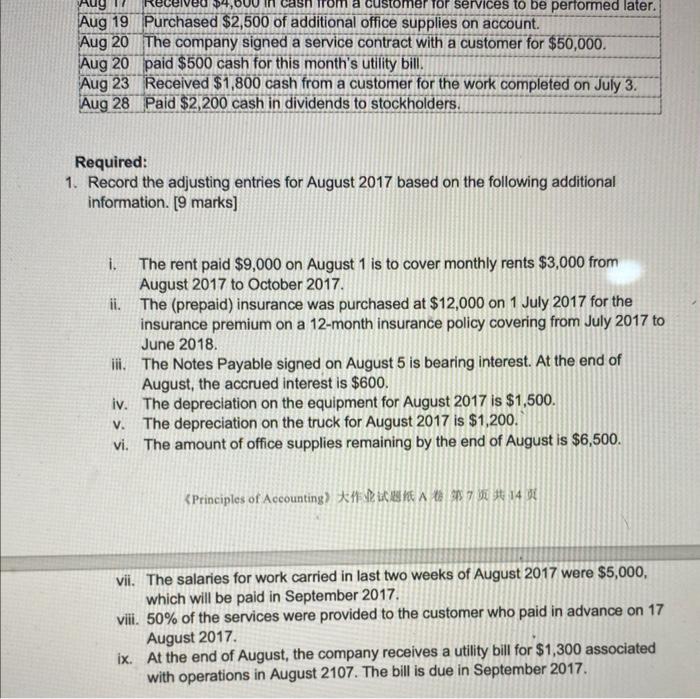

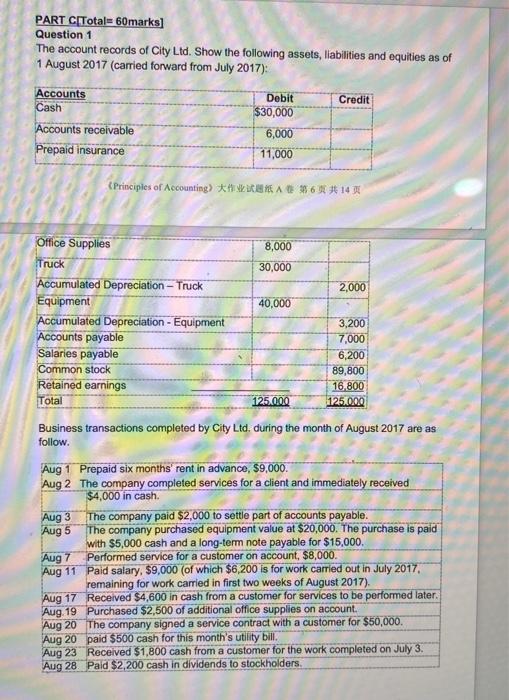

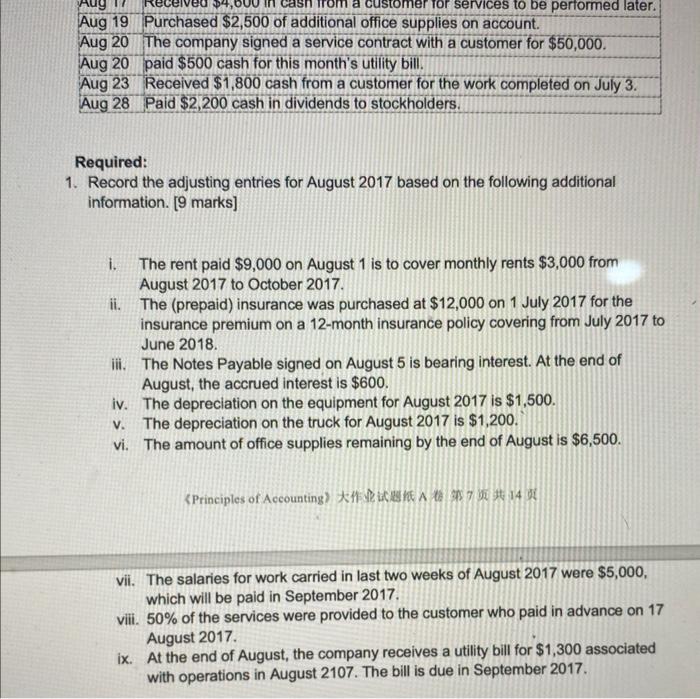

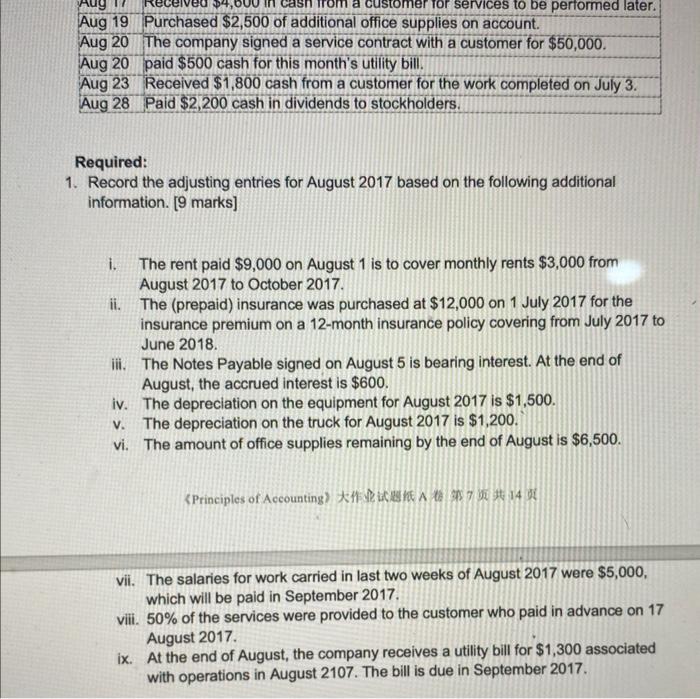

PART C[Total =60 marks] Question 1 The account records of City Ltd. Show the following assets, liabilities and equities as of 1 August 2017 (carried forward from July 2017): Business transactions completed by City Ltd. during the month of August 2017 are as follow. Required: 1. Record the adjusting entries for August 2017 based on the following additional information. [9 marks] i. The rent paid $9,000 on August 1 is to cover monthly rents $3,000 from August 2017 to October 2017. ii. The (prepaid) insurance was purchased at $12,000 on 1 July 2017 for the insurance premium on a 12-month insurance policy covering from July 2017 to June 2018. iii. The Notes Payable signed on August 5 is bearing interest. At the end of August, the accrued interest is $600. iv. The depreciation on the equipment for August 2017 is $1,500. v. The depreciation on the truck for August 2017 is $1,200. vi. The amount of office supplies remaining by the end of August is $6,500. vii. The salaries for work carried in last two weeks of August 2017 were $5,000, which will be paid in September 2017. viii. 50% of the services were provided to the customer who paid in advance on 17 August 2017. ix. At the end of August, the company receives a utility bill for $1,300 associated with operations in August 2107. The bill is due in September 2017. PART C[Total =60 marks] Question 1 The account records of City Ltd. Show the following assets, liabilities and equities as of 1 August 2017 (carried forward from July 2017): Business transactions completed by City Ltd. during the month of August 2017 are as follow. Required: 1. Record the adjusting entries for August 2017 based on the following additional information. [9 marks] i. The rent paid $9,000 on August 1 is to cover monthly rents $3,000 from August 2017 to October 2017. ii. The (prepaid) insurance was purchased at $12,000 on 1 July 2017 for the insurance premium on a 12-month insurance policy covering from July 2017 to June 2018. iii. The Notes Payable signed on August 5 is bearing interest. At the end of August, the accrued interest is $600. iv. The depreciation on the equipment for August 2017 is $1,500. v. The depreciation on the truck for August 2017 is $1,200. vi. The amount of office supplies remaining by the end of August is $6,500. vii. The salaries for work carried in last two weeks of August 2017 were $5,000, which will be paid in September 2017. viii. 50% of the services were provided to the customer who paid in advance on 17 August 2017. ix. At the end of August, the company receives a utility bill for $1,300 associated with operations in August 2107. The bill is due in September 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started