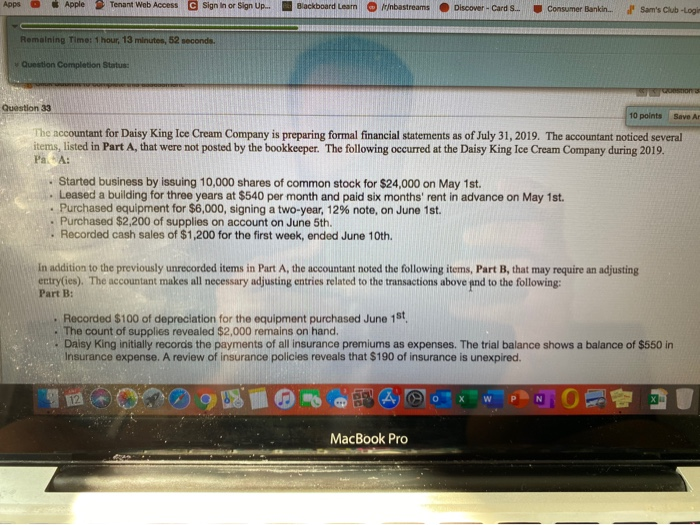

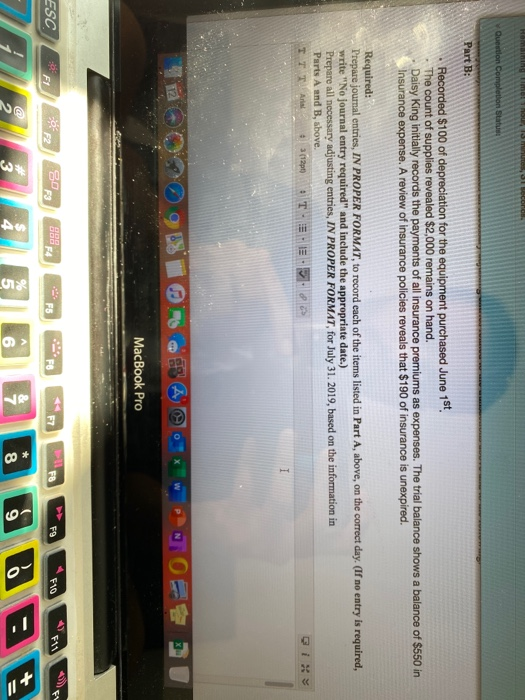

Apps Apple Tenant Web Access Sign in or Sign Up Blackboard Learn bastreams Discover - Cards. Consumer Bankin. Sam's Cub-Log Remaining Time: 1 hour, 13 minutes, 52 second Question Completion Status: Question 33 10 points Save The accountant for Daisy King Ice Cream Company is preparing formal financial statements as of July 31, 2019. The accountant noticed several items, listed in Part A, that were not posted by the bookkeeper. The following occurred at the Daisy King Ice Cream Company during 2019. Pa A: Started business by issuing 10,000 shares of common stock for $24,000 on May 1st. Leased a building for three years at $540 per month and paid six months' rent in advance on May 1st. Purchased equipment for $6,000, signing a two-year, 12% note, on June 1st. Purchased $2,200 of supplies on account on June 5th. Recorded cash sales of $1,200 for the first week, ended June 10th. In addition to the previously unrecorded items in Part A, the accountant noted the following items, Part B, that may require an adjusting entry(ies). The accountant makes all necessary adjusting entries related to the transactions above and to the following: Part B: Recorded $100 of depreciation for the equipment purchased June 15t| The count of supplies revealed $2,000 remains on hand. Daisy King initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $550 in Insurance expense. A review of insurance policies reveals that $190 of insurance is unexpired. MacBook Pro Question Completion Status Part B: Recorded $100 of depreciation for the equipment purchased June 15 The count of supplies revealed $2,000 remains on hand. Daisy King initially records the payments of all insurance premiums as expenses. The trial balance shows a balance of $550 in Insurance expense. A review of insurance policies reveals that $190 of insurance is unexpired. Required: Prepare journal entries, IN PROPER FORMAT, to record each of the items listed in Part A, above, on the correct day. (If no entry is required, write "No journal entry required" and include the appropriate date.) Prepare all necessary adjusting entries, IN PROPER FORMAT, for July 31. 2019, based on the information in Parts A and B above. T TT Arist 4.3 (12pt) T E MacBook Pro