Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ASAP PLZ QUESTION 3 a) To purchase a car, Scott borrows $55,000 from a local bank that charge a profit rate of 8% compounded annually.

ASAP PLZ

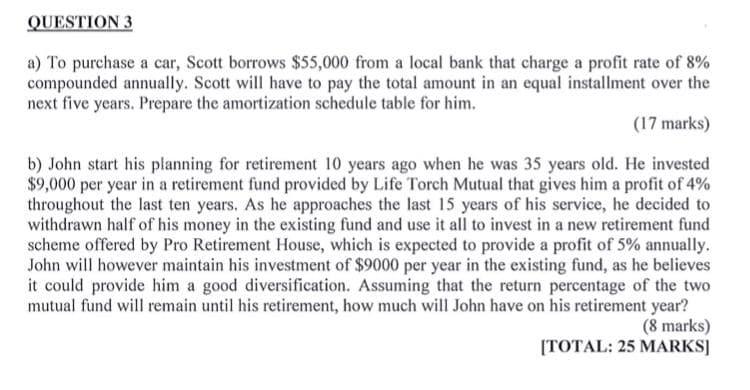

QUESTION 3 a) To purchase a car, Scott borrows $55,000 from a local bank that charge a profit rate of 8% compounded annually. Scott will have to pay the total amount in an equal installment over the next five years. Prepare the amortization schedule table for him. (17 marks) b) John start his planning for retirement 10 years ago when he was 35 years old. He invested $9,000 per year in a retirement fund provided by Life Torch Mutual that gives him a profit of 4% throughout the last ten years. As he approaches the last 15 years of his service, he decided to withdrawn half of his money in the existing fund and use it all to invest in a new retirement fund scheme offered by Pro Retirement House, which is expected to provide a profit of 5% annually. John will however maintain his investment of $9000 per year in the existing fund, as he believes it could provide him a good diversification. Assuming that the return percentage of the two mutual fund will remain until his retirement, how much will John have on his retirement year? (8 marks) [TOTAL: 25 MARKS]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started