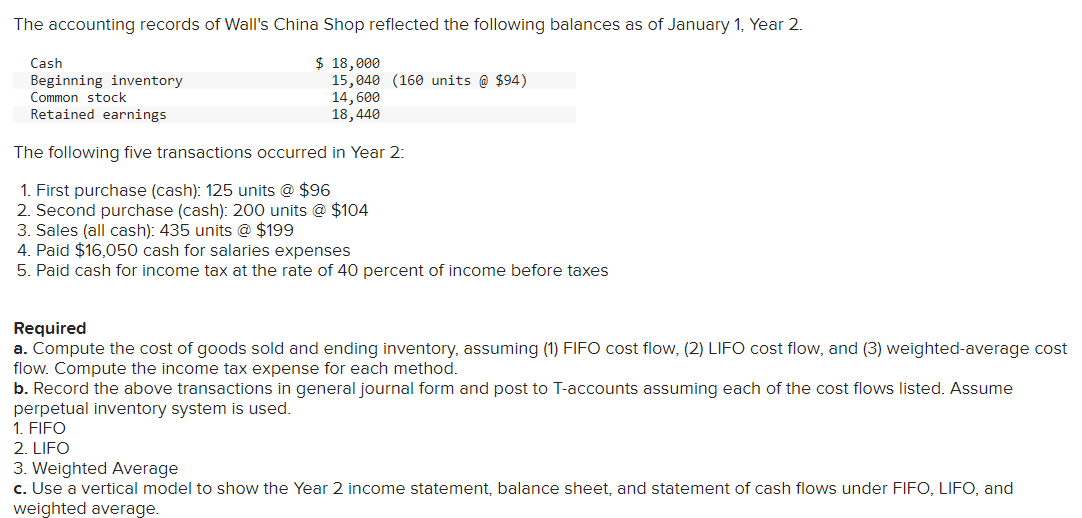

Question

ASAP Req (1) & (2) Req .1 Record the above transactions in general journal form assuming weighted-average cost flow. Assume perpetual inventory system is used.

ASAP Req (1) & (2)

Req .1

Record the above transactions in general journal form assuming weighted-average cost flow. Assume perpetual inventory system is used. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations to 3 decimal places. Round your final answers to the nearest whole dollar amount.)

Record first purchase of merchandise inventory for cash. Record second purchase of merchandise inventory for cash. Record sale of inventory for cash. Record entry for cost of goods sold. Record entry for salaries expenses paid. Record entry for income tax expenses paid.

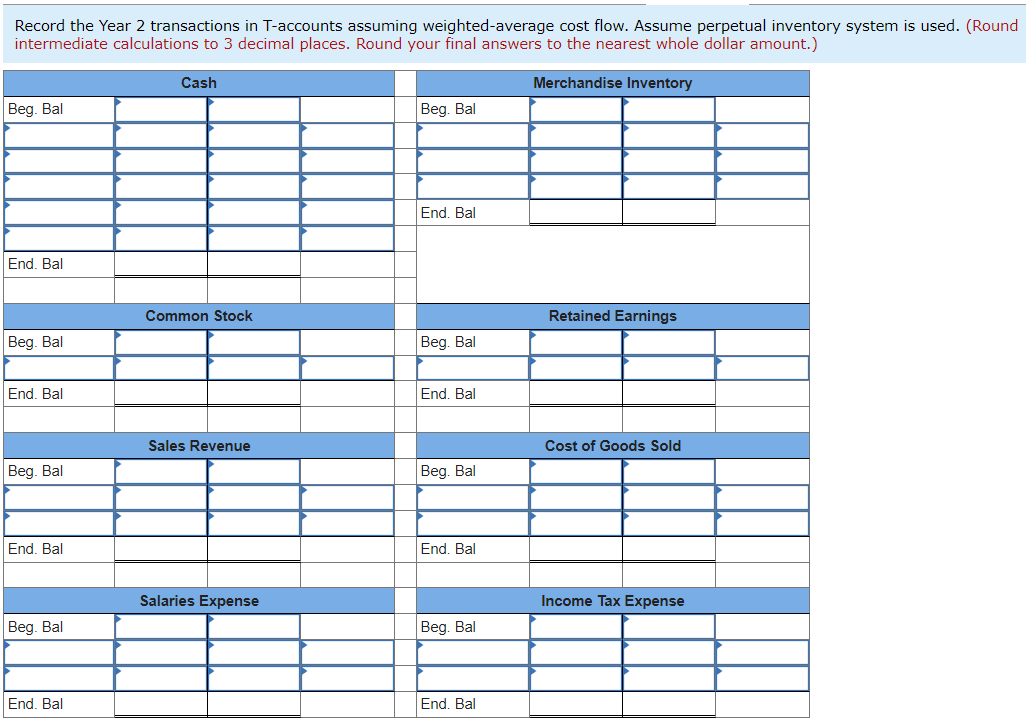

Req .2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started